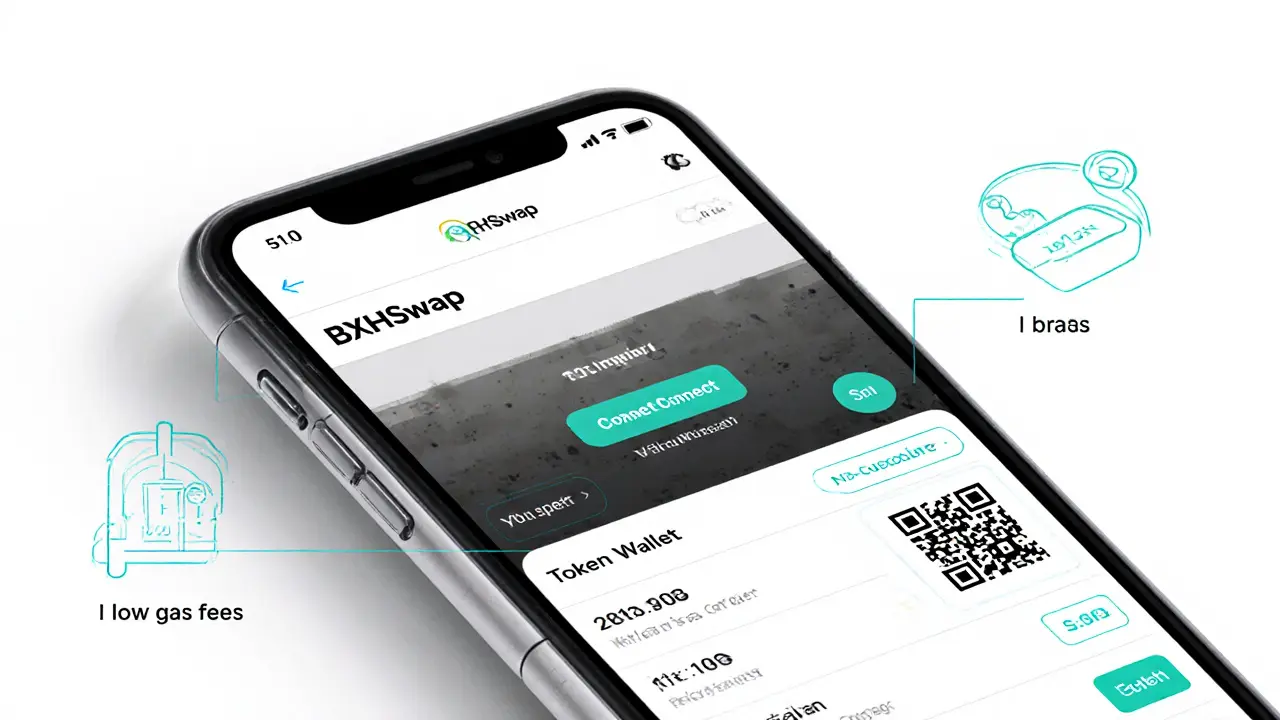

BXHSwap – Decentralized Exchange Overview

When diving into BXHSwap, a Binance Smart Chain based decentralized exchange that lets users trade tokens directly from their wallets. Also known as BXH Swap, it facilitates instant token swaps through automated liquidity pools.

In the world of Decentralized Exchange, platforms operate without a central authority, matching buy and sell orders on‑chain, BXHSwap stands out because it BXHSwap runs on the fast, low‑fee Binance Smart Chain, a high‑throughput blockchain designed for DeFi applications. The exchange relies on Liquidity Pools, smart contracts that lock paired tokens and enable automated market making. Those three pieces create a simple chain of relationships: BXHSwap enables token swaps, swaps are powered by liquidity pools, and the whole system lives on Binance Smart Chain. This structure also means users can earn fees simply by providing liquidity, and they can participate in community airdrops that reward active traders and LPs.

Why BXHSwap Matters in DeFi

For anyone chasing real‑world DeFi use cases, BXHSwap offers a low‑cost bridge between popular memes, utility tokens, and emerging projects. Its fee model is transparent: a small percentage of each swap goes straight to the pool contributors, while an extra slice funds protocol development. Because the platform is built on BSC, transaction confirmations happen in seconds, which is crucial when you’re chasing a quick airdrop claim or trying to front‑run a volatile price swing. The community also runs regular giveaway campaigns—think PERRY, WELL, and other token airdrops—that target users who have staked or swapped in the last 30 days. Those incentives turn casual traders into long‑term liquidity providers, reinforcing the pool health and creating a virtuous cycle.

Beyond swaps, BXHSwap supports advanced features like multi‑token pools, custom routing, and token‑to‑token bridges that bypass the need for intermediary stablecoins. If you’re familiar with Balancer v2 or Uniswap v3, you’ll recognize similar concepts but with the added benefit of BSC’s lower gas costs. This makes BXHSwap a practical playground for testing tokenomics ideas, launching new meme coins, or even experimenting with cross‑chain token swaps via wrapped assets. As you explore the post list below, you’ll see guides on specific airdrop mechanics, token‑swap strategies, and how to evaluate liquidity‑pool risk—all tailored to the BXHSwap ecosystem.

BXH Crypto Exchange Review: In‑Depth Look at BXHSwap DEX (2025)

A concise BXH crypto exchange review covering features, fees, security, pros, cons, and a side‑by‑side comparison with Uniswap and PancakeSwap for 2025.