BFICGOLD Dead Token Value Calculator

Important Warning

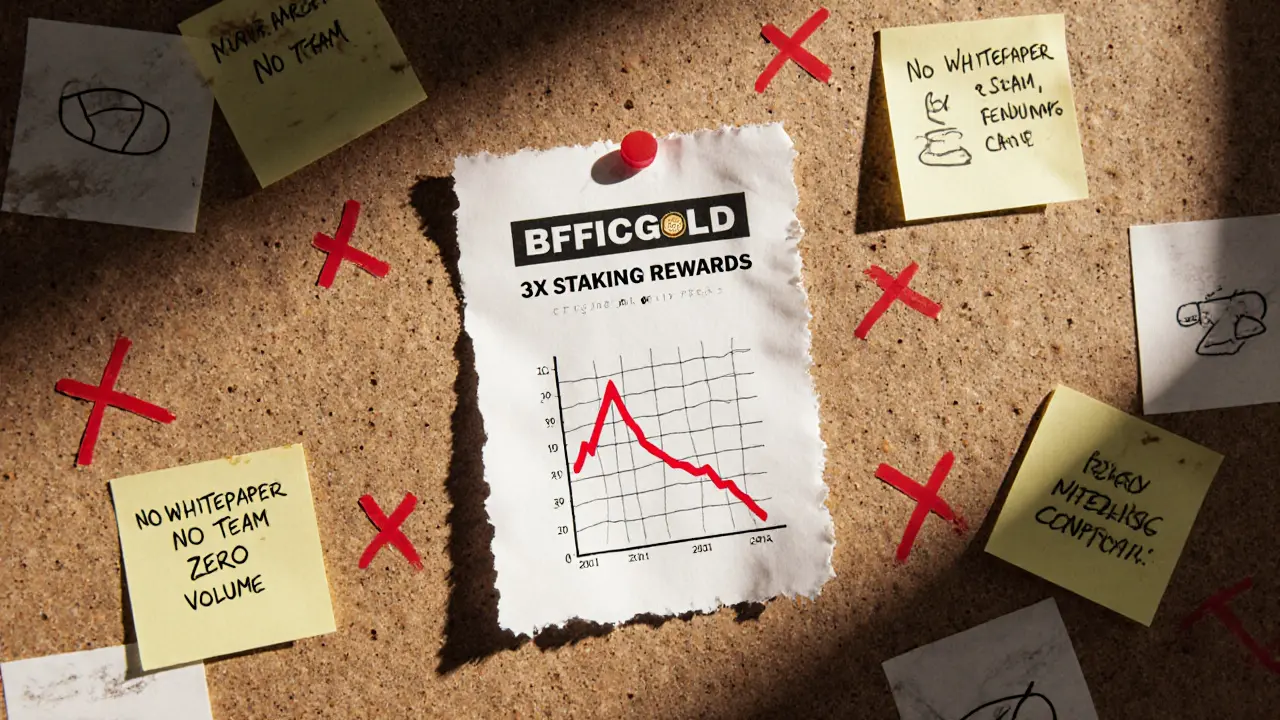

BFICGOLD is a textbook example of a "dead token" with no active development, zero trading volume, and no community. This calculator demonstrates why holding such tokens is a guaranteed loss.

Calculate Your Potential Loss

Risk Assessment

BFICGOLD (BFICGOLD) isn’t just another obscure crypto coin. It’s a textbook example of what happens when a project looks like a promise but delivers nothing but volatility, silence, and confusion.

What BFICGOLD Claims to Be

BFICGOLD is a token built on the BFIC blockchain, short for Blockchain Foundation for Innovation Collaboration. The project says it’s designed to power a new kind of network-one that rewards users for contributing to AI, Web3, and AR/VR projects. It promises faster transactions, better security, and staking rewards up to 3x. Sounds impressive? It should. But here’s the catch: none of it works.

The token’s contract address is 0xCE2B74E3137722C140772F0a0db55FEe76AC2F2D, and it has a fixed supply of 210 million coins. That’s it. No whitepaper. No GitHub. No team names. No roadmap updates since early 2024. The whole thing reads like a PowerPoint slide deck with no code behind it.

The Price That Imploded

BFICGOLD hit its peak on March 15, 2024, at $8.09. That’s not a typo. Eight dollars for a token with no real use case. Within four months, it crashed to $0.0142-a 99.82% drop. Today, prices are all over the place. LiveCoinWatch says $0.0505. CoinStats says $0.023. Holder.io says it’s not even trading anywhere. One source claims the price is fixed at $0.023 on Tuesdays. Another says it’s stuck between 2.79 and 5 cents. None of it adds up.

Why the chaos? Because there’s no real market. CoinGecko reports just $0.07573 in 24-hour trading volume. That’s less than the cost of a coffee. DropsTab admits they can’t get accurate data because the token has almost no liquidity. Poloniex is listed as the only exchange with a BFICGOLD/USDT pair, but even that’s shaky. Holder.io says BFICGOLD isn’t traded anywhere right now. So who’s buying? Who’s selling? No one knows.

No Community. No Developers. No Trust

Look for BFICGOLD on Reddit. Nothing. Zero threads. Not even a single comment asking, “Is this real?” On Twitter, all mentions are bots and spam accounts pushing fake staking links. No real users. No testimonials. No failure stories. No success stories. Just silence.

There’s no official Telegram group. No Discord server. No active website with contact info. The three URLs listed on Holder.io don’t lead to anything useful-no support, no documentation, no team page. If you had a problem with your wallet or a failed transaction, who would you call? No one.

And here’s the kicker: there’s zero developer activity. No commits on GitHub. No updates on Medium. No technical blogs. Not even a single line of code publicly reviewed. That’s not a startup. That’s a ghost.

Why Experts Ignore It

No major crypto analysis firm has ever covered BFICGOLD. Not CoinDesk. Not Messari. Not Delphi Digital. Not even a footnote in a research paper. CoinCodex says they can’t predict its price because they need “a couple of hours of trading data”-which doesn’t exist. That’s not a technical limitation. That’s a red flag.

Platforms like CoinGecko list it, but barely. No social metrics. No community growth. No wallet activity. Just a price chart with a steep cliff and a bunch of question marks. That’s not a listing-it’s a graveyard.

It’s a Shitcoin. And the Market Knows It

BFICGOLD fits perfectly into the “shitcoin” category-tokens with market caps under $10,000 that have no utility, no community, and no future. According to Messari’s 2025 report, over half of all crypto tokens fall into this bucket. Most die within a year. BFICGOLD is already past that point.

Delphi Digital’s August 2025 report says tokens like this have a 99.3% chance of becoming completely illiquid within 12 months. BFICGOLD has been dead in the water for over a year. The fully diluted valuation is $1.6 million, but with zero volume, that number is meaningless. It’s just a number on a screen.

Is It a Scam?

It’s not labeled a scam. But it ticks every box. Identical total and max supply? Check. No circulating supply distinction? Check. Price pumped then collapsed? Check. Zero developer activity? Check. No real exchange listings? Check. Fake staking claims? Check. Regulatory risk? High. The U.S. SEC has already gone after similar tokens like DEAPcoin for making false utility claims. BFICGOLD is just as vulnerable.

If this were a legitimate project, it would have a public roadmap, a dev team, and at least one real partner. Instead, it has a contract address and a price chart that looks like a heart attack.

Should You Buy BFICGOLD?

No.

Not because it’s risky. Because it’s pointless. There’s no upside. No community to grow with. No team to build with. No future to bet on. Even if you bought at $0.02, you’d be gambling on a token that has no buyers, no sellers, and no reason to exist.

Some might say, “What if it rebounds?” But rebounding from $8 to $0.02 isn’t a correction. It’s a collapse. And the market has already moved on. The altcoin season of 2024 is over. The money has flowed into real projects with real teams and real products. BFICGOLD didn’t survive the purge. It was never meant to.

Final Reality Check

BFICGOLD isn’t a crypto coin you invest in. It’s a warning sign. It’s what happens when hype replaces substance. When a team disappears after a pump. When a token has a contract address but no purpose.

If you see BFICGOLD pop up on a social media ad promising 3x staking rewards, close the tab. If a friend says they made money on it, ask how. Chances are, they sold before the crash. If you’re thinking of buying because the price is “low,” remember: low price doesn’t mean value. It just means no one else wants it.

BFICGOLD is dead. Not because it was banned. Not because regulators shut it down. But because no one believed in it. And in crypto, belief is the only thing that matters.

Is BFICGOLD a real cryptocurrency?

Technically, yes-it exists as a token on a blockchain with a contract address. But it has no real utility, no active development, no community, and no trading volume. It’s a ghost project. Real cryptocurrencies have teams, roadmaps, and users. BFICGOLD has none of that.

Why is the price so inconsistent across platforms?

Because there’s no real market. With less than $0.10 traded in 24 hours, prices are either pulled from fake order books, manually entered by data sites, or based on one-off trades from defunct exchanges. There’s no liquidity to anchor the price, so every site shows something different.

Can you stake BFICGOLD and earn 3x rewards?

No. The claim of 3x staking rewards appears only on spammy websites and bot posts. No official staking platform exists. No smart contract for staking has been verified. If you try to stake it, you’ll likely lose your tokens to a fake site.

Where can you buy BFICGOLD?

Poloniex is the only exchange that ever listed BFICGOLD/USDT, and even that’s unreliable. Holder.io says it’s not traded anywhere as of late 2025. If you find it on another exchange, it’s likely a scam site or a mirror page designed to steal your wallet keys.

Is BFICGOLD likely to recover?

Almost certainly not. The token has been stagnant for over a year. No team updates, no exchange listings, no community growth. Delphi Digital’s 2025 report says tokens with under $2,000 market cap and zero volume have a 99.3% chance of dying. BFICGOLD meets all those criteria.

What should you do if you already own BFICGOLD?

If you’re holding it hoping for a rebound, you’re wasting your time. The chances of recovery are near zero. If you want to cut your losses, try selling on Poloniex-if it’s still listed. If not, you’re stuck. The best move now is to write it off as a learning experience and avoid similar tokens in the future.

Does BFICGOLD have a whitepaper or technical documentation?

No. There is no official whitepaper, technical documentation, or developer guide. The only information comes from promotional sites like Blockspot.io, which offer vague buzzwords like “proof-of-contribution” and “enhanced daily lifestyle applications” without any technical detail or code.

Is BFICGOLD listed on CoinGecko or CoinMarketCap?

Yes, it’s listed on CoinGecko, but with almost no data-no social metrics, no volume, no wallet activity. CoinMarketCap does not list it at all. Being on CoinGecko doesn’t mean legitimacy-it just means someone submitted the token. Thousands of dead tokens are listed there.

What’s the difference between BFIC and BFICGOLD?

BFIC is the native coin of the BFIC blockchain, meant to be the base currency. BFICGOLD is a separate utility token built on top of it. But since the BFIC blockchain itself has no verified development or usage, BFICGOLD has no foundation to stand on. Neither token is functional.

Could BFICGOLD be rebranded or relaunched?

Technically, yes-but it would need a complete rebuild: a new team, real code, a whitepaper, exchange listings, and community trust. None of that has happened. Rebranding a dead token without fixing the core issues is just another pump-and-dump scheme waiting to happen.