Two-Way Peg: The Backbone of Cross-Chain Asset Transfers

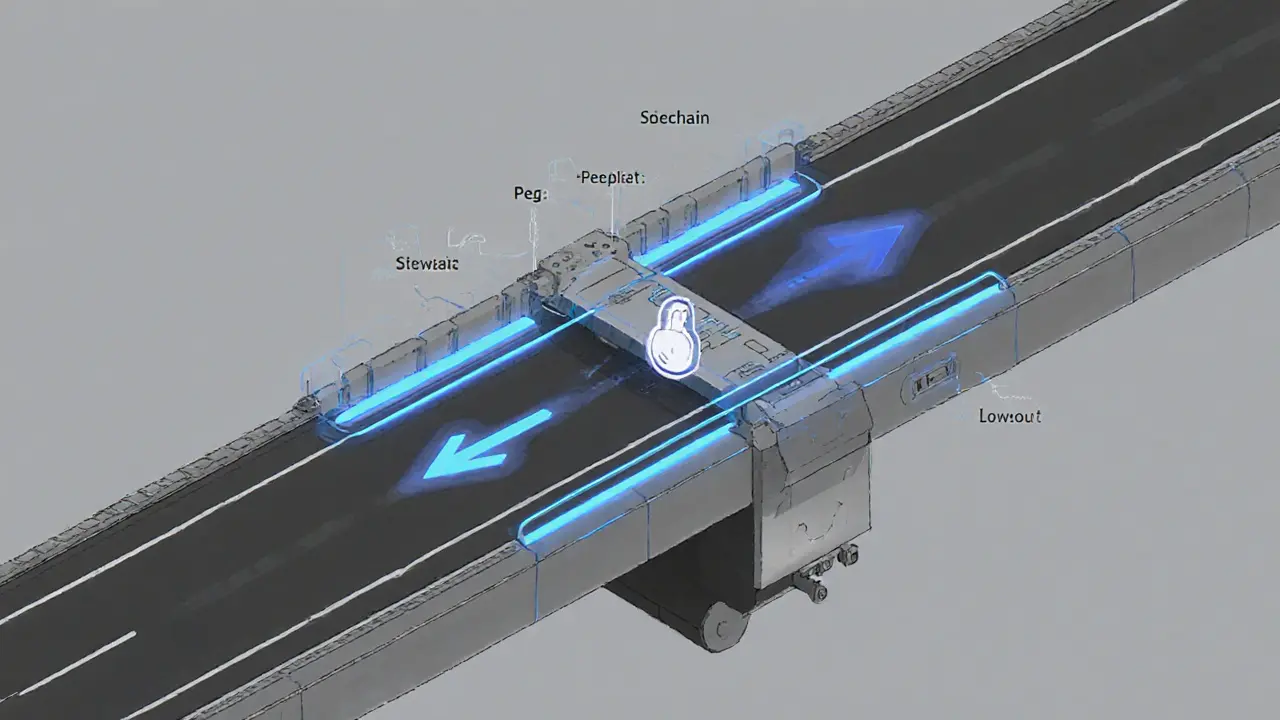

When talking about Two-Way Peg, a system that locks an original asset on one blockchain and creates a matching token on another chain. Also known as bidirectional peg, it lets users move value without losing security or trust.

To make that happen you need a Cross-Chain Bridge, software and validator set that monitors lock events, mints replicas, and later burns them when the original asset is released. The bridge is the engine that drives the two-way peg, handling everything from network messages to fraud proofs. In simple terms, the bridge *requires* two core actions: minting on the destination chain and redemption on the source chain.

That brings us to the Wrapped Token, a derivative asset that represents the locked original token on another blockchain. Think of it as a digital receipt: you hand over Bitcoin, the bridge locks it, and you receive an ERC‑20 token—renBTC—on Ethereum. When you want your Bitcoin back, you send the wrapped token to the bridge, it burns the receipt, and releases the locked Bitcoin.

Why Two-Way Pegs Matter Today

DeFi, NFT marketplaces, and gaming platforms all run on different chains. Without a reliable way to move assets, each ecosystem stays isolated. Two-way pegs break those silos, letting you provide liquidity on Uniswap with a wrapped Bitcoin, stake ETH on a liquid staking platform, or pay for a blockchain game using a token originally minted on another network. The security model hinges on the bridge’s ability to enforce the peg—any mismatch, and users could lose funds.

Different designs balance trust and decentralization. Some bridges rely on a handful of validators (more centralized, faster), while others use multi‑party computation or zero‑knowledge proofs (more trustless, slower). The choice influences fees, latency, and the risk profile of the peg. For example, the Frax Ether (FRXETH) system uses a two‑way peg between the Frax stablecoin ecosystem and Ethereum’s staking contracts, allowing instant liquidity without waiting for the usual withdrawal window.

Understanding the two-way peg also helps you evaluate projects that claim “bridge‑less” or “native cross‑chain” features. Often, those solutions still implement a peg under the hood; they just hide the mechanics. Knowing what to look for—custodial vs. non‑custodial bridges, on‑chain vs. off‑chain validators, and the audit status of the minting/redeeming contracts—can save you from hidden risks.

Below you’ll find a curated set of articles that dive deeper into each piece of the puzzle: from liquid staking tokens that rely on two‑way pegs, to detailed reviews of bridges, to security analyses of wrapped assets like renBTC. Whether you’re a developer building a new bridge, an investor assessing a wrapped token’s safety, or just curious about how Bitcoin shows up on Ethereum, the posts ahead give you practical, jargon‑free guidance.

Ready to explore the specifics? Scroll down to see how different projects implement two‑way pegs, what fees you might face, and which bridges are worth your trust.

Understanding Sidechains: Scaling and Interoperability in Cryptocurrency

A clear, conversational guide explains what sidechains are, how two‑way pegs work, real‑world examples like Liquid and Rootstock, benefits, risks, and future trends.