Lock-up Period in Crypto Tokens

When working with Lock-up Period, a predefined timeframe during which newly issued tokens cannot be transferred, sold, or otherwise liquidated, projects aim to curb early sell‑offs and protect market stability. Also known as vesting lock, it creates a predictable supply curve that investors can trust.

Key Concepts that Shape a Lock-up Period

One of the most common companions of a lock-up period is Token Vesting, the gradual release of tokens to founders, team members, or early backers over time. Vesting schedules often mirror the lock‑up, letting participants earn their allocation step by step. Another related piece is the Token Sale, the public or private offering where a project sells its tokens to raise funds. Sales usually attach a lock‑up to prevent buyers from dumping tokens immediately after the event. Airdrop, a free distribution of tokens to a community or specific users may also carry a lock‑up to encourage long‑term holding. Finally, Staking, locking tokens in a protocol to secure the network and earn rewards often respects the lock‑up rules, meaning staked assets stay immobile until the period ends.

The lock‑up period influences token liquidity by delaying when large chunks of supply hit the market. This delay can smooth price volatility, especially right after a token sale or airdrop. At the same time, it creates a demand‑side incentive: early investors know that their tokens will become tradable later, which can drive speculative interest during the waiting phase. Projects also use lock‑ups to align incentives; founders who must wait years before cashing out are more likely to stay committed to the network’s success.

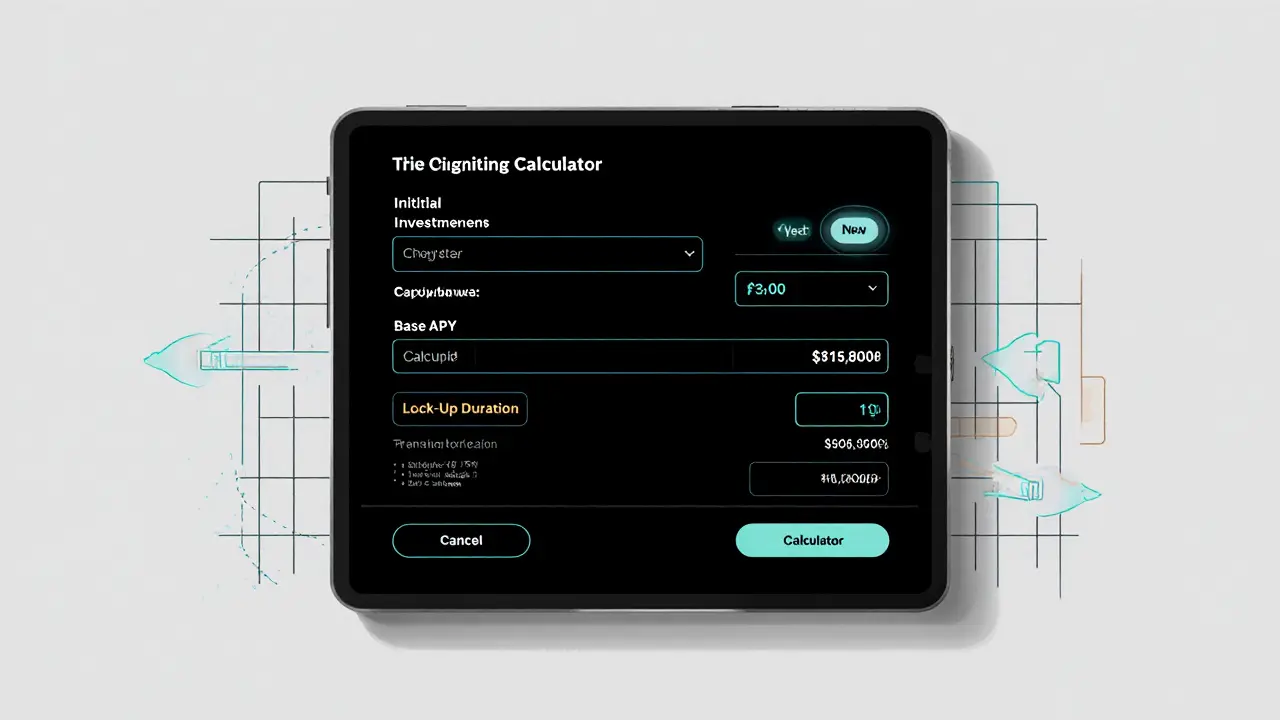

From an investor’s perspective, understanding the lock‑up details is crucial. A short lock‑up of a few weeks may signal confidence but also a risk of rapid sell‑pressure. A multi‑year lock‑up, such as 12‑ or 24‑month schedules, often reflects a more cautious approach, giving the market time to absorb new supply. Checking the lock‑up’s start date, cliff length (the initial period with zero releases), and release cadence (monthly, quarterly, or annual) lets you gauge how the token’s price might react over time.

Regulators are paying close attention to lock‑up periods because they affect how tokens are classified—security versus utility. A well‑structured lock‑up can demonstrate that a project is not simply a fundraising scheme, reducing regulatory scrutiny. Meanwhile, developers need to communicate the lock‑up terms clearly in their whitepapers and tokenomics dashboards; transparency builds trust and reduces the chance of community backlash when the first unlock happens.

Below you’ll find a curated set of articles that dive deeper into each of these angles—how lock‑up periods work in liquid staking tokens, what they mean for airdrop eligibility, the role they play in token sale structures, and how they intersect with vesting and staking strategies. Explore the guides to see real‑world examples and actionable tips for navigating lock‑up periods in today’s crypto landscape.

Liquidity Mining: How Duration and Lock‑Ups Shape DeFi Rewards

Learn how liquidity mining duration and lock‑up periods affect rewards, risk, and governance in DeFi, with practical tips for choosing the right commitment.