Liquidity Mining: A Practical Guide

When diving into Liquidity Mining, the practice of providing assets to a DeFi protocol in exchange for token rewards, you're entering a core part of modern decentralized finance. Also known as yield farming, a strategy that layers multiple incentive programs to boost returns, it often requires staking, locking tokens in a contract to secure network operations and earn interest and the creation of a liquidity pool, a shared reserve of tokens that traders can swap without a traditional order book. Together they form the backbone of DeFi, decentralized financial services built on blockchain. In simple terms, liquidity mining encompasses yield farming, requires staking tokens, and relies on liquidity pools to function.

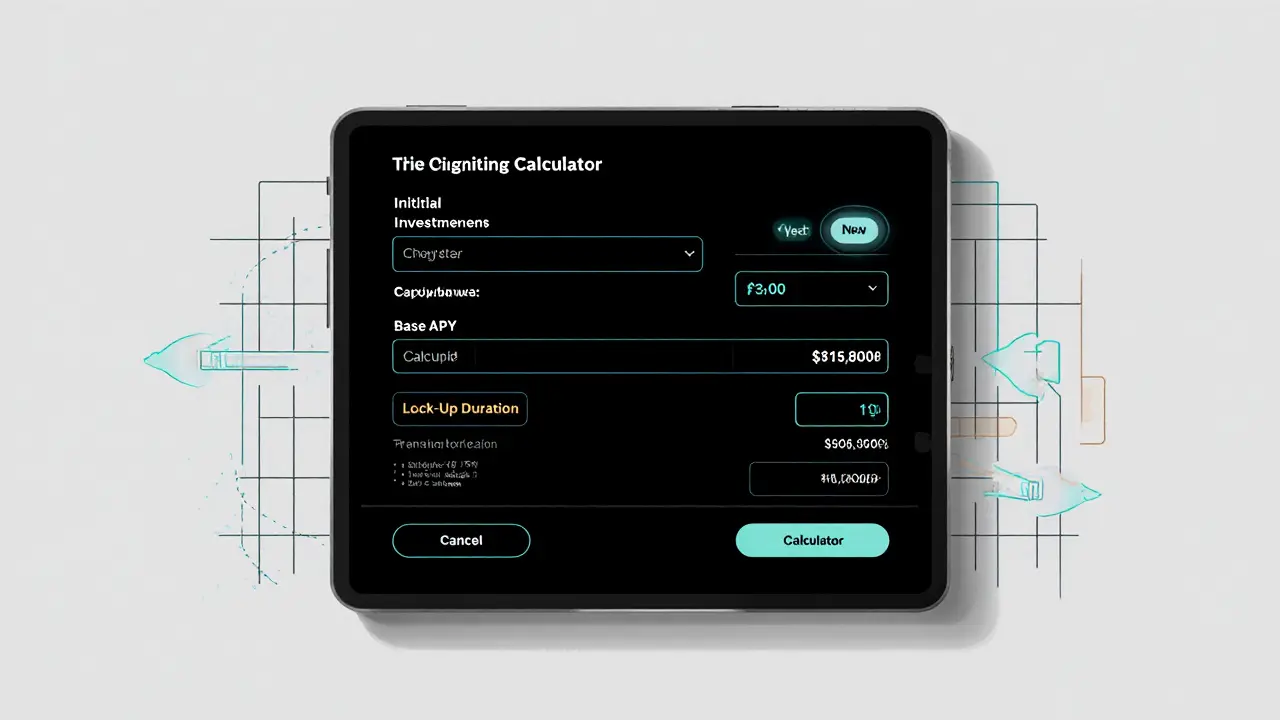

How does it actually work? A protocol offers a reward token—often its native coin—to anyone who supplies a pair of assets to a pool. The supplied assets become part of the pool’s capital, enabling traders to swap between them. In return, the provider earns a share of the trading fees plus the newly minted reward tokens. Some projects, like Frax Finance’s FRXETH, add auto‑compounding features so that earned rewards are instantly reinvested, boosting the effective APY without extra effort.

While the upside looks attractive, risk management is a must. The biggest hidden cost is impermanent loss, which occurs when the price ratio of the two supplied assets shifts dramatically. If one token surges while the other stalls, the value of your pooled share can fall below what you’d have had by simply holding the assets. Therefore, evaluating tokenomics—total supply, emission schedule, and peg mechanisms—is essential before committing capital.

Fortunately, a growing toolbox helps you monitor and optimize liquidity mining positions. Dashboard platforms like Zapper, DeBank, and Dune Analytics aggregate farm data, APR calculations, and risk metrics in one view. On-chain routers such as Balancer v2 let you create custom multi‑token pools, reducing exposure to any single asset. Meanwhile, smart‑contract auditors and community forums provide early warnings about buggy contracts or potential rug pulls.

Best practices for newcomers revolve around diversification and gradual scaling. Start with well‑established pools on major DEXs (Uniswap, SushiSwap) before exploring niche farms. Allocate only a fraction of your portfolio to high‑yield experiments, and use stable‑coin pairs (e.g., USDC/DAI) to mitigate volatility. Rebalancing periodically—say, monthly—helps lock in gains and adjust to shifting market conditions.

Looking ahead, cross‑chain liquidity mining is gaining momentum. Bridges and layer‑2 solutions allow assets to flow between Ethereum, Optimism, and Polygon, opening new arbitrage opportunities and higher capital efficiency. Keep an eye on emerging standards like ERC‑4626, which aim to standardize yield‑bearing vaults and simplify integration across platforms.

Below you’ll find a curated list of articles that dive deeper into each of these aspects— from FRXETH’s liquid staking token to advanced yield‑farming strategies, tax implications, and security considerations. Use them as a roadmap to sharpen your liquidity mining game and stay ahead in the fast‑moving DeFi landscape.

Liquidity Mining: How Duration and Lock‑Ups Shape DeFi Rewards

Learn how liquidity mining duration and lock‑up periods affect rewards, risk, and governance in DeFi, with practical tips for choosing the right commitment.