Crypto Scam Checker

Is This Crypto Project Legitimate?

Check if this cryptocurrency project is potentially a scam by answering key questions about their transparency and security.

Scam Risk Assessment

The Squid Game crypto coin (SQUID) isn't a real investment. It was a scam that exploded in late 2021 and vanished overnight, leaving thousands of people with worthless tokens and massive losses. The project used the massive popularity of Netflix’s Squid Game TV show to trick people into thinking they were getting in on the next big thing. But behind the flashy website, fake team photos, and promises of 100x returns was a rigged system designed to steal money - not build value.

How the SQUID Scam Worked

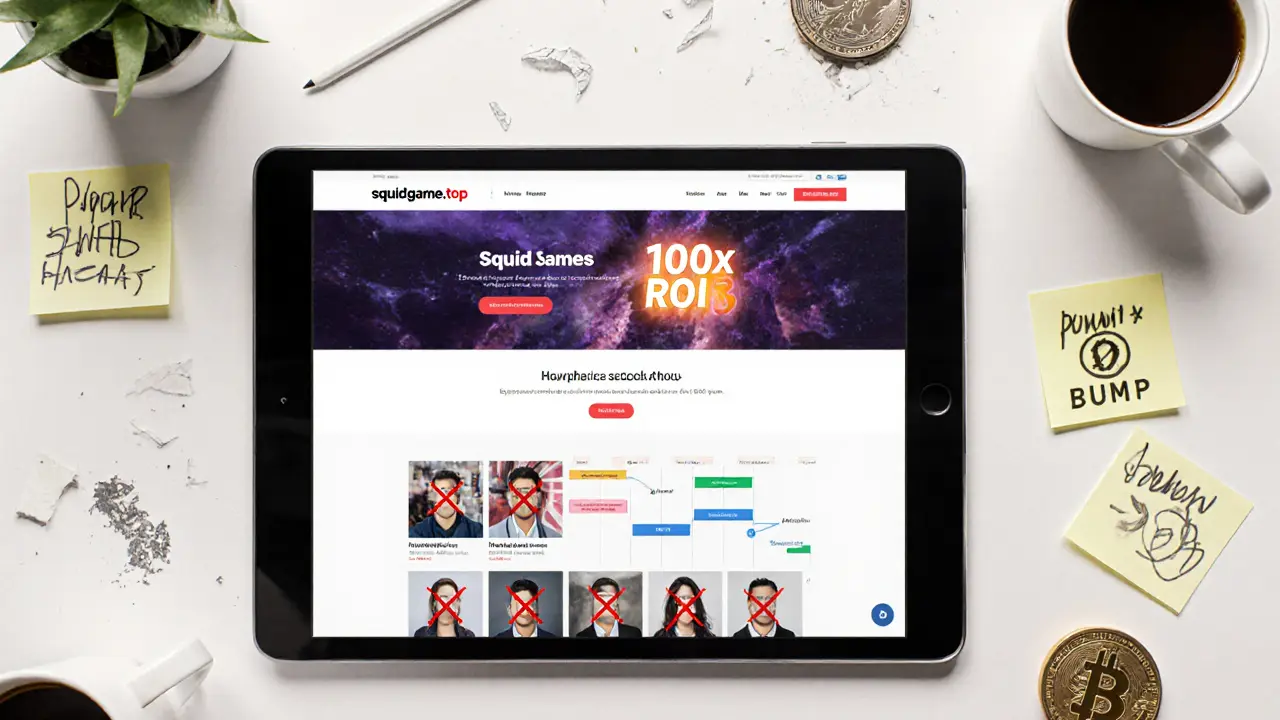

The SQUID token launched in October 2021, just weeks after Season 1 of Squid Game became a global phenomenon. The creators claimed it was a ‘play-to-earn’ game token tied to a future video game. They even built a website - squidgame.top - that looked professional, complete with a whitepaper, roadmap, and team profiles. But none of it was real. The team members? Their LinkedIn profiles were fake. The photos? Stock images pulled from Google. The game? Never existed. The only thing real was the smart contract - and it was built to cheat investors. The token ran on the Binance Smart Chain (BSC), which is common for low-cost crypto projects. But here’s the trap: the smart contract had a hidden rule. Regular users couldn’t sell their SQUID tokens. Not until the developers were ready. Meanwhile, the creators could cash out anytime by swapping their SQUID for BNB (Binance Coin), which is easy to sell on major exchanges. This is called a rug pull. It’s when the people behind a crypto project suddenly drain all the money from the project’s wallet and disappear. In SQUID’s case, they stole between $3.3 million and $3.4 million. That’s not a typo. Millions gone in hours.The Price Surge That Was Too Good to Be True

Within weeks, the price of SQUID jumped 40,000%. It went from pennies to over $2,800 per token on November 1, 2021. People saw the chart going straight up and thought they’d found gold. They rushed in - some investing life savings. Reddit threads filled with excitement. YouTube influencers posted videos saying, “Buy now before it’s too late!” But the rise wasn’t driven by demand for a product. It was fueled by hype, fear of missing out, and bots programmed to create fake trading volume. The more people bought, the higher the price climbed - and the more the scammers made. It was a classic pump-and-dump, disguised as a gaming revolution. Then, on November 2, 2021, the rug was pulled. The website went dark. The Telegram groups vanished. The token’s price crashed to zero in minutes. Investors were locked in. They couldn’t sell. And no one came back.Why People Fell for It

This wasn’t a technical scam. It was a psychological one. The creators knew people were already obsessed with Squid Game. They used the show’s branding - the masks, the red uniforms, the game names - to make the token feel legit. They didn’t need to explain how the game would work. They just needed people to feel like they were part of something big. Also, crypto is still new for most people. Many don’t know how to check a smart contract. They don’t know what a “rug pull” means. They see a token with a cool name, a trending meme, and a rising price - and they assume it’s safe. The scammers counted on that. They used social proof: fake testimonials, bots posting “I made $50,000!” on Twitter, and influencers who got paid to promote it without saying it was a paid ad. One user on Reddit said they put in $5,300. Now it’s worth nothing.

How to Spot a Crypto Scam Like SQUID

If you’re looking at any new crypto project, ask yourself these questions:- Is the team real? Search their names on LinkedIn. Do the photos match? Are their past jobs verifiable?

- Is the code public? Legitimate projects publish their smart contracts on GitHub. SQUID didn’t. Not even a trace.

- Has the contract been audited? Real projects pay $10,000-$15,000 for independent audits. SQUID had none.

- Can you sell your tokens? If the project restricts selling - especially for regular users - it’s a red flag.

- Are the returns too good to be true? “100x returns in a week”? “Risk-free”? That’s not crypto. That’s a lie.

- Is there a working product? SQUID promised a game. No demo. No beta. No code. Just promises.

What Happened After the Crash?

After the scam collapsed, blockchain analysts from FTI Consulting and TRM Labs published detailed reports showing exactly how the money moved. They traced every transaction - from the first investor deposit to the final withdrawal into BNB wallets controlled by the scammers. Netflix, the creators of the show, had nothing to do with the token. They issued a public statement denying any involvement. The U.S. Commodity Futures Trading Commission (CFTC) added SQUID to their list of known scams in early 2022. When Squid Game Season 2 dropped in late 2024, new copycat tokens popped up - SQUID2, DALMATIAN, etc. But none came close to the original scam’s scale. The largest new one only hit $1.2 million in market cap. The original peaked at over $2.6 billion - all of it stolen.