Crypto Exchange Compliance Checker

Check Exchange Compliance

Verify if a cryptocurrency exchange is registered with FINTRAC (Canada's financial intelligence unit) and meets regulatory requirements.

Compliance Verification Results

Why This Matters

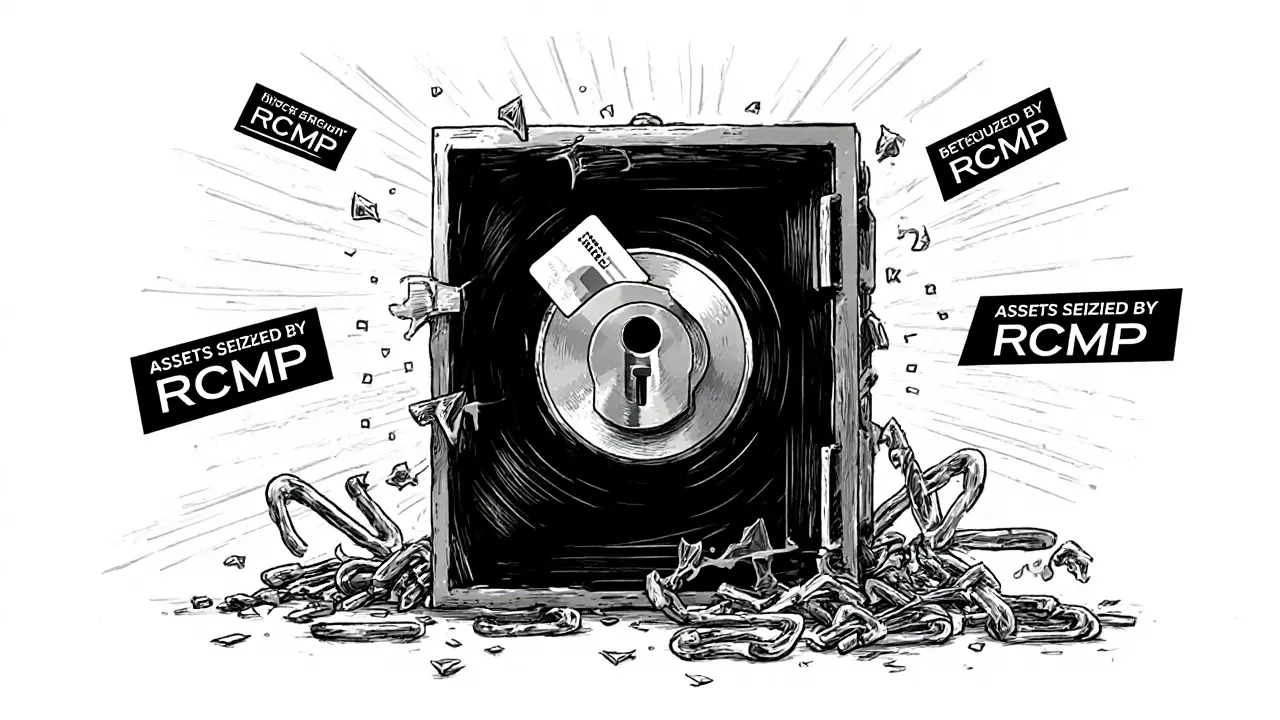

The TradeOgre shutdown wasn’t just another crypto exchange going dark. It was Canada’s biggest cryptocurrency seizure ever - $56 million CAD ($40 million USD) frozen, traced, and seized by the Royal Canadian Mounted Police in a single operation. And it didn’t happen by accident. This was the result of a year-long investigation that exposed how a privacy-focused exchange operated outside the law, and why that’s no longer acceptable in Canada.

What Was TradeOgre?

TradeOgre launched in 2018 as a no-frills, no-KYC cryptocurrency exchange. Unlike Binance or Coinbase, it didn’t ask for your ID, email, or phone number. You could trade Monero, Bitcoin, and obscure altcoins anonymously - no questions asked. It ran on the Tor network, hiding its servers from public view. For users who wanted to avoid banks, governments, or surveillance, TradeOgre was the go-to platform. But under the surface, it was a legal time bomb. Canadian law requires any business handling money - including crypto exchanges - to register with FINTRAC, Canada’s financial intelligence unit. TradeOgre never did. It didn’t monitor transactions for suspicious activity. It didn’t report anything. That made it a magnet for money laundering, ransomware payments, and darknet market activity.How Did Canada Find It?

The break came in June 2024. Europol, Europe’s law enforcement agency, flagged unusual transaction patterns linking TradeOgre to known criminal wallets. The RCMP’s Money Laundering Investigative Team picked up the trail. They didn’t raid servers. They didn’t hack systems. They used blockchain analytics. Enter Arkham Intelligence. This firm tracks every crypto movement across public ledgers. By mapping wallet connections, transaction timestamps, and even hidden messages embedded in blockchain data, they traced $56 million in assets back to TradeOgre’s wallets. The money wasn’t sitting idle. It was moving - shuffled through dozens of intermediate addresses, trying to hide. But each transfer left a digital fingerprint. By July 2025, TradeOgre’s website vanished. No announcement. No warning. Just silence. Then, in late August, users noticed strange transactions from TradeOgre-linked wallets - messages embedded directly into the blockchain saying: “Assets seized by RCMP.” It wasn’t a hack. It was a legal seizure. Law enforcement had control.The Seizure: A First in Canada

On September 18, 2025, the RCMP made it official. They didn’t just freeze accounts. They seized the entire exchange’s holdings - the largest crypto seizure in Canadian history. What made this different from past actions? Previous crackdowns targeted individual wallets or mixing services. This time, they took down a full exchange platform. The seized assets included Monero, Bitcoin, Ethereum, and dozens of obscure tokens. Investigators believe most of the funds originated from criminal activity - ransomware, fraud, darknet sales - but they haven’t named specific cases. That’s intentional. The goal wasn’t to prosecute individual users. It was to send a message: If you run a crypto exchange in Canada’s orbit and ignore the law, you will be shut down.

Why This Changes Everything

Before TradeOgre, many thought privacy-focused exchanges could operate in a legal gray zone. If you’re based in the U.S. and serve Canadian users, can Canada reach you? TradeOgre proved they can. The RCMP didn’t need a warrant to seize servers. They didn’t need to cross borders. They traced the money. They identified the wallets. They embedded a public notice on the blockchain - a digital paper trail saying, “This is ours now.” That’s a new level of enforcement. It’s not just about arresting people. It’s about taking control of the assets themselves. This also kills the myth that privacy coins like Monero are untraceable. Arkham Intelligence and other analytics firms now have tools to follow even the most private transactions - especially when they flow through centralized exchanges. Monero isn’t broken. But using it on an unregulated exchange? That leaves a trail.What This Means for Users

If you used TradeOgre to trade anonymously, your funds are gone. There’s no appeal process. No customer service line. No refund. The exchange was illegal from day one. Canadian law doesn’t protect users of unregistered platforms - even if you didn’t know it was illegal. For other users, this is a warning. Exchanges that don’t do KYC are risky. They’re not just vulnerable to hacks. They’re vulnerable to government seizures. And once that happens, there’s no recourse. Your coins aren’t yours anymore - they’re evidence. Even if you’re not in Canada, this matters. If your exchange serves Canadian users - or processes transactions through Canadian banks - you’re under Canadian jurisdiction. TradeOgre was registered in the U.S., but it still got taken down. Geography doesn’t protect you anymore.

What This Means for Exchanges

The message is clear: compliance isn’t optional. If you’re building or running a crypto exchange, you need to register with financial regulators. You need KYC. You need AML checks. You need to report suspicious activity. The cost of compliance is far lower than the cost of getting shut down. Major exchanges like Kraken and Coinbase already do this. But smaller platforms - especially those marketing themselves as “privacy-first” or “no KYC” - are now in the crosshairs. The TradeOgre case sets a precedent. It shows regulators have the tools, the will, and the international cooperation to go after them. This isn’t just about Canada. It’s part of a global trend. The U.S., U.K., EU, and Australia are all ramping up enforcement. TradeOgre was the first full exchange shutdown in Canada. It won’t be the last.What Happened to TradeOgre’s Founders?

No one knows. There’s been no arrest. No press release. No legal filings. The founders never responded. That silence speaks volumes. Either they’re hiding, or they never existed. TradeOgre was run by anonymous operators - possibly a single person or a small group. The RCMP didn’t need to find them to seize the assets. They just needed to trace the money. This is the future of crypto enforcement: you don’t need to catch the person. You just need to freeze the wallet.What’s Next?

The RCMP is now reviewing other unregistered exchanges that serve Canadian users. Sources say at least three more platforms are under investigation. One is based in Eastern Europe. Another operates through a shell company in the Seychelles. Both process Canadian transactions. Both are now on watch lists. Meanwhile, Canadian regulators are pushing for new laws that would require all crypto platforms - even those outside Canada - to register if they serve Canadian customers. The goal? Make it impossible for any exchange to operate in the shadows. For users, the lesson is simple: if an exchange doesn’t ask for your ID, it’s not protecting you. It’s exposing you. And when the government moves, you won’t get a second chance.Was TradeOgre a scam?

TradeOgre wasn’t a scam in the traditional sense - it didn’t steal users’ money. It was a legitimate exchange in terms of functionality. But it operated illegally by ignoring Canadian financial laws. It allowed money laundering, which made it a target for law enforcement. Users lost their funds not because the platform cheated them, but because the government seized assets tied to criminal activity.

Can I still use TradeOgre?

No. TradeOgre’s website has been offline since July 2025. Its servers are inaccessible. The RCMP has seized its cryptocurrency holdings, and the platform has not responded to any public inquiries. There is no way to access your funds or use the service.

Why did Canada target TradeOgre and not bigger exchanges?

Bigger exchanges like Coinbase and Kraken are fully registered with FINTRAC and follow KYC/AML rules. TradeOgre was the opposite - it deliberately avoided all regulations. Canada didn’t target it because it was big. They targeted it because it was a clear, unlicensed violation of the law. It was an easy, high-impact case to set a precedent.

Are privacy coins like Monero now illegal in Canada?

No. Monero and other privacy coins are not banned. What’s illegal is using them on unregistered exchanges that don’t track users or report suspicious activity. You can still hold Monero in a personal wallet. But if you trade it on an exchange that doesn’t comply with Canadian law, you risk losing your funds - just like TradeOgre users did.

How can I tell if a crypto exchange is compliant in Canada?

Check FINTRAC’s public registry of registered money services businesses. Any legitimate crypto exchange serving Canadians must be listed there. If you can’t find it on the list, assume it’s not compliant. Also, look for KYC requirements - if the exchange doesn’t ask for ID, it’s likely operating illegally.

Did anyone get arrested in this case?

As of now, no arrests have been made. The RCMP focused on seizing the assets, not identifying the operators. This was a strategic decision - taking down the platform and its funds was the priority. Arresting individuals is a separate legal process that may come later, but there’s no public confirmation yet.

Is my crypto safe on other exchanges?

If you’re using a registered exchange that follows KYC and AML rules, your funds are protected under Canadian law. The TradeOgre case only affects unregulated platforms. Stick to exchanges listed on FINTRAC’s registry. Avoid any platform that boasts “no KYC” - that’s a red flag, not a feature.

What should I do if I had funds on TradeOgre?

Unfortunately, there’s nothing you can do. The funds have been seized by law enforcement as part of a criminal investigation. They are not being returned to users, even innocent ones. This is why using unregulated exchanges is so dangerous - you have no legal protection. Learn from this: only use platforms that verify your identity and follow the law.