FRXETH Yield Calculator

frxETH (Liquid ETH)

Represents 1:1 ETH with liquidity. Does not earn staking rewards.

- Exchange Rate 1.00

- Uses DeFi Integration

sfrxETH (Auto-Compounding Yield)

Earns staking rewards automatically compounded.

- Exchange Rate 1.00+

- Yield Type Auto-Compounding

Fee Breakdown

Protocol charges 10% fee on yield:

8% to Treasury | 2% to Insurance Fund

Projected Earnings Summary

Initial Investment:

0 ETH

Total Yield Earned:

0 ETH

Protocol Fees Paid:

0 ETH

Net Earnings:

0 ETH

Final frxETH Amount:

0 frxETH

Final sfrxETH Amount:

0 sfrxETH

Exchange Rate Growth:

When you hear the term FRXETH, you’re looking at a token that lets you earn staking rewards on Ethereum without locking your funds for years. Frax Ether bridges the gap between traditional ETH staking and the fast‑moving DeFi world, giving you instant liquidity, auto‑compounding yields, and a safety net through the Frax Finance ecosystem.

Key Takeaways

- FRXETH is a liquid staking derivative that represents 1ETH on a 1:1 basis.

- Two tokens run the system: frxETH - a stable‑coin‑like token pegged to ETH, and sfrxETH - an ERC‑4626 vault token that auto‑compounds staking rewards.

- Staking yields come from validator rewards, transaction fees, and MEV, all funneled into sfrxETH holders.

- The protocol charges a 10% fee (8% protocol, 2% insurance fund) and is audited by Certik and Trail of Bits.

- FRXETH sits alongside other liquid staking tokens (stETH, rETH) but offers unique flexibility through the broader Frax ecosystem.

What is Frax Ether?

Frax Ether (FRXETH) is a liquid staking derivative created by Frax Finance. Launched in late 2022, it tokenizes ETH that’s been deposited into Ethereum 2.0 validators. The token gives you immediate liquidity while the underlying ETH earns the usual 5‑6% annual staking reward plus extra MEV income.

The system revolves around three core components:

- frxETH - a 1:1 peg to ETH, acting like wrapped ETH (WETH) but with a built‑in peg‑defense band of 0.99‑1.01.

- sfrxETH - an ERC‑4626 vault token that automatically compounds all validator yields.

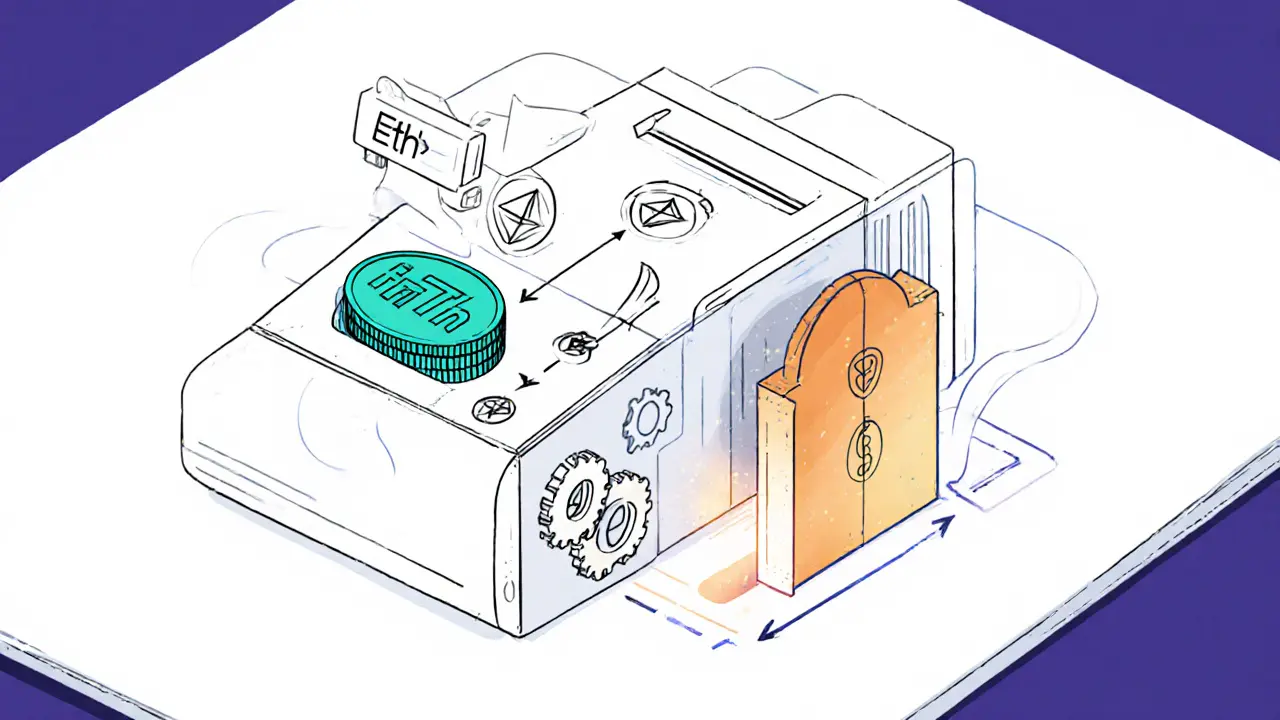

- The Frax ETH Minter contract, which swaps native ETH for frxETH and spins up new validator nodes when the minter balance hits 32ETH.

How the Two‑Token Model Works

When you deposit ETH into the Frax Ether Minter, you receive frxETH at a 1:1 rate. Holding frxETH alone gives you a liquid version of ETH but no staking rewards - similar to holding WETH. To start earning, you move your frxETH into the sfrxETH vault. The vault’s exchange rate (frxETH per sfrxETH) rises over time as staking rewards, fees, and MEV are added to the pool.

For example, if the exchange rate starts at 1.00, after a month of successful validation it might be 1.04. A holder of 1sfrxETH can then redeem it for 1.04frxETH, effectively cashing in the accumulated yield. This auto‑compounding mechanism means you never need to claim rewards manually; the vault does it for you.

Fees, Security, and Risk Management

The protocol takes a flat 10% fee on the total yield generated by validators. Eight percent of that goes to the Frax Finance treasury, while the remaining 2% feeds an insurance fund designed to protect against slashing events or validator downtime. This fee structure is outlined in the code and reinforced by third‑party audits from Certik and Trail of Bits. Both firms confirmed that the smart contracts follow best‑in‑class security practices and that the insurance fund is correctly isolated from user balances.

Because frxETH’s peg is maintained independently of Frax’s stablecoin balance sheets, a market shock that hits FRAX or FPI won’t directly affect FRXETH’s 1:1 relationship with ETH. The system’s design thus isolates liquidity risk while still benefiting from Frax’s proven stablecoin engineering.

Comparing FRXETH to Other Liquid Staking Tokens

| Metric | FRXETH (Frax) | stETH (Lido) | rETH (Rocket Pool) |

|---|---|---|---|

| Primary Token | frxETH (liquid), sfrxETH (yield) | stETH (auto‑yield) | rETH (auto‑yield) |

| Yield Source | Validator rewards + MEV + fees (auto‑compounded) | Validator rewards + fees (auto‑compounded) | Validator rewards + fees (auto‑compounded) |

| Fee Structure | 10% of yield (8% protocol, 2% insurance) | ~10% of yield (Lido fee) | ~15% of yield (rocket pool & node operator fees) |

| Peg Stability | 1:1 ±1% band, independent of FRAX stablecoin | 1:1 (subject to Lido’s custodial model) | 1:1 (subject to node operator risk) |

| Insurance | 2% fund, audited by Certik & Trail of Bits | None (reliant on Lido’s DAO governance) | Partial (rocket pool’s reserve pool) |

| Integration with DeFi | Deep Frax ecosystem (stablecoins, yield farms) | Broad DEX support, but less Frax‑specific composability | Supports Rocket Pool’s own vaults and some DEXes |

FRXETH’s dual‑token design offers a unique choice: keep frxETH for pure ETH exposure or convert to sfrxETH for hassle‑free auto‑compounding. This flexibility is less common in stETH or rETH, where the single token already yields rewards.

How to Get Started with FRXETH

- Connect a Web3 wallet (MetaMask, Ledger, etc.) to a supported interface like Frax Finance’s official UI.

- Deposit the amount of ETH you wish to stake. The Minter contract instantly mints the same amount of frxETH.

- If you want to earn rewards, click “Stake frxETH”. The platform moves your tokens into the sfrxETH vault.

- Watch the exchange rate climb. When you’re ready, redeem sfrxETH for a larger amount of frxETH, then withdraw to native ETH if you need cash.

All steps are gas‑efficient because the Minter only triggers a validator spin‑up when the total balance reaches a new 32‑ETH threshold. This batching reduces transaction costs compared to individually creating validators.

Potential Pitfalls and What to Watch

- Understanding the two‑token flow: New users sometimes mistake frxETH for a yield‑bearing token. Remember, you need to convert to sfrxETH to capture rewards.

- Fee impact on small balances: The 10% yield fee can eat into returns if you stake only a few ETH for a short period.

- Validator risk: Although the insurance fund mitigates slashing, extreme network events could still affect the overall yield.

- Liquidity considerations: While frxETH trades on major DEXes, large withdrawals may experience temporary slippage during peak market stress.

Future Outlook for Frax Ether

Frax Finance’s roadmap shows plans to integrate frxETH more tightly with its own stablecoins (FRAX, FPI) and to launch multi‑asset vaults that combine frxETH with other high‑yield strategies. As Ethereum moves toward full proof‑of‑stake finality with Shanghai and subsequent upgrades, the demand for liquid staking solutions like FRXETH is expected to grow. The protocol’s proven audit track record and its insurance fund give it a competitive edge in a space where security scares can quickly shift user preference.

Frequently Asked Questions

What’s the difference between frxETH and sfrxETH?

frxETH is a 1‑to‑1 liquid representation of ETH; it does not earn staking rewards. sfrxETH is an ERC‑4626 vault token that automatically compounds all rewards earned by the underlying staked ETH. To earn yield, you must move frxETH into the sfrxETH vault.

How is the frxETH peg maintained?

The peg stays within a 0.99‑1.01 band. If the market price drifts, arbitrage bots can swap frxETH for ETH (or vice‑versa) via the Minter contract, pulling the price back toward 1ETH per frxETH.

What fees does Frax Ether charge?

A 10% fee on all generated yield: 8% goes to the Frax Finance treasury and 2% is allocated to an insurance fund that backs against slashing or validator failures.

Is FRXETH audited?

Yes. Independent security firms Certik and Trail of Bits have audited the core contracts, confirming that the architecture follows best‑practice standards and that the insurance fund is correctly isolated.

Can I use frxETH in other DeFi protocols?

Absolutely. Since frxETH behaves like wrapped ETH, you can supply it to Curve, Aave, or Uniswap for additional yield or liquidity. Just remember it won’t earn the native staking reward unless you convert it to sfrxETH first.