veTokenomics: Understanding Vote‑Escrowed Token Models

When you see veTokenomics, a framework that locks tokens to grant voting power and extra yields. Also known as vote‑escrowed tokenomics, it aligns long‑term holders with protocol governance. This model veTokenomics requires token holders to commit assets for a set period, turning time‑locked balances into influence and reward multipliers. The core idea is simple: the longer you lock, the bigger your say and the higher your share of fees.

Key Components that Power veTokenomics

One of the most common extensions of the vote‑escrow concept is liquid staking, a service that gives you a tradable token representing your staked assets. Liquid staking lets users earn staking yields while still using the derivative token in DeFi, creating a feedback loop that boosts protocol TVL. Another vital piece is token burn, the permanent removal of tokens from circulation to increase scarcity. When a protocol couples veTokenomics with regular burns, it rewards long‑term voters with a deflationary edge, making the locked supply effectively more valuable. Together, these mechanisms form a semantic triple: veTokenomics → enables → liquid staking; veTokenomics → enhances → token burn; and liquid staking → feeds → governance token appeal.

Beyond the mechanics, veTokenomics shapes the entire governance token, the native asset that grants decision‑making rights in a blockchain project. By tying voting weight to lock duration, projects can filter out short‑term speculation and empower stakeholders who care about lasting success. This relationship influences everything from fee distribution to roadmap votes, and it dovetails with token‑omics designs that prioritize sustainability over hype. As you explore the articles below, you’ll see real‑world examples of FRXETH’s liquid staking token, Verasity’s burn‑and‑stake model, and other projects that blend veTokenomics with innovative reward structures. Ready to see how these ideas play out in practice? Dive into the curated posts to get concrete details, step‑by‑step guides, and the latest perspectives on vote‑escrowed token economics.

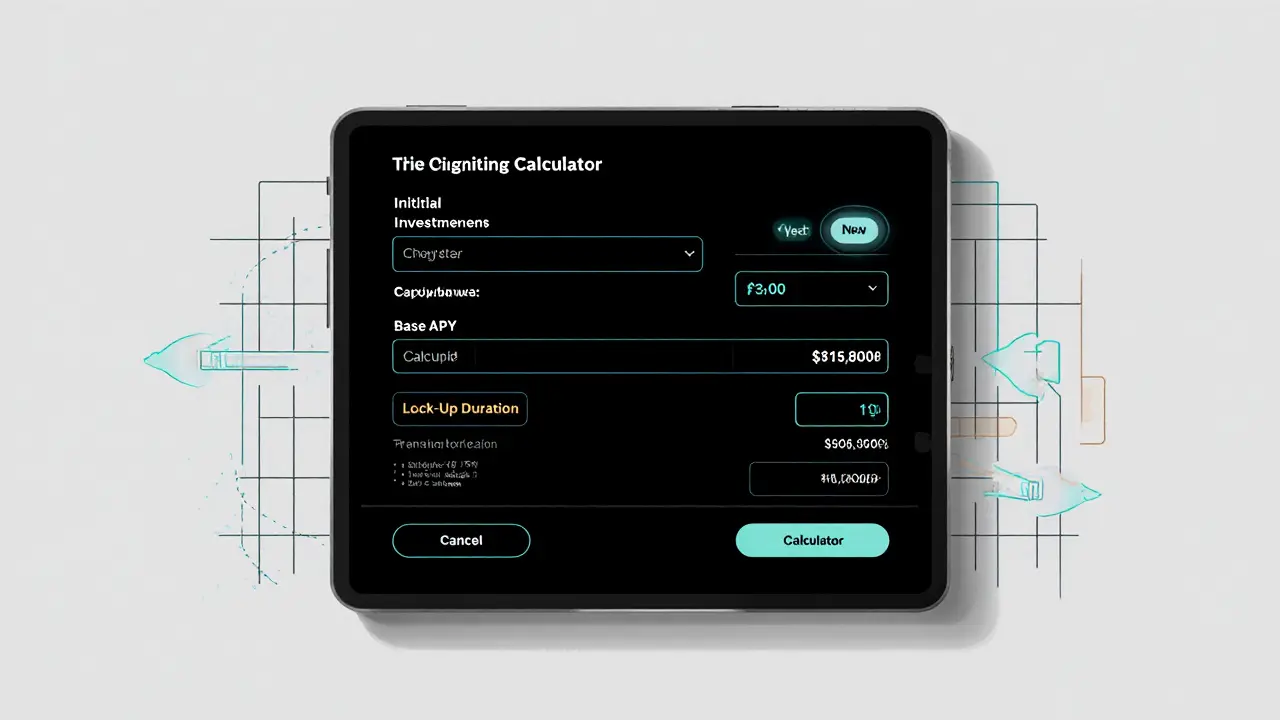

Liquidity Mining: How Duration and Lock‑Ups Shape DeFi Rewards

Learn how liquidity mining duration and lock‑up periods affect rewards, risk, and governance in DeFi, with practical tips for choosing the right commitment.