BSC Gas Fee Estimator

Token Swap Cost Calculator

Estimated Transaction Costs

Looking for a non‑custodial way to swap tokens without the hassle of a traditional exchange? BXH crypto exchange review breaks down what BXHSwap really offers, how it stacks up against the big DEX players, and whether it’s a fit for your DeFi needs in 2025.

Key Takeaways

- BXHSwap runs on the BNB Smart Chain, giving lower gas costs than Ethereum‑based DEXs.

- Supports major wallets like MetaMask and WalletConnect, plus native iOS/Android apps.

- Offers a free‑to‑use interface; revenue comes from standard transaction fees.

- Security is non‑custodial, but the platform lacks the depth of features found on Uniswap or PancakeSwap.

- Best for users who want a simple swap tool on BSC without account registration.

What Is BXHSwap?

BXHSwap is a decentralized exchange (DEX) built on the BNB Smart Chain (BSC) ecosystem. It enables peer‑to‑peer token swaps without holding users’ private keys, meaning you stay in control of your funds at all times.

Core Features & Supported Wallets

The platform touts a few core capabilities:

- Cross‑chain token swapping via integrated bridges.

- Zero‑fee tier for small‑scale trades (fees apply only on larger volumes).

- Live price charts and slippage controls directly on the UI.

On the wallet side, BXHSwap integrates with several popular solutions:

- MetaMask - the go‑to browser extension for DeFi.

- WalletConnect - QR‑code linking for mobile wallets.

- Binance Web3 Wallet, Bitget Wallet, and native iOS/Android apps.

How It Works - Swapping on BNB Smart Chain

When you initiate a swap, BXHSwap routes the transaction through BSC’s smart contract layer. The steps are straightforward:

- Connect your wallet (e.g., MetaMask) to the DEX interface.

- Select the token you want to sell and the token you want to receive.

- Set slippage tolerance - typically 0.5‑1% for BSC tokens.

- Confirm the transaction; the smart contract locks your source token, executes the swap, and releases the target token to your address.

Because BSC’s block time averages 3 seconds, most swaps finalize within a minute, assuming network congestion is low.

Security & Non‑Custodial Model

BXHSwap follows the standard DEX security model: the platform never stores private keys, and all trades happen on‑chain. This reduces the attack surface compared to centralized exchanges, but it also means you’re responsible for safeguarding your wallet’s seed phrase.

There’s no formal audit report publicly linked to the codebase as of 2025, which is a red flag for risk‑averse investors. However, the smart contracts are open source on GitHub, allowing community scrutiny.

Performance & Fees

Performance on BSC is generally fast and cheap. Typical gas fees hover between $0.05 and $0.15 per transaction, far lower than Ethereum’s $5‑$15 range in 2025. BXHSwap itself does not levy a platform fee; it earns a modest spread (usually 0.2‑0.3%) baked into the swap rate.

During peak BSC traffic (e.g., major token launches), confirmation times can climb to 10‑15 seconds, and fees may spike modestly. The platform does not offer advanced order types like limit or stop orders, limiting its appeal to traders who need precise entry points.

Pros, Cons & Who It’s Best For

Pros

- Low gas fees thanks to BSC.

- Simple UI - ideal for newcomers to DeFi.

- Broad wallet support, including mobile apps.

Cons

- Lack of advanced trading tools (no limit orders, no liquidity mining).

- Minimal community feedback - hard to gauge real‑world reliability.

- No public security audit as of 2025.

Best suited for users who want a quick, cost‑effective swap on BSC without dealing with registration, KYC, or order‑book complexities.

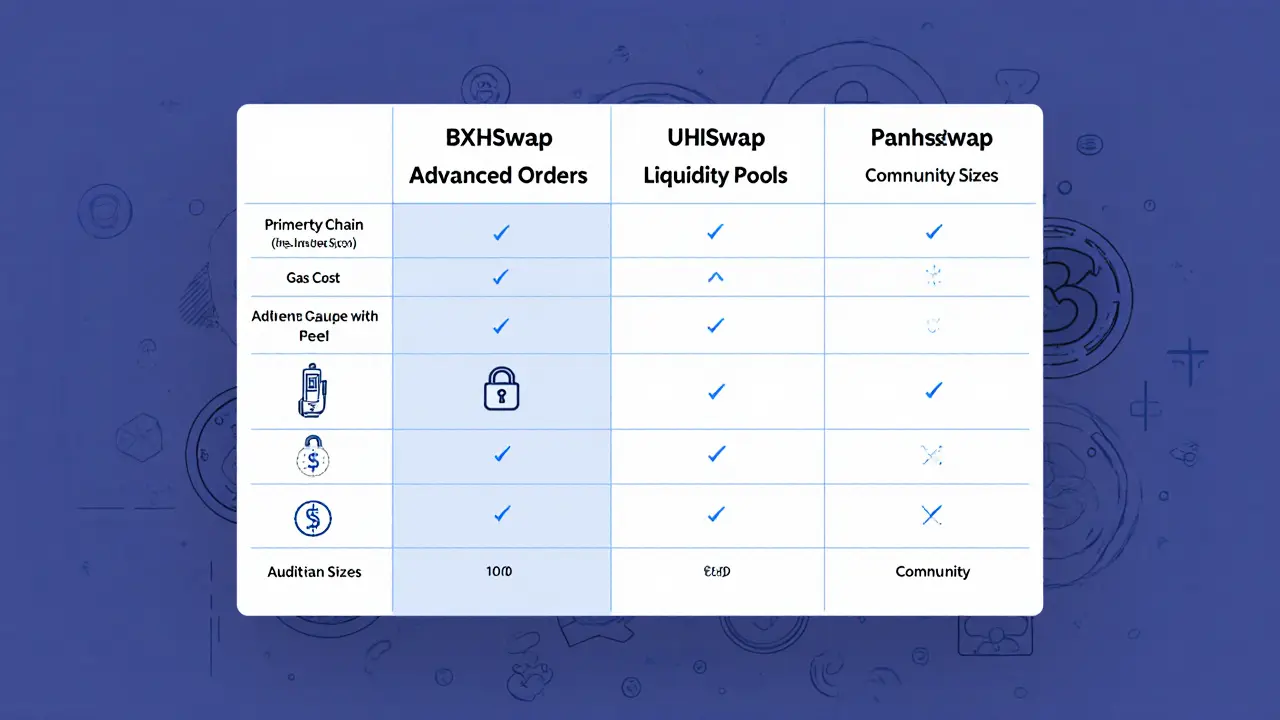

Comparison with Leading DEXs

| Feature | BXHSwap | Uniswap | PancakeSwap |

|---|---|---|---|

| Primary Chain | BNB Smart Chain | Ethereum (Layer‑2 support) | BNB Smart Chain |

| Typical Gas Cost | $0.05‑$0.15 | $5‑$15 (mainnet) | $0.06‑$0.20 |

| Advanced Order Types | None | Limit, range, TWAP | Limit (via extensions) |

| Liquidity Pools | Standard pools, no incentives | V3 concentrated liquidity | Standard + yield farms |

| Wallet Integration | MetaMask, WalletConnect, Binance Web3, Bitget | MetaMask, Coinbase Wallet, WalletConnect | MetaMask, Trust Wallet, WalletConnect |

| Audit Status (2025) | No public audit | Audited by ConsenSys Diligence | Audited by CertiK |

| Community Size | Very limited (few hundred active users) | Millions of active traders | Hundreds of thousands |

Is BXHSwap Worth Using in 2025?

If you’re already operating on BSC and need a no‑frills swap tool, BXHSwap delivers on speed and cost. However, the lack of audited contracts, limited feature set, and scarce community feedback mean it’s not the go‑to choice for high‑value or complex trading strategies.

For casual token swaps, especially when you want to avoid KYC, it’s a handy option. For serious DeFi participants, platforms like Uniswap (for Ethereum exposure) or PancakeSwap (for richer BSC features) are safer bets.

Next Steps & Troubleshooting

Ready to try BXHSwap? Follow these quick steps:

- Install MetaMask (or another supported wallet) and fund it with BNB for gas.

- Visit bscswap.bxh.com and click “Connect Wallet.”

- Select your source and target tokens, set a slippage limit, and confirm the transaction.

If a transaction hangs:

- Check BSC network status - high traffic can delay confirmations.

- Increase the gas price slightly in your wallet settings.

- Refresh the DEX interface and reconnect your wallet.

For persistent issues, reach out via the platform’s 24/7 live chat (available on the support page) or consult the community Discord channel for real‑time help.

Frequently Asked Questions

Is BXHSwap a centralized exchange?

No. BXHSwap is a decentralized exchange. It never stores your private keys, and all trades happen directly on the BNB Smart Chain.

What wallets can I use with BXHSwap?

Supported wallets include MetaMask, WalletConnect, Binance Web3 Wallet, Bitget Wallet, and the native iOS/Android apps.

Are there any hidden fees?

The platform itself charges no extra fee; you only pay the standard BSC gas fee and a small spread (≈0.2‑0.3%) embedded in the swap rate.

Is BXHSwap safe without a formal audit?

Safety is limited to the usual non‑custodial model. While the code is open source, the lack of a published third‑party audit means you should use it for modest amounts until more security data emerges.

Can I trade assets other than BSC tokens?

Currently BXHSwap focuses on BSC and a handful of cross‑chain bridges. Direct Ethereum or other chain swaps require moving assets to BSC first.