There are at least four different crypto tokens called Jeet (JEET) - and none of them are what you think they are. If you’ve seen a post saying "Jeet is going to 100x!" or found it listed on a random exchange, you’re not alone. But here’s the hard truth: Jeet isn’t a real cryptocurrency project. It’s a collection of abandoned, low-liquidity tokens with no team, no roadmap, and almost no users.

There’s no single Jeet coin - just four confused tokens

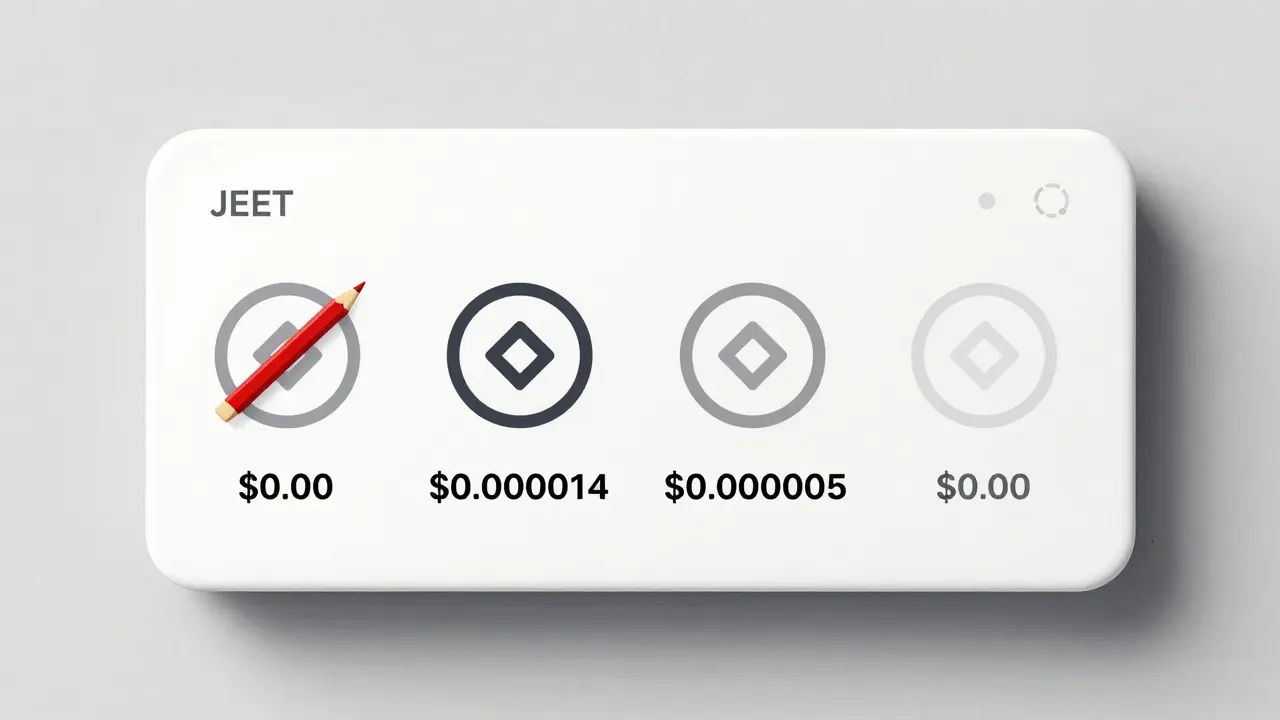

The name "Jeet" gets thrown around like it’s one thing. It’s not. You’ve got at least four separate tokens using the same name, each on a different blockchain, each with its own price history, and each mostly dead. One version lives on Ethereum. Its contract address is 0xdc5bcae599099a3036eb8f03c76e99cc915e948d. It hit a peak of $0.000293 back in 2023. Then, nothing. No trades since July 4, 2023. No updates. No website. No Twitter. Just a ghost in the blockchain ledger. Its market cap? So low it doesn’t even register on most trackers. It’s not just inactive - it’s forgotten. Then there’s "I’m a Jeet" (JEETS) on Solana. This one had a brief flash of life. It once traded at $0.002518, with a market cap of over $1.5 million. Then, in a matter of weeks, it dropped to $0.00. Complete collapse. No recovery. No explanation. Just vanished. This is textbook rug pull behavior - a token pumped by promoters, then abandoned when the money was pulled out. A third version, also on Solana, still shows up on CoinCodex with a price of $0.00001419. It has a circulating supply of 1 billion tokens and a market cap of just $14,194. That’s less than the cost of a decent used laptop. Its all-time high was $0.00006575 in November 2024. Since then, it’s lost over 78% of its value. The 24-hour trading volume? Around $1,233. That’s not a market. That’s a few people trading between wallets. And then there’s "Jeeter on Solana" ($JEET), which as of October 2025 was trading at $0.0000055881. CoinGecko showed no price movement for 19 hours. No volume. No news. Just silence.Why does this confusion even exist?

Because anyone can create a token. On Ethereum, you can deploy an ERC-20 token in under 10 minutes using a template. On Solana, it’s even faster and cheaper - sometimes under a dollar in fees. No approval needed. No verification. No oversight. So people do it. They pick a catchy name like "Jeet" - something short, meme-y, easy to shout in a Discord server. Then they list it on a decentralized exchange. They might pay a few hundred dollars to get it promoted on Twitter or Telegram groups. They get a few early buyers. The price ticks up. Then they sell their entire holding and disappear. There’s no whitepaper. No team. No GitHub activity. No roadmap. No utility. No purpose beyond being a ticker symbol on a chart. These aren’t projects. They’re gambling chips.What’s the difference between Ethereum and Solana Jeet tokens?

The blockchain matters - but not in the way you think. The Ethereum version runs on ERC-20. That means it’s compatible with MetaMask, Coinbase Wallet, and most major exchanges. But Ethereum transactions cost money - sometimes $5 to $20 in gas fees. If you’re trading a token worth pennies, you could spend more in fees than you make. The Solana versions run on a different system. Transactions cost less than a cent. They confirm in under a second. That’s why most of the "active" Jeet tokens are on Solana - it’s cheaper to pump and dump there. But here’s the catch: you can’t buy Solana-based Jeet tokens on Binance or Coinbase. You need a Solana wallet (like Phantom or Slope), you need SOL (Solana’s native coin), and you need to connect to a decentralized exchange like Raydium or Jupiter. You have to understand slippage, liquidity pools, and transaction failures. If you don’t, you’ll lose money on failed trades - and still pay the gas fee.

Who’s buying this stuff?

Not institutions. Not serious investors. Not even most retail traders. It’s a tiny group of people chasing quick wins. They see a token with a 10% daily gain. They jump in. They hold for a few hours. If it goes up, they cash out. If it crashes, they blame the market. Reddit has zero threads about Jeet. Twitter has no official accounts. Telegram groups are ghost towns. No developer has posted a code update in over a year. Compare that to Dogecoin or Shiba Inu - both had massive communities, real memes, and actual engagement. Jeet has none of that.Is Jeet a good investment?

No. Let’s be blunt. If you’re thinking of buying Jeet, you’re not investing. You’re gambling. All versions of Jeet fall into the "nanocap" category - tokens with market caps under $10 million. These are the riskiest assets in crypto. They have almost no liquidity. A single large sell order can crash the price 90% in minutes. There’s no safety net. No team to rescue it. No community to support it. The Solana version with the $14,194 market cap? That’s not a company. That’s not a product. That’s the total value of 1 billion tokens worth 0.00001419 dollars each. If 10 people sold all their Jeet at once, the price could drop to zero in seconds. And if you buy it? You’re taking on risk no financial advisor would ever recommend. You’re not getting exposure to innovation. You’re not backing a team. You’re not betting on technology. You’re betting that someone else will pay more for it tomorrow - even though there’s no reason it should ever go up.What should you do instead?

If you’re interested in meme coins, look at ones with real history - Dogecoin, Shiba Inu, PEPE. They’ve survived multiple market cycles. They have communities. They have developers. They have actual use cases - even if they’re silly ones. If you want to try low-cap tokens, do your homework. Check the contract address. Look at the trading history. See if there’s any on-chain activity beyond price pumps. Ask: Is there a team? Is there a website? Are they active on social media? Have they responded to questions in the last 6 months? If the answer is no - walk away. Jeet isn’t the next big thing. It’s the next forgotten token. And once it’s gone, it’s gone for good.