Nerve Finance Value Estimator

Current Nerve Finance Value Calculator

Calculate how much your NRV tokens are worth today compared to their peak value.

Results

Current Value: $0.00

Loss Since Peak: 0.00%

Based on: Peak Price: $6.86 | Current Price: $0.0007

Nerve Finance (NRV) is a decentralized exchange built on Binance Smart Chain that was designed to let users swap stablecoins like USDT, BUSD, and USDC with almost no price slippage. It launched in March 2021 during the peak of the DeFi boom, promising fast, cheap trades between dollar-pegged assets. But today, it’s barely alive.

At its height, Nerve Finance had a price of $6.86 per NRV token. That was back in May 2021. As of November 2025, the token trades for around $0.0007 - a 99.99% drop. The project’s market cap is under $31,000. For comparison, Uniswap’s market cap is over $3 billion. Nerve Finance isn’t just small - it’s practically invisible in today’s crypto market.

How Nerve Finance was supposed to work

Nerve Finance wasn’t built to trade Bitcoin or Ethereum. It was built for stablecoins. Its core tech was a specialized Automated Market Maker (AMM) called a ‘stableswap,’ similar to Curve Finance but on Binance Smart Chain. The idea was simple: if you wanted to swap USDT for USDC without losing 0.5% or more in slippage, Nerve Finance claimed it could do it with less than 0.01%.

It worked by locking up stablecoins in liquidity pools. Users who added their USDT or BUSD to these pools earned NRV tokens as rewards. Those NRV tokens weren’t just rewards - they were governance tokens. Holders could vote on changes to the protocol: fee adjustments, new pools, treasury spending. It sounded like a solid DeFi model.

But there was a catch. The liquidity never stuck.

Why the liquidity vanished

Early users did get low slippage. But they also got crushed by impermanent loss. That’s when the value of your deposited assets drops compared to holding them outside the pool. One CoinGecko user wrote in January 2022: “Great concept but liquidity dried up after the initial hype. Tried to provide liquidity but impermanent loss ate my returns.”

Why? Because the pools were too small. Even at its peak, the total value locked (TVL) in Nerve Finance never exceeded $20 million. By late 2022, it dropped below $5 million. Today, it’s at $1.66 million. That’s 0.003% of the entire DeFi ecosystem.

Meanwhile, Curve Finance expanded to multiple chains, including BSC. PancakeSwap added its own stableswap pools. Suddenly, Nerve Finance’s niche wasn’t special anymore - it was outdated.

The tokenomics problem

The NRV token supply is a mess. CoinMarketCap lists a max supply of 136 million. Holder.io says 150 million. Either way, only 46 million are in circulation. That means over 100 million tokens are still locked up or unclaimed - but nobody knows where they are or when they’ll be released.

Here’s the real issue: the market cap to TVL ratio. For healthy DeFi projects, this number is usually between 0.1 and 1.0. That means the token’s value is at least 10% of the protocol’s actual locked assets. Nerve Finance’s ratio? 0.018. That’s less than 2%. In plain terms: the token is wildly overissued compared to the value it’s supposed to represent.

DeFi analysts at Delphi Digital and Messari flagged this as a red flag years ago. When the token’s market cap is this far below the protocol’s TVL, it usually means one of two things: either the token is worthless, or the protocol isn’t capturing any value from its own use. In Nerve Finance’s case, it’s both.

No activity, no community, no future

There’s no active Discord. No Telegram group. No recent updates on the official website. The last GitHub commit was in June 2022. The Twitter account hasn’t posted anything meaningful since 2022.

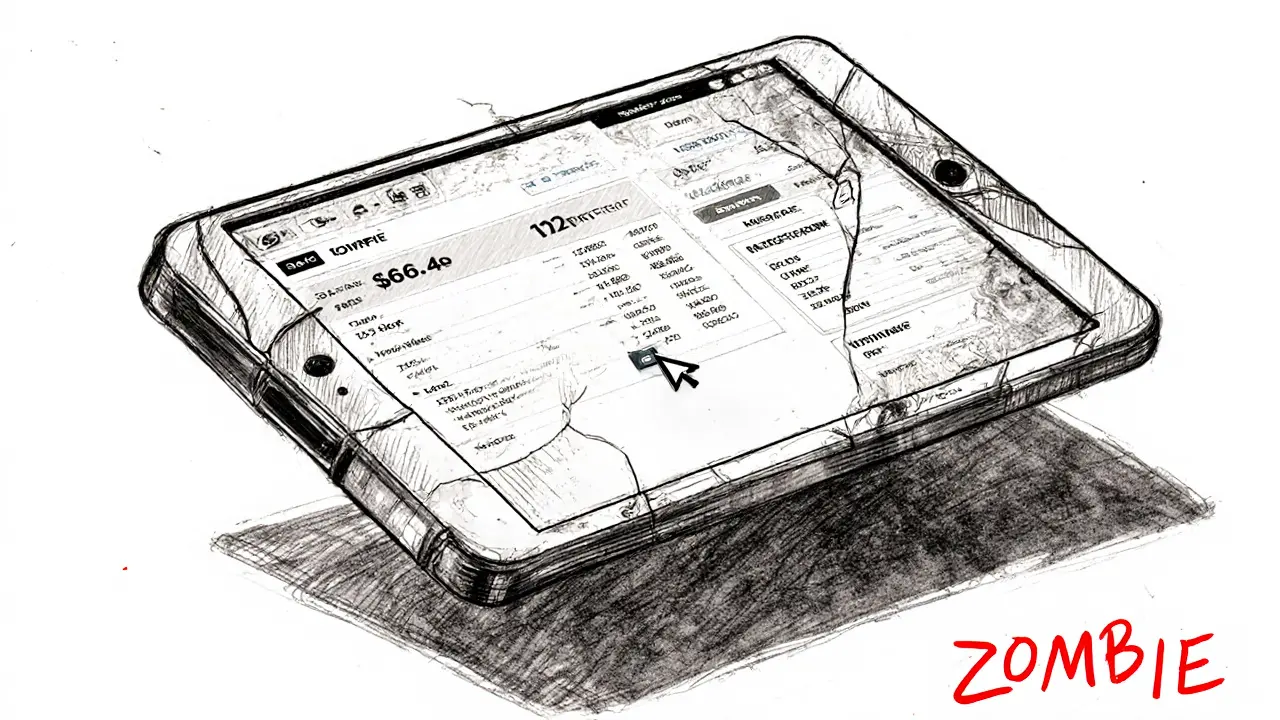

On-chain data shows only 127 unique wallet addresses interacted with Nerve Finance’s smart contracts in the last 30 days. That’s less than one interaction per day. The 24-hour trading volume? $66.46. For context, a single small-cap altcoin like Dogecoin trades over $200 million daily.

Even the exchanges that still list NRV - Gate.io, PancakeSwap V1 and V2 - barely see any activity. The NRV/USDT pair, which once accounted for 83% of volume, now trades less than $23,000 in a full day. Most of that volume is likely just bots or low-volume traders trying to cash out.

Who backed Nerve Finance - and why it matters

When Nerve Finance launched, it had serious backing. Investors like Alameda Research, Three Arrows Capital, CMS Holdings, and Primitive Ventures put money into it. These were big names in crypto finance. Alameda and Three Arrows collapsed in 2022 after the FTX implosion. That wiped out any chance of future funding or support.

When a project loses its institutional backers, it doesn’t just lose money - it loses credibility. No one wants to be the next person to pour liquidity into a dead protocol. Especially when the original investors are gone.

Is Nerve Finance still usable?

Technically, yes. You can still connect your MetaMask wallet to PancakeSwap and trade NRV for USDT. But it’s not practical. The price swings wildly because of low liquidity. A $100 trade might move the price by 10%. Slippage isn’t “minimal” anymore - it’s dangerous.

And if you try to stake NRV? The rewards are negligible. The APY on liquidity pools is below 1%. Meanwhile, you’re risking your stablecoins to impermanent loss. There’s no incentive to hold or use it.

Where does Nerve Finance stand today?

Nerve Finance isn’t dead - it’s a zombie. The smart contracts still run. The token still trades. But no one cares. No one develops it. No one uses it. It’s a relic of the 2021 DeFi bubble - a project that solved a real problem, but failed to keep users, liquidity, or trust.

It’s part of a larger trend. According to Messari’s Q3 2023 DeFi report, 18% of DeFi projects launched during the 2021 bull market are now inactive. Nerve Finance isn’t an outlier - it’s a textbook case of what happens when a niche DeFi project loses momentum.

Its story isn’t one of fraud or hacking. It’s one of neglect. The team stopped updating. The community vanished. The investors disappeared. And without any of those, even the best tech can’t survive.

Should you buy NRV?

Short answer: no.

If you’re looking to trade stablecoins, use Curve on Ethereum or PancakeSwap’s own pools on BSC. They’re far more liquid, better supported, and cheaper to use.

If you’re thinking of investing in NRV as a speculative asset - don’t. The token has lost 99.99% of its value. The trading volume is microscopic. There’s no roadmap. No team updates. No reason to believe it will ever recover.

Some might say, “It’s so cheap, it could bounce back.” But that’s the trap. A token that’s dropped 99.99% isn’t “cheap.” It’s broken. And broken things rarely fix themselves without a team, funding, and users - none of which Nerve Finance has.

There’s no upside here. Only risk.