Sidechain Comparison Tool

This tool helps compare key features of popular Bitcoin sidechains: Liquid and Rootstock (RSK). Use it to understand their differences in terms of purpose, consensus mechanism, fees, and supported features.

Fast Settlements

Designed for traders and exchanges seeking rapid settlement times and low fees. Ideal for high-volume trading and instant fiat-crypto swaps.

- Consensus: Federated (functionaries)

- Fee: ~0.001 L-BTC (a few satoshis)

- Smart Contracts: Limited (confidential transactions)

Ethereum Compatibility

Enables smart contracts and decentralized applications compatible with Ethereum's EVM. Great for DeFi, token issuance, and NFT minting.

- Consensus: Proof-of-Work merged-mined with Bitcoin

- Fee: ~0.00005 BTC (similar to Bitcoin base fee)

- Smart Contracts: Full EVM compatibility

| Feature | Liquid | Rootstock (RSK) |

|---|---|---|

| Primary Goal | Fast settlement for traders and exchanges | Enable Ethereum-compatible smart contracts on Bitcoin |

| Consensus Mechanism | Federated consensus (functionaries) | Proof-of-Work merged-mined with Bitcoin |

| Typical Transaction Fee | ≈0.001 L-BTC (a few satoshis) | ≈0.00005 BTC (similar to Bitcoin’s base fee) |

| Smart Contract Support | Limited (confidential transactions) | Full EVM compatibility |

| Use Cases | Exchange settlements, instant fiat-crypto swaps | DeFi, token issuance, NFT minting |

Select your primary use case to get a recommendation on which sidechain is better suited:

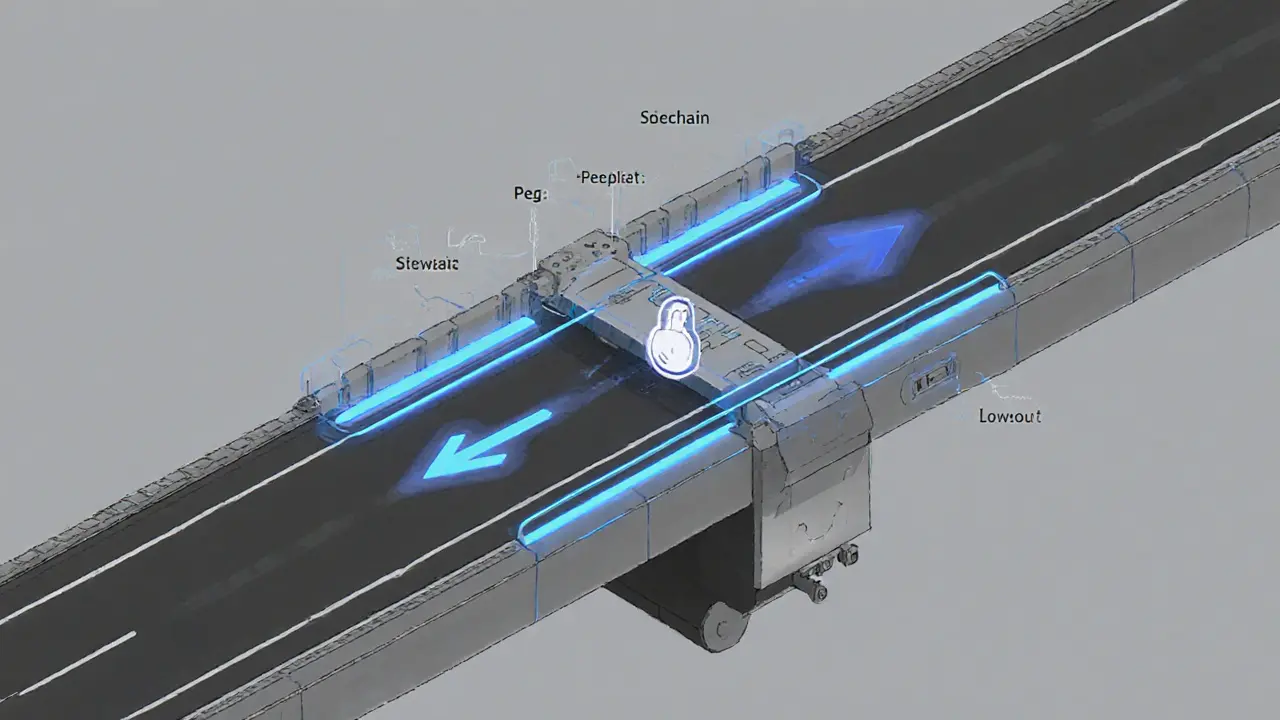

When talking about the next wave of blockchain upgrades, Sidechains are a type of separate blockchain that attaches to a mainnet through a two‑way peg, allowing assets to move back and forth while keeping the main chain’s security intact. In plain English, think of a sidechain like a private lane off a busy highway - you can zip around faster, try new road rules, and then merge back when you’re ready. This idea emerged to fix the speed and cost bottlenecks that have long haunted networks like Bitcoin and Ethereum.

Key Takeaways

- Sidechains are independent blockchains linked to a mainnet via a two‑way peg.

- The peg uses lockboxes that temporarily lock assets on the main chain.

- They boost transaction speed and lower fees without weakening mainnet security.

- Popular Bitcoin sidechains include Liquid (fast settlements) and Rootstock (smart contracts).

- Developers use sidechains to test upgrades, run complex contracts, or create niche applications.

How the Two‑Way Peg Works

The magic that makes sidechains possible is the two‑way peg. Picture sending 1BTC from Bitcoin’s mainnet to a sidechain. First, you send the coin to a special lockbox address on Bitcoin. The network marks those coins as locked - they can’t be spent on the main chain. Meanwhile, the sidechain reads the lockbox transaction, validates it, and mints an equivalent token (often called a “peg‑in”).

When you want to move the asset back, you initiate a “peg‑out” on the sidechain. The sidechain burns (or destroys) the peg‑in token and broadcasts a proof to the mainnet. After a short waiting period (usually a few blocks for security), the lockbox releases the original BTC, making it spendable again. Because both chains keep independent consensus, a breach on the sidechain never compromises the mainnet’s funds.

Why Use a Sidechain? Benefits at a Glance

- Speed: Transactions can confirm in seconds rather than minutes, saving users from waiting.

- Cost: Fees drop to a few satoshis on many sidechains, a stark contrast to Bitcoin’s sometimes‑high fees during congestion.

- Feature Flexibility: Developers can add smart contract capabilities, privacy layers, or custom token standards without rewriting Bitcoin’s core code.

- Safety Net: New upgrades are tested on a sidechain first. If something goes wrong, the main chain remains untouched.

- Interoperability: Assets can hop between multiple sidechains, creating a mesh of specialized networks that still link back to the original blockchain.

Real‑World Bitcoin Sidechains

Two projects illustrate how sidechains solve different problems.

| Feature | Liquid | Rootstock (RSK) |

|---|---|---|

| Primary Goal | Fast settlement for traders and exchanges | Enable Ethereum‑compatible smart contracts on Bitcoin |

| Consensus Mechanism | Federated consensus (functionaries) | Proof‑of‑Work merged‑mined with Bitcoin |

| Typical Transaction Fee | ≈0.001L‑BTC (a few satoshis) | ≈0.00005BTC (similar to Bitcoin’s base fee) |

| Smart Contract Support | Limited (confidential transactions) | Full EVM compatibility |

| Use Cases | Exchange settlements, instant fiat‑crypto swaps | DeFi, token issuance, NFT minting |

Under the Hood: Consensus, Lockboxes, and Security

Each sidechain runs its own consensus protocol. That could be proof‑of‑work, proof‑of‑stake, or a federated model where a handful of trusted nodes validate blocks. The key point is that the sidechain’s security is independent - a 51% attack on a sidechain does not affect the main chain because the lockbox only releases assets after the mainnet sees a valid peg‑out proof.

Lockboxes act like escrow contracts on the parent chain. They are not “smart contracts” in the Ethereum sense (Bitcoin’s script language is limited), but they are scripted outputs that become spendable only when a designated sidechain transaction is confirmed. This design ensures that the mainnet never loses custody of the original coins; they are merely locked.

When Should You Choose a Sidechain?

- High‑frequency trading: If you need sub‑second confirmation, a sidechain such as Liquid can shave minutes off your workflow.

- DeFi experimentation: Want to build a decentralized app with Solidity but stay anchored to Bitcoin? Rootstock gives you EVM compatibility without leaving the Bitcoin ecosystem.

- Cost‑sensitive payments: Low‑fee micro‑transactions (e.g., IoT payments) benefit from the cheap fee structure of many sidechains.

- Testing upgrades: Before rolling a hard fork on the mainnet, launch the change on a sidechain to catch bugs early.

Potential Pitfalls and How to Mitigate Them

Sidechains are powerful, but they aren’t a silver bullet.

- Trust assumptions: While the mainnet remains secure, you still trust the sidechain’s validators. Look for chains that are merged‑mined (share Bitcoin’s hash power) or have robust federated governance.

- Liquidity risk: Some sidechains have lower market depth, which can cause price slippage when moving large sums.

- Complexity: Users must manage two sets of addresses and understand peg‑in/peg‑out timing. Wallets that automate the process (e.g., Blockstream Green for Liquid) reduce friction.

- Regulatory uncertainty: New features like confidential transactions may attract scrutiny in certain jurisdictions. Stay updated on local compliance rules.

Future Outlook: Where Sidechains Are Headed

Industry analysts agree that sidechains will stay a cornerstone of blockchain scaling. Upcoming trends include:

- Cross‑chain bridges that connect not just a single sidechain but a whole web of chains, enabling true multi‑asset swaps.

- Smart‑contract‑driven pegs that replace simple lockboxes with programmable escrow, allowing conditional transfers.

- Hybrid models that combine sidechains with layer‑2 solutions (e.g., rollups) to push scalability even further.

As transaction volumes rise and developers keep pushing the envelope, sidechains offer a pragmatic path: keep the main chain rock‑solid while letting innovation happen in sandbox‑like environments.

Frequently Asked Questions

What is the difference between a sidechain and a layer‑2 solution?

A sidechain is a completely separate blockchain that connects to the mainnet via a two‑way peg, while a layer‑2 solution (like Lightning or Optimism) builds on top of the main chain and inherits its security directly. Sidechains let you design new consensus rules, whereas layer‑2s rely on the parent chain’s consensus.

Are assets on a sidechain safe?

The original assets stay locked on the mainnet, so even if the sidechain is compromised, the main chain’s funds cannot be stolen. Your risk then hinges on the sidechain’s own validators and the peg’s implementation.

How long does a peg‑in or peg‑out take?

Peg‑in usually completes after the transaction is confirmed on the mainnet (often 1‑6 blocks). Peg‑out adds an extra waiting period-usually a few more blocks-to give the network time to verify the sidechain proof before unlocking the original coins.

Can I use any wallet for sidechain transactions?

Only wallets that support the specific sidechain’s address format and peg protocol will work. For Liquid, Blockstream Green and the Liquid wallet are popular; for Rootstock, Metamask (connected to RSK) works well.

Will sidechains replace main blockchains?

Not likely. Main chains provide the ultimate security and decentralization, while sidechains focus on speed, flexibility, and experimentation. They complement, not replace, the core network.