DeFi Rewards – What They Are and Why They Matter

When you dive into DeFi rewards, the incentives users earn from decentralized finance protocols. Also known as yield incentives, they power a whole ecosystem of earning opportunities. One major driver is the liquid staking token, a token that represents staked assets while staying tradable on secondary markets. By holding a liquid staking token you keep exposure to staking returns yet retain liquidity for other moves. Another core piece is yield farming, the practice of moving capital across DeFi pools to capture the highest possible returns. Yield farmers chase the best APY by providing liquidity, borrowing, or staking, and they often earn additional native tokens as a bonus. Finally, airdrop, a free distribution of tokens to eligible wallets, usually to kick‑start network effects or reward early supporters can boost a user’s overall reward portfolio without any extra risk. In short, DeFi rewards combine these three mechanisms – liquid staking, yield farming, and airdrops – to create layered income streams for crypto participants.

How the Pieces Fit Together

DeFi rewards encompass multiple layers of incentive design. A liquid staking token like FRXETH lets you earn the base staking yield from Ethereum while still having a tradable asset for swapping or collateral. That liquidity opens the door to yield farming: you can deposit FRXETH into a multi‑token pool, earn a portion of transaction fees, and often receive extra governance tokens as a farming bonus. When a new protocol launches, it might run an airdrop targeting holders of FRXETH or participants in a specific farm, adding an extra reward on top of the existing yields. This creates a feedback loop – higher staking participation drives more liquidity, which fuels richer farms, which in turn attract larger airdrop campaigns. The result is a constantly shifting landscape where users balance safety (staking), opportunism (farming), and luck (airdrops) to maximize their earnings.

Below you’ll find a curated set of articles that break down each of these components. We cover how liquid staking tokens work, why yield farming remains a top strategy, and what to watch for in upcoming airdrops. Whether you’re just starting out or looking to fine‑tune an existing portfolio, the pieces in this collection will give you the context you need to navigate DeFi rewards effectively.

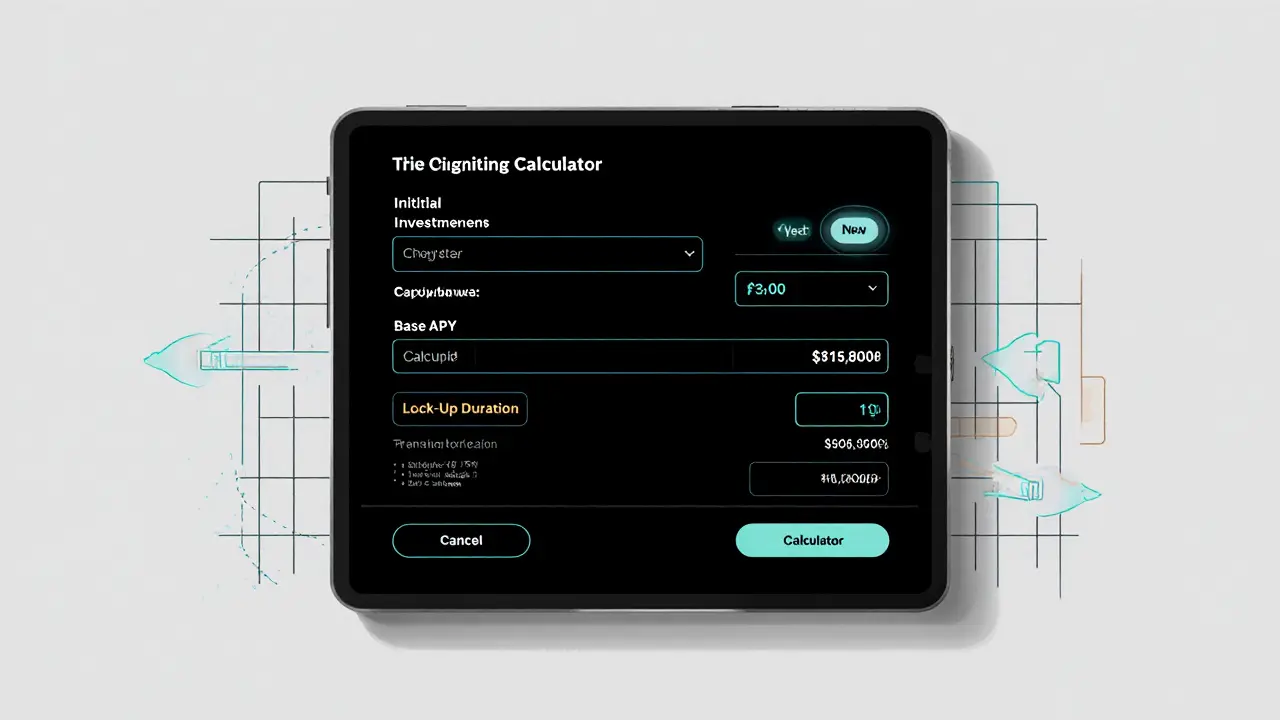

Liquidity Mining: How Duration and Lock‑Ups Shape DeFi Rewards

Learn how liquidity mining duration and lock‑up periods affect rewards, risk, and governance in DeFi, with practical tips for choosing the right commitment.