Chivo Wallet Comparison Tool

Compare Chivo Wallet Features

See how Chivo compares to traditional services and private crypto wallets based on key criteria.

Comparison Results

Key Takeaways

- Zero Fees: Chivo wallet charges no transaction fees, unlike traditional services which charge 5-10%.

- Instant Transfers: On-chain Bitcoin transfers happen in seconds, faster than traditional methods.

- Volatility Risk: Users face significant price fluctuations with Bitcoin holdings.

- Accessibility: Requires smartphone access, unlike physical locations used by remittance services.

When ElSalvador launched its bold cryptocurrency plan, Chivo wallet became the world’s first government‑issued national crypto wallet, allowing citizens to send and receive Bitcoin with zero transaction fees took center stage. The rollout on September72021 coincided with President NayibBukele’s historic decision to make Bitcoin legal tender, a move that instantly put a tiny Central American country under the global fintech spotlight.

Why ElSalvador Chose Bitcoin and a National Wallet

The government highlighted two main problems: more than 70% of the population lacked a traditional bank account, and remittances-money sent home by Salvadorans living abroad-accounted for up to 20% of GDP. By using Bitcoin’s borderless network, the state hoped to slash the 5‑10% fees charged by services like Western Union, while the free‑to‑use Chivo wallet offered a seamless bridge between the Bitcoin network and the US‑dollar economy.

Technical Backbone and Early Adoption Numbers

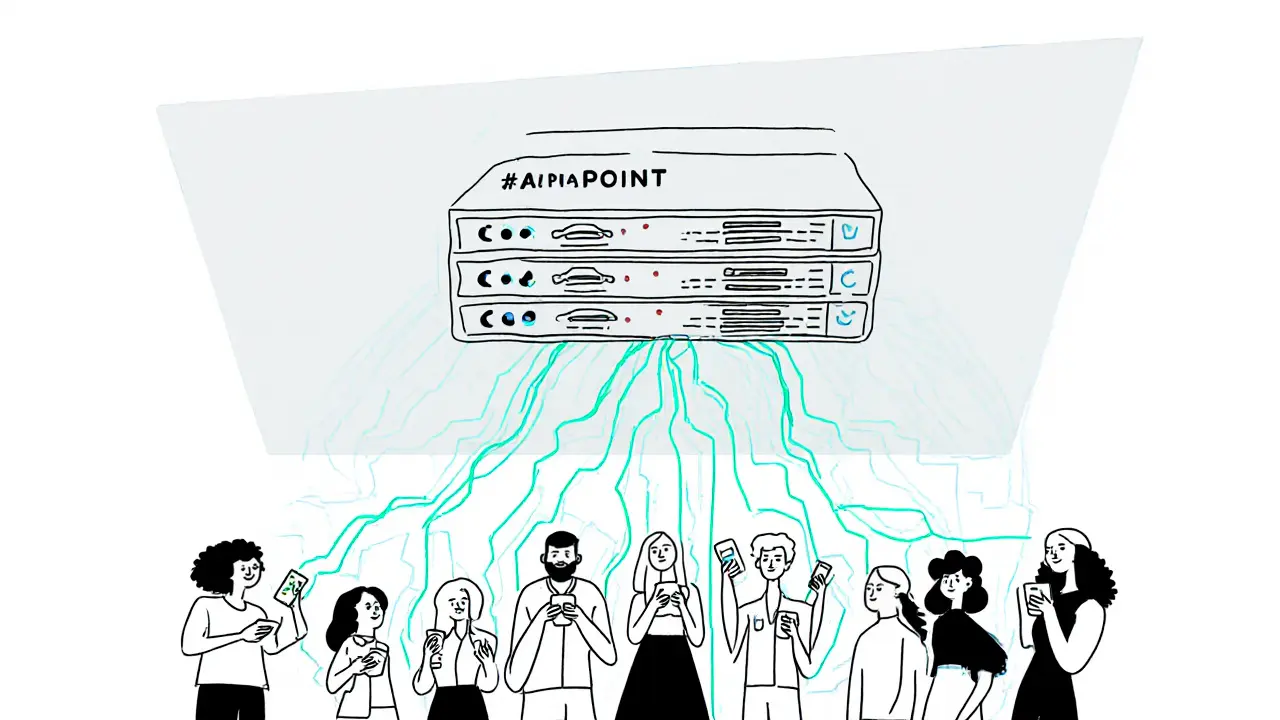

The wallet’s infrastructure was built by AlphaPoint a fintech firm with over nine years of experience providing backend services for crypto exchanges worldwide. AlphaPoint designed the system to handle millions of simultaneous users, a lofty target for a country of just 6.5million people.

- Dual‑currency support: Bitcoin and USDollar.

- Zero‑fee Bitcoin transfers, funded by the state.

- Initial $30 seed deposit to every registered user.

Within two weeks, roughly 46% of Salvadorans had downloaded the app-a remarkable adoption spike for any national digital platform.

What Went Wrong: Technical Glitches and Volatility

Despite the strong start, the rollout hit several roadblocks. The app suffered from server overloads, occasional shutdowns, and reports of identity theft that eroded trust. More fundamentally, Bitcoin’s price swung wildly: from a $69000 peak in late2021 to under $16000 by mid‑2022. For users who kept their seed $30 in Bitcoin, the purchasing power vanished almost overnight.

Comparison with Traditional and Private Alternatives

| Feature | Chivo wallet | Western Union / MoneyGram | Coinbase / Binance (private) |

|---|---|---|---|

| Transaction fee | 0% (government‑funded) | 5‑10% | 0‑1% (varies) |

| Speed (average) | Seconds (on‑chain) / minutes (network) | Minutes‑hours | Seconds‑minutes |

| Legal status | Government‑backed, legal tender (until Jan2025) | Fully regulated | Regulated in limited jurisdictions |

| Accessibility | Smartphone only, requires internet | Physical locations, cash pickup | Smartphone & web, KYC required |

| Volatility exposure | High - tied to Bitcoin price | Low - fiat currency | High - crypto assets |

The table shows why Chivo wallet looked attractive at launch: no fees and instant transfers. Yet the volatility column reveals the hidden risk that ultimately alarmed many users and policymakers.

Policy Reversal and the Role of the IMF

By late2024, the International Monetary Fund (IMF the global financial watchdog that provides loans and policy advice to member countries) made clear that continued financial assistance hinged on removing Bitcoin’s legal tender status. In January2025, ElSalvador complied, ending the mandatory use of Bitcoin while keeping the National Commission of Digital Assets (CNAD) the regulatory body created under the Digital Assets Issuance Act to oversee crypto activities in place.

The Digital Assets Issuance Act (LEAD the 2023 law that established a legal framework for digital assets in ElSalvador) remains active, allowing private crypto businesses to operate even after the government scaled back its own involvement.

Current State and Future Outlook

Despite the policy shift, the government still holds a sizeable Bitcoin reserve. The Strategic Bitcoin Reserve Fund a state‑owned pool of roughly 6,102 BTC worth about $500million as of March2025 continues to be managed under the LEAD framework.

ElSalvador is also positioning itself as a regional crypto hub, hosting the PLANB Forum 2025, Central America’s largest crypto‑assets conference. The event attracted developers, regulators, and investors, highlighting the country’s pivot from a mandatory Bitcoin model to a more open‑innovation stance.

Lessons Learned for Other Nations

Several clear takeaways emerge from the Chivo experiment:

- Infrastructure matters. Even with AlphaPoint’s expertise, the platform struggled under sudden mass adoption, suggesting that scaling plans need real‑world stress testing.

- Volatility is a deal‑breaker. When a national currency’s value can swing 70% in months, everyday users face unpredictable purchasing power.

- Incentives aren’t enough. The $30 seed deposit drove downloads, but active usage fell quickly once the novelty wore off.

- Regulatory flexibility helps. Maintaining a regulatory body (CNAD) and a legal framework (LEAD) allowed the country to keep crypto businesses alive after the wallet’s mandated status ended.

How to Get Started with the Chivo Wallet Today

If you’re a resident or a traveler interested in trying the app after the policy change, the onboarding steps remain largely the same:

- Download the official Chivo app from the Google Play Store or Apple App Store.

- Complete identity verification using a national ID and selfie.

- Link a local bank account or debit card to move between Bitcoin and USDollar.

- Explore the “Buy Bitcoin” feature if you want exposure, but remember the price can swing wildly.

- Use the “Send” function for low‑cost remittances to family abroad.

Support channels have improved since 2022, but users should still watch for phishing attempts and keep backup recovery phrases safe.

Common Pitfalls and Pro Tips

Even seasoned crypto users trip up with Chivo. Here are the most frequent issues and how to avoid them:

- Forgotten recovery phrase. Write it down on paper, store it in a secure place, and never share it.

- Confusing Bitcoin price with USDollar balance. The app shows both; always double‑check which column you’re looking at before sending.

- Network congestion. During peak times, transaction confirmation may take longer; consider using the “Lightning Network” option if available.

- Security updates. Keep the app updated to benefit from the latest patches issued by AlphaPoint.

Next Steps for Stakeholders

Policymakers looking at replicating a national crypto wallet should first run pilot programs with clear exit clauses. Financial institutions can partner with existing crypto infrastructure providers rather than building from scratch. For entrepreneurs, the post‑legal‑tender environment offers fertile ground for services like crypto‑backed loans, payment processors, and educational platforms.

Frequently Asked Questions

Is the Chivo wallet still free to use?

Yes. The government continues to cover network fees for Bitcoin transactions, so users still pay zero transaction fees inside the app.

Can I convert my Bitcoin to USDollar within Chivo?

The app includes a built‑in exchange that lets you sell Bitcoin for USDollar at the market rate, minus a small spread.

What security measures protect my funds?

Chivo uses multi‑factor authentication, encrypted storage, and backend safeguards from AlphaPoint. Still, users are responsible for keeping their recovery phrases private.

How does the removal of Bitcoin’s legal tender status affect me?

You can still hold, send, and receive Bitcoin in the wallet, but merchants are no longer required to accept it. The app remains functional for remittances and personal transfers.

Is there any risk if Bitcoin’s price drops further?

Yes. Your Bitcoin balance will be worth less in fiat terms. If you need to spend money locally, consider converting to USDollar inside the app to avoid volatility.