FRED is not a cryptocurrency built to solve a problem, power a network, or offer real-world use. It’s a memecoin - a speculative token launched on Solana with no code, no team, and no roadmap. Its entire value comes from hype, social media trends, and the hope that someone else will pay more for it tomorrow. If you’re wondering what FRED is, the short answer is: it’s gambling dressed up as investing.

Where did FRED come from?

FRED, short for First Convicted RACCON, launched on November 1, 2024, through Pump.fun - a platform designed for anyone to create a crypto token in minutes with zero technical skill. The name itself is a joke: "RACCON" is a deliberate misspelling of "raccoon," referencing a meme character from the PNUT community, another Solana memecoin. There’s no legal entity behind FRED. No company. No whitepaper. No developers. Just a contract address: CNvitv...N9pump.

It started with 999,856,448 tokens, all distributed at launch. No tokens were reserved for founders, no team allocations, no venture capital. That sounds fair - until you realize that 58.7% of all FRED tokens are held by the top 10 wallets. The biggest single wallet owns over 22% of the supply. That’s not decentralization. That’s centralization with a thin veneer of "fair launch."

What’s its price right now?

There’s no single answer. That’s the problem.

CoinMarketCap says FRED is trading around $0.00085. CoinGecko says it’s $0.00004. LiveCoinWatch says $0.00116. CoinCodex says $0.00158. Why the chaos? Because FRED trades on tiny decentralized exchanges with almost no liquidity. A single $500 trade can move the price 12%. When a few big holders decide to sell, there aren’t enough buyers to absorb it. The price crashes. When a Telegram group coordinates a "pump," the price spikes - then collapses within hours.

Its all-time high was $0.2328 in November 2024. Today, it’s down 99.6%. That’s not a market correction. That’s a corpse.

Why does FRED even exist?

FRED isn’t meant to last. It’s meant to be a side project - a companion to PNUT, a larger memecoin with a $2 billion market cap. FRED exists to give PNUT holders something else to trade. It’s like buying a branded t-shirt after you’ve already bought the concert ticket. You’re not investing in the shirt. You’re investing in belonging to the group.

Analysts call this a "companion memecoin." They’re not rare. But they’re deadly. According to Messari, companion memecoins lost 68.3% of their value between January and November 2025 - far worse than the broader memecoin market. Gartner predicts 95% of them will be worthless within 18 months.

How do you buy FRED?

You don’t need a broker. You don’t need KYC. You just need a Solana wallet - usually Phantom - and some SOL. Then you go to Raydium or Jupiter, connect your wallet, swap SOL for FRED, and pray.

But here’s the catch: slippage. Because there’s so little liquidity, every trade you make moves the price against you. If you try to buy $100 worth of FRED, you might end up paying 8-10% more than the listed price. When you try to sell, you might only get 60% of what you paid. That’s not market risk. That’s market manipulation.

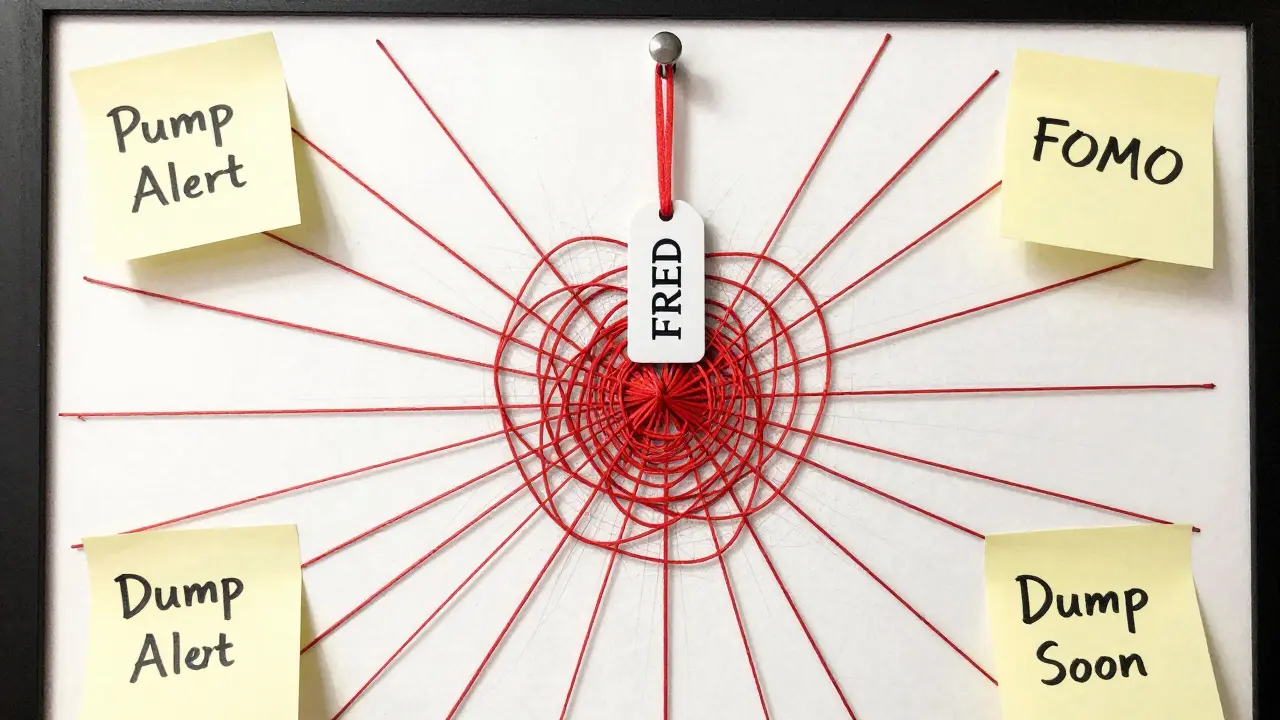

There’s no official support. No customer service. No FAQ. No help desk. The only "community" is a Telegram group with 12,500 members. Most messages are memes. Some are pump alerts. Almost none are answers to technical questions. If you get stuck, you’re on your own.

Who’s buying it?

Not institutions. Not hedge funds. Not even serious retail traders. It’s mostly people chasing quick wins - often young, inexperienced, and emotionally driven by FOMO.

On Reddit, users like "CryptoGambler420" lost $1,200 in one trade because there were no buyers when they tried to exit. On Twitter, influencers post "FRED TO THE MOON!" screenshots that are clearly fake. On Telegram, organized groups run "pump-and-dump" cycles - buying hard, hyping the coin, then dumping it on the crowd before the price drops.

Only about 8% of users report making money. The rest? They’re the ones who get stuck holding the bag.

Is FRED safe?

No. Not even close.

It has no utility. No governance. No staking. No burns. No roadmap. No team. No audits. No legal protection. The SEC has warned about tokens like FRED - ones that "derive value solely from association with other tokens" - calling them potential securities violations. That means regulators could shut it down tomorrow with no warning.

TradingView data shows 92% of FRED’s daily candles since launch have closed below its 200-day moving average. That’s a technical way of saying: it’s been in a death spiral since day one.

What do experts say?

Michael van de Poppe, a top crypto analyst with half a million followers, called FRED "a pure gambling instrument with no fundamental value." He added: "99.8% of tokens like this go to zero."

Alex Mason from Memecoin Research Group says companion memecoins like FRED serve a "psychological function" - letting fans feel more involved. But he also admits: "Survival rate at 12 months is below 5%."

Bloomberg Intelligence flagged FRED as a "concentrated risk vector" - meaning if PNUT crashes, FRED will collapse even harder. And it will.

Should you invest in FRED?

If you’re looking for a long-term investment, the answer is no. If you’re looking for a lottery ticket, then maybe - but only if you treat it like one.

Only risk money you can afford to lose completely. Never use savings. Never borrow. Never go all-in. If you buy FRED, assume it’s already worth zero. If it goes up, consider it a gift. If it goes down - which it will - don’t be surprised.

There are thousands of crypto projects with real teams, real tech, and real use cases. FRED isn’t one of them. It’s a meme. A distraction. A trap wrapped in a ticker symbol.

What’s next for FRED?

Nothing.

No development. No updates. No new features. The project’s website - fredraccon.com - hasn’t changed since launch. Its Twitter account has lost 25% of its followers. Trading volume is down 74% from its peak. Holder count is falling. The only thing growing is the number of people asking, "Why is this still alive?"

It might limp along for a few more months, fueled by the occasional pump from a well-timed Telegram alert. But the data is clear: FRED is dying. Slowly. Quietly. And there’s nothing anyone can do to stop it.