When you're looking for a crypto exchange, you want something that works reliably, offers real choices, and keeps your money safe. AUX Exchange doesn’t meet any of those basic standards. It’s not just underdeveloped-it’s barely there. If you’re considering using it, you need to know exactly what you’re walking into.

What Is AUX Exchange?

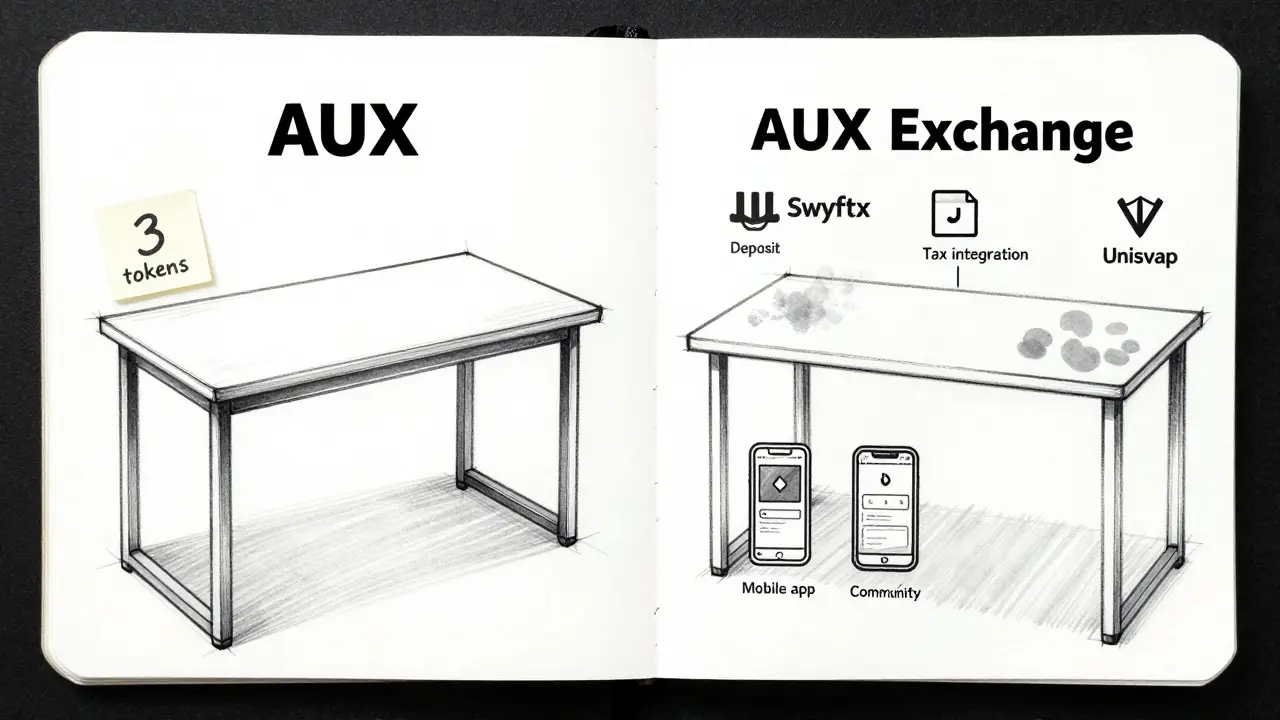

AUX Exchange claims to be a decentralized exchange (DEX), meaning it’s supposed to let you trade cryptocurrencies directly from your wallet without handing control to a central company. But that’s where the claim ends. Unlike Uniswap, SushiSwap, or even smaller DEXs like PancakeSwap, AUX Exchange offers almost no public information. Coingecko lists it with only three supported cryptocurrencies and three trading pairs. That’s not a platform-it’s a placeholder. Most serious DEXs support dozens, if not hundreds, of tokens. AUX Exchange doesn’t even have enough liquidity to make trading meaningful.No Transparency, No Trust

Legitimate crypto exchanges publish security details. They show how they store funds, whether they use cold storage, if they’ve been audited, and if they comply with financial regulators. AUX Exchange does none of this. There are no Proof-of-Reserves reports. No ISO27001 certification. No mention of two-factor authentication or API access. Even basic things like trading fees or withdrawal limits aren’t listed anywhere. If you can’t find this information on their site-and you can’t-it’s a red flag. You’re trading blind.Absent From Every Major Review

In Australia, where crypto regulation is tightening, every reputable exchange is covered. Koinly, Cryptonews.au, Finder.com, NFTEvening, and Arielle.com.au all publish annual lists of the best exchanges. AUX Exchange isn’t on any of them. Not even as a footnote. YouTube creators like Raymond La, who reviewed the top five exchanges in Australia in April 2025, didn’t even mention AUX. Why? Because it doesn’t have enough users, features, or credibility to be worth discussing. If it were a viable option, someone would have tested it by now.

No Fiat Support, No Australian Market Presence

If you’re in Australia, you need to deposit Australian dollars (AUD). Every major exchange-Coinspot, Swyftx, Kraken, Coinbase-lets you do this via bank transfer, PayID, or P2P. AUX Exchange doesn’t support AUD at all. No deposits. No withdrawals in local currency. That means you’d need to buy crypto on another exchange first, send it to AUX, trade it there, and then send it back out. That’s not a trading platform-it’s a middleman with no purpose. And since it doesn’t integrate with tax tools like Koinly or Sharesight, you’re on your own for reporting gains to the ATO. That’s not just inconvenient-it’s risky.No Community, No Activity

Crypto is built on communities. Reddit threads, Telegram groups, Twitter discussions-they all help you learn, spot scams, and find support. AUX Exchange has none of that. There are no user reviews on Trustpilot. No discussions on Reddit’s r/CryptoCurrency. No YouTube tutorials. No Facebook groups. No GitHub activity. No GitHub at all. If a platform has zero online presence, it’s either brand new (unlikely) or dead (more likely). There’s no evidence of active development, customer support, or even a functioning website beyond the bare Coingecko listing.

Why This Matters

You might think, “It’s just a small DEX. Why does it matter?” But here’s the truth: small doesn’t mean safe. In crypto, small often means abandoned. Exchanges that don’t update, don’t publish audits, don’t support fiat, and don’t engage users aren’t trying to build something-they’re just taking up space. There are thousands of crypto projects that launched with big promises and vanished within months. AUX Exchange fits that pattern perfectly.What You Should Use Instead

If you want a DEX, try Uniswap or PancakeSwap. They’re open-source, audited, and used by millions. If you want an easy, regulated exchange in Australia, use Swyftx or Coinspot. Both support AUD deposits, have mobile apps, offer tax reporting, and have real customer support. Kraken and Coinbase are solid global options with deep liquidity and advanced tools. All of them have been tested, reviewed, and trusted by hundreds of thousands of users. AUX Exchange has none of that.The Bottom Line

AUX Exchange isn’t a crypto exchange you can trust. It’s not even a real one. It lacks transparency, security, usability, and community. It doesn’t support your local currency. It doesn’t integrate with tax tools. It doesn’t appear in any credible reviews. And most importantly-it doesn’t seem to exist beyond a single Coingecko listing. Don’t waste your time. Don’t risk your crypto. There are dozens of better options that actually work.Is AUX Exchange a scam?

There’s no direct evidence AUX Exchange is a scam, but it shows all the warning signs of one. No transparency, no user base, no documentation, no regulatory compliance, and no updates suggest it’s either abandoned or not operating as a legitimate service. In crypto, absence of evidence is evidence of absence. If a platform doesn’t show up in reviews, on YouTube, or in community discussions, it’s not trustworthy.

Can I deposit AUD into AUX Exchange?

No. AUX Exchange does not support any fiat currency, including Australian dollars (AUD). You cannot deposit money directly from your bank account. To use it, you’d need to buy crypto on another exchange, transfer it to AUX, and then trade. This adds unnecessary steps, fees, and risk without any benefit.

Does AUX Exchange have a mobile app?

There is no official mobile app for AUX Exchange. No app is listed on the Apple App Store or Google Play Store. No screenshots, download links, or user guides exist online. This is another sign that the platform is not actively maintained or developed.

Is AUX Exchange regulated?

No. AUX Exchange shows no evidence of regulatory registration with any financial authority, including AUSTRAC in Australia, ASIC, or any international body. Legitimate exchanges in Australia are required to register with AUSTRAC and follow anti-money laundering rules. AUX Exchange doesn’t appear in any public registry of compliant platforms.

Why is AUX Exchange listed on Coingecko?

Coingecko lists hundreds of exchanges, including many with minimal activity. Their listings don’t imply trust or quality-they simply track publicly available data. AUX Exchange appears because someone submitted basic info (like trading pairs), not because it’s a reliable or popular platform. A Coingecko listing is not a stamp of approval.

Can I use AUX Exchange for tax reporting?

No. AUX Exchange doesn’t integrate with any tax reporting tools like Koinly, Sharesight, or CryptoTaxCalculator. You won’t be able to automatically import your trade history. That means manually tracking every transaction, which is time-consuming and error-prone. If you’re in Australia, the ATO requires accurate records. Using AUX Exchange puts you at risk of incorrect reporting.

Are there any fees on AUX Exchange?

There is no public information about trading fees, withdrawal fees, or deposit fees on AUX Exchange. Unlike platforms like Kraken or MEXC that clearly state their fee structures, AUX Exchange provides zero details. This lack of transparency makes it impossible to calculate the true cost of trading.

What cryptocurrencies does AUX Exchange support?

According to Coingecko, AUX Exchange supports only three cryptocurrencies and offers three trading pairs. The exact tokens aren’t listed publicly, and no documentation explains which ones are available. This extreme limitation makes it useless for anyone looking to diversify or trade beyond a handful of assets.