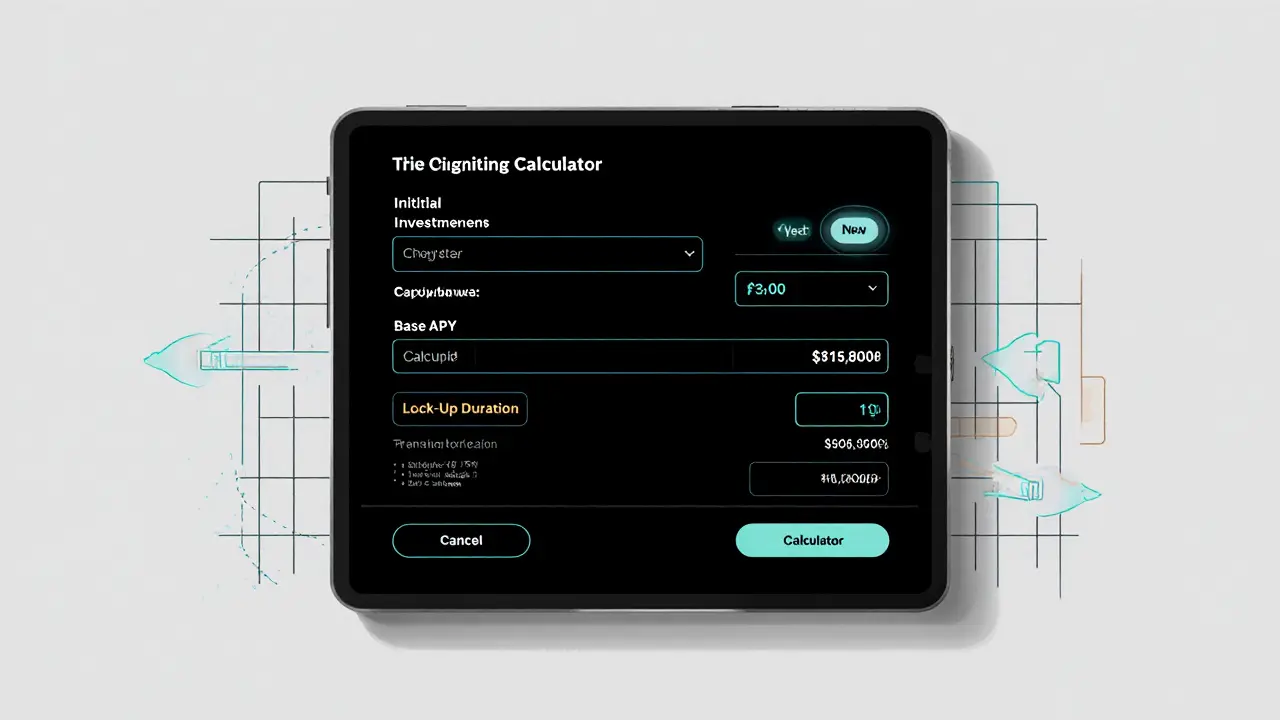

Liquidity Mining Duration Calculator

Results Summary

Effective APY:

Potential Annual Return:

Risk Level:

Lock-Up Period:

Impermanent Loss Protection:

Governance Power:

How This Works

This calculator estimates your potential returns based on:

- Your initial investment amount

- Base APY offered by the protocol

- Lock-up duration and associated reward multiplier

Adjust inputs to compare different scenarios and understand how duration affects your liquidity mining strategy.

In liquidity mining is a process where users deposit token pairs into an automated market maker (AMM) pool and earn rewards for providing depth to the market.

Quick Takeaways

- Short‑term liquidity offers flexibility but lower yields.

- Long‑term lock‑ups boost APY, governance power, and sometimes include loss protection.

- Reward multipliers can range from 1.5× to 5× depending on commitment length.

- Impermanent loss risk rises with market volatility, regardless of lock‑up.

- New veTokenomics models tie voting power to lock‑up length.

Why Duration Matters in Liquidity Mining

Most DeFi protocols need stable capital to keep trading fees flowing and to prevent sudden pool depletion. By asking LPs (liquidity providers) to keep their assets in the pool for a set period, the protocol gains predictability. In return, the protocol usually offers a higher reward multiplier or additional governance perks. The trade‑off is obvious: you can’t pull your funds out whenever you want.

For casual traders, flexibility is king. They prefer “drink‑as‑you‑go” liquidity that mirrors spot‑market behavior. For institutions and long‑term holders, the promise of a 10× or 20× boost in reward tokens can outweigh the inconvenience of a locked position.

Types of Lock‑Up Mechanisms

DeFi projects fall into three broad buckets when they talk about duration:

- Flexible (no lock‑up): You can add or remove liquidity at any moment. Rewards are usually flat‑rate, often between 5%-20% APY.

- Time‑Weighted Rewards: The longer you stay, the larger the multiplier. A typical curve might be 1× for 0‑7 days, 1.5× for 30‑days, and 3× after 90 days.

- Fixed‑Term Commitments: You lock your LP tokens for a preset window-30days, 90days, 180days, or even a year. Fixed‑term pools often advertise 50%-150% APY, plus extra perks like governance voting power.

Each design targets a different user profile, but all share the same goal: keep liquidity on‑board when the market is most active.

Reward Structures Across Durations

Reward calculations usually blend two variables: the base emission rate (how many tokens the protocol mints per block) and a duration‑based boost. Below is a snapshot of how a few popular platforms handle this:

| Feature | Flexible (No lock‑up) | Fixed‑Term (Lock‑up) |

|---|---|---|

| Withdrawal | Instant | Locked until expiry (early exit may incur penalty) |

| Reward Rate | 5%‑20% APY | 50%‑150% APY (often tiered) |

| Risk Mitigation | None | Often includes partial impermanent‑loss protection after 30‑60 days |

| Typical Duration | 0‑7days | 30‑365days |

| Governance Power | Proportional to LP share | Boosted by lock‑up length (veTokenomics) |

Note how the fixed‑term option swaps flexibility for higher yields and sometimes extra safety nets.

Impermanent Loss and How Lock‑Ups Influence It

Impermanent loss occurs when the price ratio of the two tokens in the pool drifts apart. Even if the pool generates fees, you could end up with fewer dollars than if you had simply held the assets.

Longer lock‑ups don’t stop the loss, but they can reduce its impact in two ways:

- Psychological buffer: LPs aren’t tempted to instantly withdraw during a price dip.

- Built‑in protection: Some protocols add a “loss‑cover” pool that starts reimbursing after a set duration (often 30‑90days).

However, the protection usually caps at a percentage of the loss, so you still need to weigh the market outlook before committing for months.

Smart Contract and Governance Risks Over Time

Every locked position lives inside a smart contract. The longer you’re locked, the longer you’re exposed to any undiscovered bugs. A contract that looked solid at launch could be exploited a year later, and you’d be stuck until the lock‑up expires.

Governance changes add another layer. Many protocols let token holders vote on reward rates, fee structures, or even the very existence of a pool. If a proposal passes that reduces rewards while you’re still locked, you’ll have to accept the new terms.

Choosing the Right Commitment for Your Situation

Here’s a quick decision tree you can run in your head:

- Do you need immediate access to capital? If yes, stay flexible.

- Are you comfortable with market volatility for the next 3‑6months? If yes, consider a 30‑day or 90‑day lock‑up.

- Do you hold a governance token that offers voting power via veTokenomics? If you care about influencing protocol direction, longer lock‑ups give you more votes.

- Can you absorb a potential smart‑contract exploit loss? If not, keep your exposure short.

Aligning your financial goals, risk tolerance, and desire for protocol influence will point you to the optimal duration.

Emerging Trends: veTokenomics and Dynamic Lock‑Ups

Curve Finance pioneered the veTokenomics model with its veCRV system-locking CRV for up to four years grants you voting power and a reward boost that can reach 5×. Since then, dozens of projects-SushiSwap, Aave, Balancer-have launched their own “ve” tokens.

Two trends are reshaping how lock‑ups work:

- Dynamic adjustment: Protocols monitor TVL and trade volume, then automatically tweak lock‑up length or boost rates to keep pools healthy.

- Hybrid positions: Some platforms let you split a LP token into a “locked” portion and a “flexible” portion, offering a middle ground.

These innovations aim to attract both traders who need liquidity and long‑term believers who want higher yields.

Practical Checklist Before Locking Your Liquidity

- Confirm the exact lock‑up duration and any early‑withdrawal penalties.

- Calculate the effective APY, factoring in the reward multiplier and any fee discounts.

- Check if the protocol offers impermanent‑loss protection and the eligibility window.

- Read the latest audit report; note any unresolved issues.

- Understand the governance model-will your lock increase voting weight?

- Assess gas costs (especially on Ethereum) to ensure short‑term positions remain profitable.

Wrapping It All Up

Duration and lock‑ups are the invisible levers that turn a basic liquidity provision into a strategic investment. By matching the right lock‑up to your risk appetite, capital needs, and governance ambitions, you can capture higher yields while keeping surprise losses in check. Keep an eye on emerging veTokenomics models-they’re quickly becoming the centerpiece of DeFi reward design.

Frequently Asked Questions

What is the difference between flexible liquidity and locked liquidity?

Flexible liquidity lets you withdraw at any moment but usually pays a flat, lower APY. Locked liquidity requires you to keep your assets in the pool for a set period, rewarding you with higher APY, extra voting power, or loss‑protection features.

How do reward multipliers work?

A protocol sets a base emission rate (e.g., 100 tokens per day). For each day you stay locked, a multiplier is applied-1.5× after 30 days, 2× after 60 days, etc. Your final reward equals base×multiplier.

Can lock‑up periods reduce impermanent loss?

Lock‑ups don’t stop price divergence, but many protocols introduce partial loss protection after a minimum duration (often 30‑90 days). The protection reimburses a portion of the loss, easing the impact.

What are veTokens and why do they matter?

"ve" stands for vote‑escrow. By locking a protocol’s governance token for months or years, you earn voting power and often a reward boost. The longer the lock, the higher the influence and yield-making it a key factor in long‑term DeFi strategies.

Are there any risks unique to long lock‑ups?

Yes. Extended exposure to smart‑contract bugs, governance changes that could lower rewards, and the inability to react quickly to market crashes. Always audit the contract and consider diversification across lock‑up lengths.