When the UK first declared its ambition to become a global crypto hub, it wasn’t just talking. In 2023, under Prime Minister Rishi Sunak, the government laid out a clear plan: make Britain the safest, most transparent place in the world to build and use cryptocurrency. But by early 2026, that vision has hit a wall-not because the tech failed, but because politics changed.

Why the UK Wanted to Be a Crypto Hub

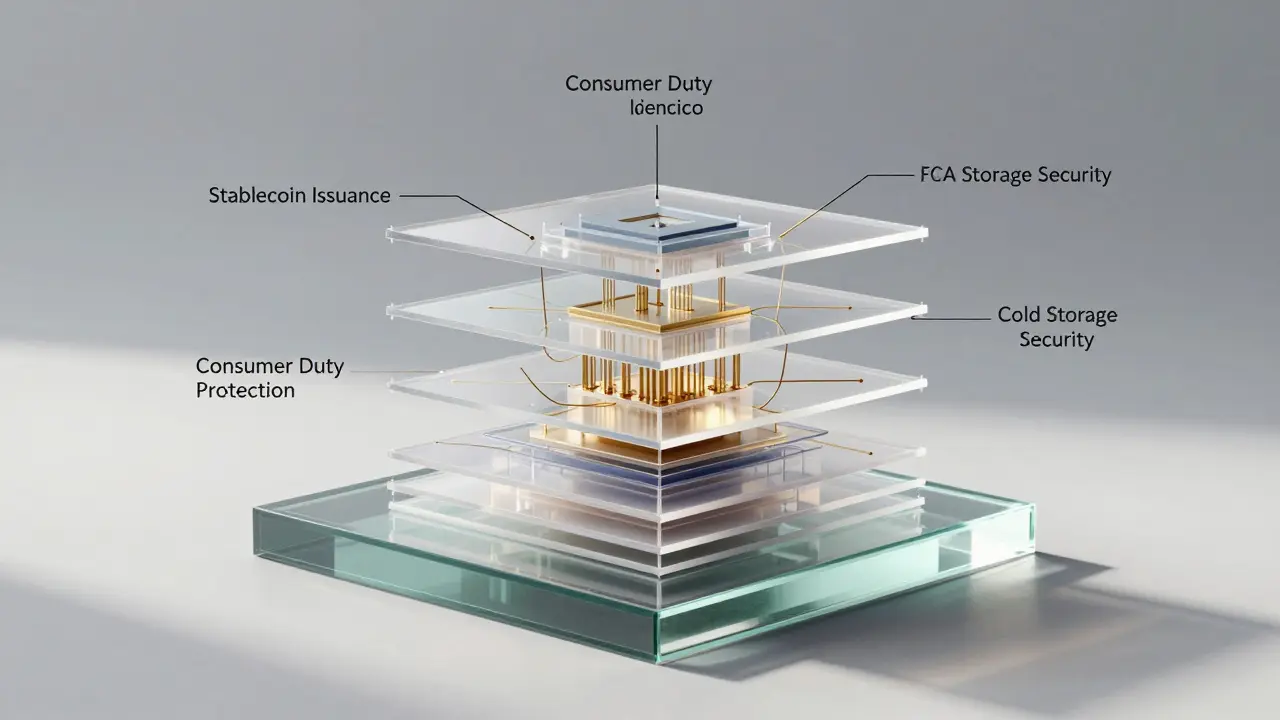

By 2024, about 7 million UK adults-12% of the population-had owned or still owned crypto. That’s more than in the US, Germany, or Japan. People weren’t just buying Bitcoin. They were using stablecoins to send money abroad, trading altcoins on local exchanges, and even getting paid in crypto through freelance platforms. The UK had the infrastructure, the talent, and the demand. All it needed was rules that made sense. The government’s answer? A two-phase regulatory plan. Phase 1 focused on the most practical part of crypto: stablecoins. These are digital coins pegged to real money, like the pound or dollar. They’re used for payments, not speculation. The UK made it clear: if you issue or custody a stablecoin in the UK, you need FCA approval. You must keep reserves, report transactions, and follow anti-fraud rules. No more shady operations hiding behind "decentralized" claims. Phase 2, which started rolling out in 2025, went even further. It brought nearly every type of crypto asset under the Financial Services and Markets Act 2000 a UK law that governs financial firms, including banks and investment platforms. That means exchanges, lending platforms, staking services, and even wallet providers now need FCA authorization to serve UK customers. The rules are strict: you need strong cybersecurity, clear disclosures, and proper complaint handling. If you mess up, you can lose your license.How the UK’s Rules Compare to the Rest of the World

The UK didn’t copy other countries. It built something new. Unlike China, which banned crypto outright, or Costa Rica, which ignored it, the UK chose a middle path: regulate, don’t restrict. Here’s how it stacks up:| Country | Stablecoin Regulation | Exchange Licensing | Consumer Protection | Tax Treatment |

|---|---|---|---|---|

| United Kingdom | Yes, FCA-regulated | Yes, mandatory | Consumer Duty applies | Capital gains tax applies |

| United States | State-by-state, fragmented | Varies by state | Some protections | Capital gains, income tax |

| Singapore | Yes, MAS-regulated | Yes, strict licensing | High standards | No capital gains tax |

| European Union | Yes, MiCA framework | Yes, EU-wide | Strong | Varies by country |

| China | Banned | Banned | N/A | Banned |

What Changed After the Labour Government Took Over

Here’s the twist: the plan started under the Conservatives. But by 2025, Labour was in power. And suddenly, crypto stopped being a top priority. Industry insiders noticed the shift. Meetings with ministers slowed down. Funding for crypto innovation grants vanished. The Digital Pound a central bank digital currency being explored by the Bank of England project, once seen as a bridge to crypto adoption, became a low-priority research exercise. The Digital Securities Sandbox a testing environment for blockchain-based asset trading still exists, but few new firms are applying. Arvin Abraham, a partner at Goodwin’s private equity group, put it bluntly: "The UK does not feel like it’s prioritizing it as much as it was a few years ago." The FCA still holds consultations. The legal framework is still being finalized. But without political backing, firms are hesitating. Why invest millions in compliance if the government might change the rules again in 2027?Real-World Impact: Who’s Winning and Who’s Losing

The UK’s approach has created winners and losers. Winners: Legitimate crypto firms that were already following best practices. Companies like Coinbase UK a major cryptocurrency exchange operating in the UK and Kraken UK a regulated crypto exchange serving UK customers have spent years preparing. They now have licenses, clear compliance teams, and audit trails. They’re thriving. Losers: The fly-by-night operators. Since 2023, over 180 unregistered crypto firms have been shut down by the FCA. Many were running fake staking platforms or misleading "earn crypto" ads. The regulator now publishes a public list of unlicensed firms-no more hiding. But here’s the real problem: talent is leaving. Developers and blockchain engineers are moving to Singapore, Switzerland, and Dubai-places offering faster approvals, lower taxes, and clearer long-term policies. The UK has the rules, but not the excitement.

What’s Next for UK Crypto?

The legal foundation is now solid. The Financial Services and Markets Act 2000 (Regulated Activities and Miscellaneous Provisions) (Cryptoassets) Order 2025 the key law that brought crypto under UK financial regulation is law. The Travel Rule a global standard requiring crypto firms to share sender/receiver data for transactions over a certain amount is enforced. The Economic Crime and Corporate Transparency Act a UK law that now includes crypto asset seizure powers lets police freeze digital wallets linked to crime. But the big question remains: will the government keep its word? Right now, the UK’s crypto strategy is like a car with a perfect engine-but no driver. The rules are there. The infrastructure is there. The users are there. But without consistent political leadership, innovation stalls. The next 12 months will be critical. If Labour signals renewed support-through funding, public campaigns, or tax incentives-the UK could still become a global leader. If not, the country risks becoming a regulatory graveyard: safe, but boring. And in crypto, boring doesn’t attract talent. It doesn’t attract investment. It doesn’t attract the future.What This Means for You

If you’re a UK resident using crypto: your rights are clearer than ever. You can now file complaints, demand transparency, and expect protection. But you’re also expected to understand the risks. No one’s shielding you from market crashes anymore. If you’re a business looking to operate in the UK: the path is long, expensive, and slow. But once you’re licensed, you’re in one of the most trusted financial jurisdictions on earth. If you’re watching from abroad: the UK is no longer the fastest-growing crypto hub. But it might still be the most trustworthy.Are crypto transactions legal in the UK?

Yes, buying, selling, and holding cryptocurrency is fully legal in the UK. However, businesses that provide crypto services-like exchanges, wallets, or lending platforms-must be registered with the FCA. Individuals can use crypto without registration, but they must report gains for tax purposes.

Can I use stablecoins like USDC or DAI in the UK?

Yes, but only if they’re issued by FCA-authorized firms. Since 2024, all fiat-backed stablecoins used for payments in the UK must meet strict reserve and transparency rules. Unregulated stablecoins can’t be marketed or sold to UK consumers. You can still use them if you buy them overseas, but you won’t have legal recourse if something goes wrong.

Do I need to pay tax on crypto in the UK?

Yes. The UK taxes crypto as property. You pay Capital Gains Tax when you sell, trade, or spend crypto for a profit. If you earn crypto through staking or mining, it’s treated as income and taxed at your normal rate. HMRC requires you to keep detailed records of all transactions.

What happens if a UK crypto firm goes bankrupt?

If an FCA-licensed firm fails, customer crypto assets are supposed to be held separately from company funds. But unlike bank deposits, crypto isn’t protected by the Financial Services Compensation Scheme (FSCS). You might get some assets back if they’re still in the firm’s custody, but there’s no guarantee. That’s why the FCA now requires firms to use cold storage and third-party audits.

Is the UK’s crypto regulation better than the EU’s?

It’s different. The EU’s MiCA rules are broader and apply across all member states, but the UK’s rules are more targeted and include stronger consumer protections like the Consumer Duty. The UK also allows more flexibility for firms to adapt, while MiCA is more prescriptive. Neither is "better"-but the UK’s approach gives firms more room to innovate within a strict safety net.

If you’re wondering whether the UK will succeed as a crypto hub, the answer isn’t in the laws. It’s in the politics. And right now, the signal is quiet.