Liquidity Cost Calculator

Calculate Your Slippage Costs

See how much you might lose due to limited liquidity on WenX Pro compared to major exchanges.

WenX Crypto Exchange Review: Security Focus vs. Limited Liquidity in 2025

If you’re looking for a crypto exchange that puts security above everything else, WenX Pro might catch your eye. But if you want to trade popular coins like Bitcoin or Ethereum with tight spreads and fast execution, you’ll hit walls fast. As of November 2025, WenX Pro is not a replacement for Binance, Coinbase, or Kraken. It’s something else entirely: a niche platform built for users who fear hacks more than they crave trading options.

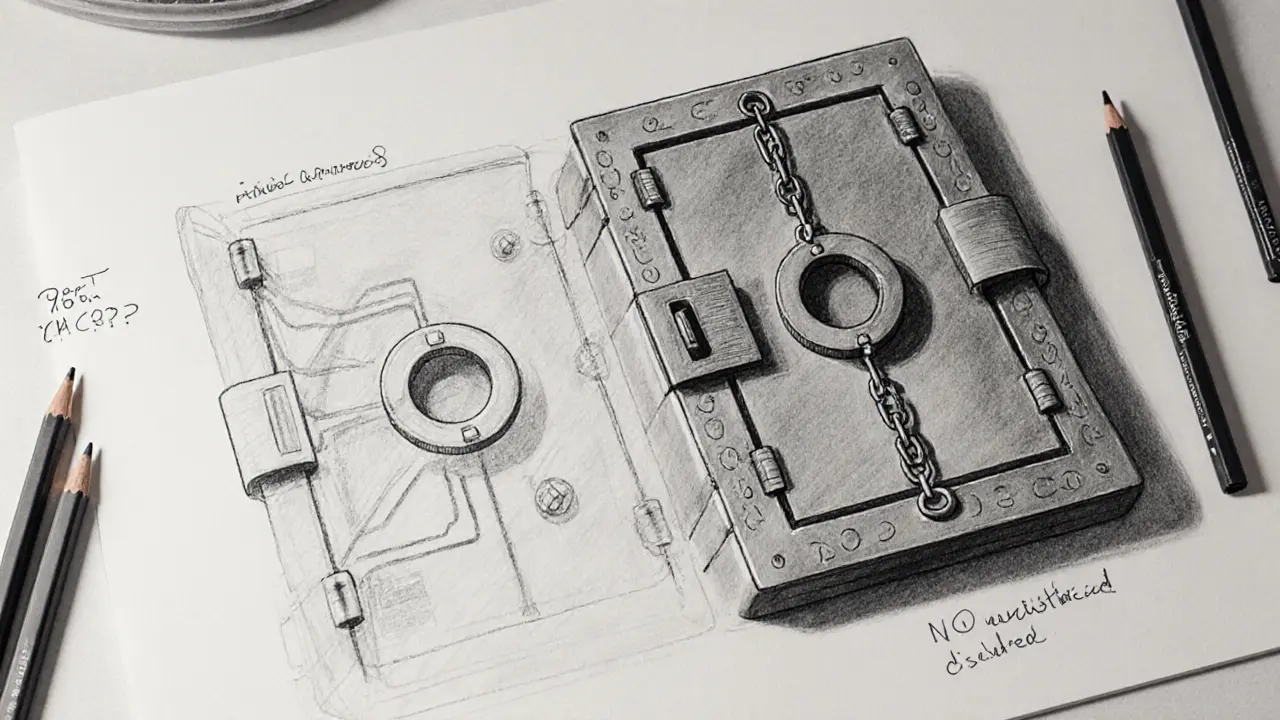

Most exchanges fight for more coins, lower fees, and better apps. WenX Pro fights for trust. Its entire design leans into one claim: three-factor authentication (3FA) makes it safer than almost every other exchange out there. That’s rare. Most platforms still use two-factor (2FA), the industry standard since 2018. WenX Pro doesn’t just match it - it exceeds it. But here’s the catch: safety without liquidity is like having a vault with no money inside.

How WenX Pro Stacks Up on Security

WenX Pro’s biggest selling point isn’t its interface, its fees, or its coin selection. It’s 3FA. That means you need three things to log in: something you know (password), something you have (phone or authenticator app), and something you are (biometric scan like fingerprint or facial recognition). This isn’t marketing fluff. According to Kudelski Security’s 2025 audit framework, 3FA reduces account takeovers by 99.9% compared to single-factor login. That’s not a small improvement - it’s a game-changer.

On top of that, WenX Pro uses a dual-wallet system. Funds are split between hot wallets (for quick trades) and cold storage (offline, encrypted, and disconnected from the internet). While most top exchanges keep 95-98% of assets in cold storage, WenX Pro hasn’t published exact numbers. That’s a red flag. If you can’t see the numbers, you can’t verify the claim. ChainUp’s 2025 benchmark shows 78% of major exchanges publicly disclose their cold storage ratios. WenX Pro doesn’t. That’s a trust gap.

There’s another problem: no third-party audit. HashcodeX’s security methodology says plain and simple - if an exchange doesn’t release an independent audit report, its security claims are just words. WenX Pro’s website has zero mention of audits from firms like CertiK, PeckShield, or Trail of Bits. Compare that to Kraken, which publishes quarterly audit results, or Binance, which has had multiple audits since 2021. Without those reports, you’re trusting a black box.

Trading Options: Few Coins, Thin Markets

WenX Pro says it supports “hundreds of cryptocurrencies.” That sounds impressive until you check what’s actually available. As of October 2025, CoinGecko’s data shows it lists fewer than 50 coins - far behind Binance (350+), KuCoin (700+), or even Kraken (200+). Major coins like Solana, Polygon, and Arbitrum are missing. Even Ethereum and Bitcoin trading pairs are limited.

Why does that matter? Liquidity. If you try to trade a small altcoin on WenX Pro, you’ll likely face massive slippage. One Reddit user (u/CryptoNewbie2025) reported their ETH trade got ruined because the order book was too thin. The spread between buy and sell prices was over 8%. On Binance, that same trade would have a 0.2% spread. That’s not a bug - it’s a design flaw. Thin markets mean you pay more to enter and exit positions.

WenX Pro does offer perpetual contracts and a proprietary tool called the “Lucky 8 trading bot.” But without deep order books, automated bots can’t perform reliably. They’ll chase phantom prices and trigger false signals. The bot might feel cool, but in practice, it’s like using a sports car on a dirt road - overkill with poor results.

Fees and Costs: Vague, But Likely Competitive

WenX Pro claims “low deposit fees” and “competitive trading fees,” but it won’t tell you the numbers. No percentage. No maker-taker breakdown. No comparison chart. That’s unusual. Even smaller exchanges like Bitrue or Gate.io publish their fee schedules openly. Binance charges 0.1% per trade. Kraken’s maker fee is 0.16%. If WenX Pro’s fees are lower, why hide them?

There’s no evidence of hidden charges, but the lack of transparency is worrying. If you’re trading infrequently, fee differences won’t hurt you. But if you’re an active trader, not knowing your costs is like driving without a speedometer. You might be going too fast - or too slow - and not even realize it.

User Experience and Support

The interface is clean. That’s the only thing users consistently agree on. One Reddit commenter said, “The layout is simple, no clutter.” That’s good. But simplicity doesn’t make up for missing features. There’s no mobile app. No API access. No educational resources beyond a basic help center. If you’re new to crypto, you’re on your own.

Customer support is a mystery. TrustFinance’s October 2025 review noted that “contact details aren’t readily available.” No live chat. No email address listed. No phone number. You can submit tickets through the platform, but response times are unknown. In a crisis - like a failed withdrawal or hacked account - that’s dangerous. You need help fast. WenX Pro doesn’t make it easy to get.

Who Should Use WenX Pro?

This exchange isn’t for everyone. It’s not for traders who want to swing trade Solana or day trade memecoins. It’s not for beginners who need tutorials. It’s not for people who want to buy Bitcoin with a credit card.

It’s for one type of user: someone who owns a significant amount of crypto and fears losing it to a hack. If you’ve watched the Bybit breach in February 2025 - where $1.5 billion in ETH was stolen - and you’re terrified of the same thing happening to you, WenX Pro’s 3FA might be worth the trade-off. You’ll sacrifice liquidity, speed, and variety. But you’ll gain peace of mind.

Think of it like buying a safe for your home. You don’t need a vault-grade safe if you only keep spare cash inside. But if you’re storing gold bars? Then you want the best lock you can get. WenX Pro is that vault-grade lock. Just don’t expect it to hold much inside.

What’s Missing? The Big Gaps

WenX Pro has no public roadmap. No team bios. No press releases. No updates since its launch. That’s not normal. Even new exchanges like Bybit or OKX post monthly product updates. WenX Pro is silent. That silence suggests one of two things: either they’re working quietly on big improvements, or they don’t have the resources to grow.

The market doesn’t reward silence. In 2025, the crypto exchange industry is worth $12.8 billion and growing. Exchanges with no user growth, no transparency, and no visibility get left behind. WenX Pro’s TrustScore is 2.6 out of 5 - based on one review. That’s not a rating. That’s a warning sign.

Final Verdict: A Safety Net, Not a Trading Hub

WenX Pro isn’t broken. It’s incomplete. It’s a security-first experiment in a market that rewards scale, speed, and selection. If you’re a high-net-worth holder who doesn’t trade often, and you want to lock your assets away from hackers, WenX Pro could be a smart choice.

But if you want to buy, sell, or swing trade crypto - especially anything beyond Bitcoin and Ethereum - look elsewhere. The liquidity is too thin, the tools are too limited, and the support is too hidden. You’re paying for safety with your trading freedom. And in crypto, freedom is often more valuable than security.

For now, WenX Pro is a niche tool. Not a replacement. Not a challenger. Just a quiet option for the paranoid.

Is WenX Pro safe to use?

WenX Pro has strong security features like Three-Factor Authentication (3FA), which is rare and effective. However, it lacks independent security audits and doesn’t disclose how much of user funds are stored in cold storage. Without verified proof, safety claims remain unconfirmed. Use it only if you prioritize security over transparency.

What coins can I trade on WenX Pro?

WenX Pro supports fewer than 50 cryptocurrencies as of late 2025, far fewer than top exchanges like Binance (350+) or KuCoin (700+). Major coins like Solana, Polygon, and Arbitrum are missing. Bitcoin and Ethereum trading pairs are available but have low liquidity, leading to high slippage during trades.

Does WenX Pro have a mobile app?

No, WenX Pro does not have a dedicated mobile app. Access is limited to its web platform through browsers. This limits convenience for users who want to trade on the go or monitor positions outside of desktop use.

Are trading fees low on WenX Pro?

WenX Pro claims to have low fees but doesn’t publish exact rates. No maker-taker structure, deposit fees, or withdrawal costs are listed publicly. This lack of transparency makes it impossible to compare with exchanges like Binance (0.1% fee) or Kraken (0.16% maker fee). Avoid using it for frequent trading until fee details are confirmed.

Can I trust the Lucky 8 trading bot?

The Lucky 8 bot is a proprietary tool, but it runs on a platform with very low liquidity. Automated bots need deep order books to function accurately. On WenX Pro, the bot is likely to generate false signals and poor trade execution due to thin markets. It’s a feature without real-world utility at this stage.

Is WenX Pro regulated?

WenX Pro claims to follow KYC and AML compliance, which is standard for exchanges operating in regulated jurisdictions. However, it doesn’t disclose which country it’s registered in or whether it holds any official license. Without this information, users can’t verify its legal standing or protections.

Why does WenX Pro have so few reviews?

WenX Pro has minimal user adoption. As of October 2025, it has only one verified review on TrustFinance and two mentions on Reddit. It has no presence on Trustpilot, Capterra, or other major review sites. Low user numbers mean little feedback, which makes it hard to judge real-world performance or reliability.

Should I move my crypto to WenX Pro?

Only if you’re holding a large amount of crypto and rarely trade. If your priority is keeping assets safe from hacks, WenX Pro’s 3FA is a strong advantage. But if you trade regularly, need access to altcoins, or want fast support, it’s not the right choice. Consider using it as a long-term cold storage option, not a trading platform.