Impermanent Loss

When working with impermanent loss, the temporary reduction in value that liquidity providers see when the prices of the paired tokens diverge. Also known as IL, it does not become permanent unless you withdraw while the price gap remains. This risk impermanent loss is a core part of providing capital to liquidity pools, shared reserves that enable token swaps on automated market makers. An AMM, a protocol that prices assets algorithmically instead of using an order book continuously rebalances the pool, and that rebalancing creates the price‑divergence effect behind impermanent loss. Understanding this chain – AMM pricing → pool rebalancing → potential IL – lets you decide whether the upside from fees and rewards outweighs the downside.

Key Factors that Drive Impermanent Loss

The first factor is price volatility. When one token in the pair spikes or crashes, the AMM algorithm forces you to hold more of the losing asset, locking in a temporary loss relative to simply HODLing. Second, pool composition matters: stable‑coin pairs or assets with tightly correlated price movements generate far lower IL than wildly different tokens like ETH/USDC. Third, the fee structure of the decentralized exchange, the platform where the pool lives and collects swap fees for providers can offset IL – higher fees mean more revenue to cover the loss. Finally, the strategy you use – pure liquidity provision, yield farming, staking the LP tokens for extra rewards, or layering with staking derivatives like frxETH – changes the net outcome. For example, a high‑yield farm may pay out enough native tokens to make the effective APR positive even after accounting for IL, while a low‑fee, low‑reward pool might leave you worse off.

To keep IL in check, many traders pick pools with low volatility, use dynamic rebalancing tools, or set stop‑loss thresholds that trigger a withdrawal when the loss crosses a preset level. Others combine LP positions with hedging strategies, such as borrowing the over‑represented token to maintain a balanced exposure. The posts below dive into real‑world cases – from liquid‑staking tokens like frxETH, to DEX reviews of Balancer v2, to practical guides on Dollar‑Cost Averaging and yield farming – showing how the theory of impermanent loss plays out across different protocols. Explore the collection to see concrete examples, risk‑mitigation tactics, and the latest tools that help you decide when the fee earnings are worth the temporary dip.

Understanding Impermanent Loss in DeFi with Real Examples

Impermanent loss is a common but misunderstood risk in DeFi liquidity pools. Learn how price changes between two assets can reduce your value-even if prices go up-and how to protect yourself with smart pair choices and fee tracking.

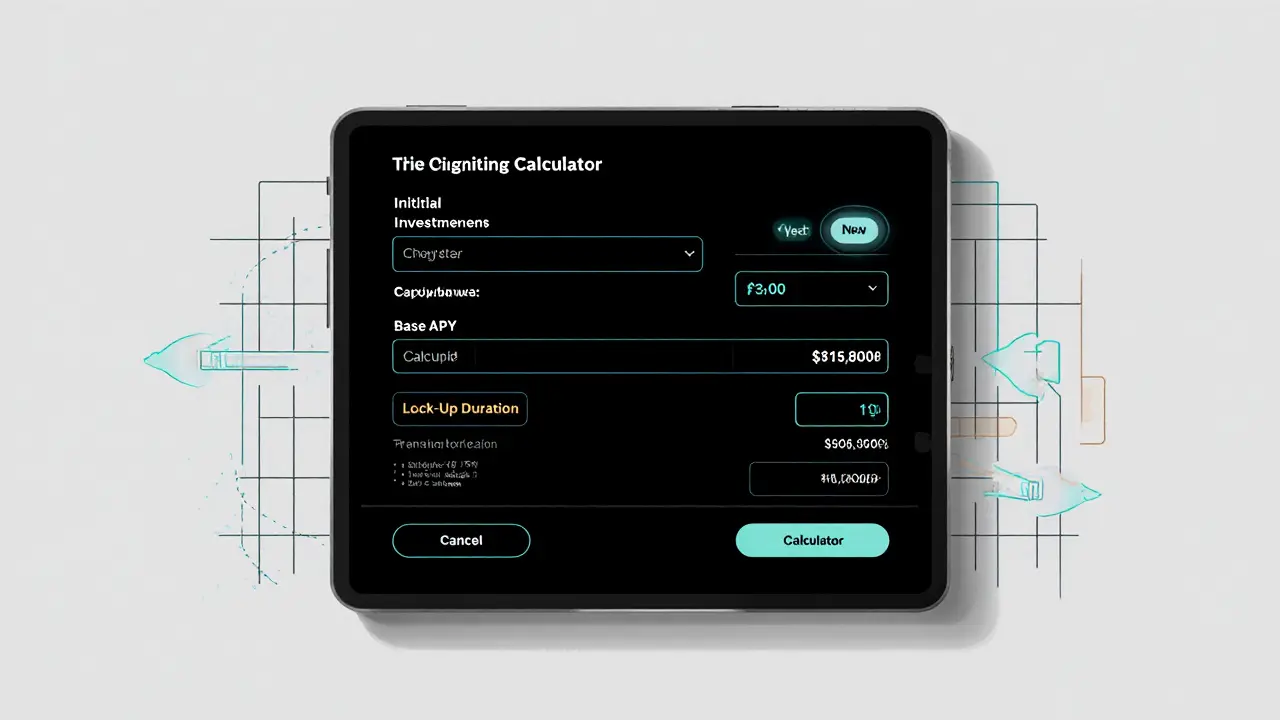

Liquidity Mining: How Duration and Lock‑Ups Shape DeFi Rewards

Learn how liquidity mining duration and lock‑up periods affect rewards, risk, and governance in DeFi, with practical tips for choosing the right commitment.