NFT Collection Valuation Checker

CryptoPunks

The OGs of the NFT space, these 10,000 algorithmically generated 24×24 pixel characters launched in 2017. Floor price: ~47.5 ETH (~$180k).

Value Drivers

- Historical Significance 9/10

- Artistic Merit 7/10

- Community Engagement 8/10

- Utility 6/10

Market Metrics

- Total Sales $1.2B+

- Floor Price ~47.5 ETH

- Holders ~1,500

- Chain Ethereum

Your Collection Score

Overall Value Rating

Quick Tips

- Always verify provenance on Etherscan

- Check for active community engagement

- Factor in gas fees and storage costs

- Look for utility beyond visual appeal

When you hear the phrase most valuable NFT collections, you probably picture pixel‑perfect avatars, giant auction houses, and wallets worth six figures. The reality is a mix of pioneering art, tight‑knit communities, and blockchain tech that’s reshaped how we think about ownership. Below you’ll find a practical rundown of the collections that dominate the market, why they matter, and how you can start evaluating them yourself.

TL;DR

- CryptoPunks (Ethereum) - floor ~47.5ETH (~$180k) and historic prestige.

- Bored Ape Yacht Club - $3.16bn total sales, strong utility for members.

- Pak’s "The Merge" - $91.8mn record sale via fractional ownership.

- Axie Infinity - $4.27bn volume, gaming‑first value driver.

- Taproot Wizards (Bitcoin Ordinals) - floor ~0.2368BTC (~$28k) and fast‑growing community.

What Makes an NFT Collection Valuable?

Value isn’t just about price tags; it’s a blend of four core drivers:

- Historical significance - First‑movers like CryptoPunks set the cultural tone.

- Artistic merit - Works by creators such as Pak a digital artist known for experimental, often minimalist, NFT pieces push visual boundaries.

- Community engagement - Collections that reward holders with events, merch, or exclusive drops (think BAYC members getting private concerts).

- Utility - Some NFTs unlock in‑game assets, voting rights, or access to virtual worlds.

When all four line up, you’ve got a blue‑chip collection that can sustain multi‑year price growth.

Ethereum’s Crown Jewels

Ethereum remains the go‑to chain for high‑end digital art. Its robust tooling, large developer base, and established marketplaces give collectors confidence.

CryptoPunks

CryptoPunks a set of 10,000 algorithmically generated 24×24 pixel characters launched by Larva Labs in 2017 are the OGs of the space. As of July2025 the floor sits at 47.5ETH (about $180,000), a 53% jump that month alone. Their value stems from scarcity, cultural status, and the fact that many early adopters still hold them as a status symbol.

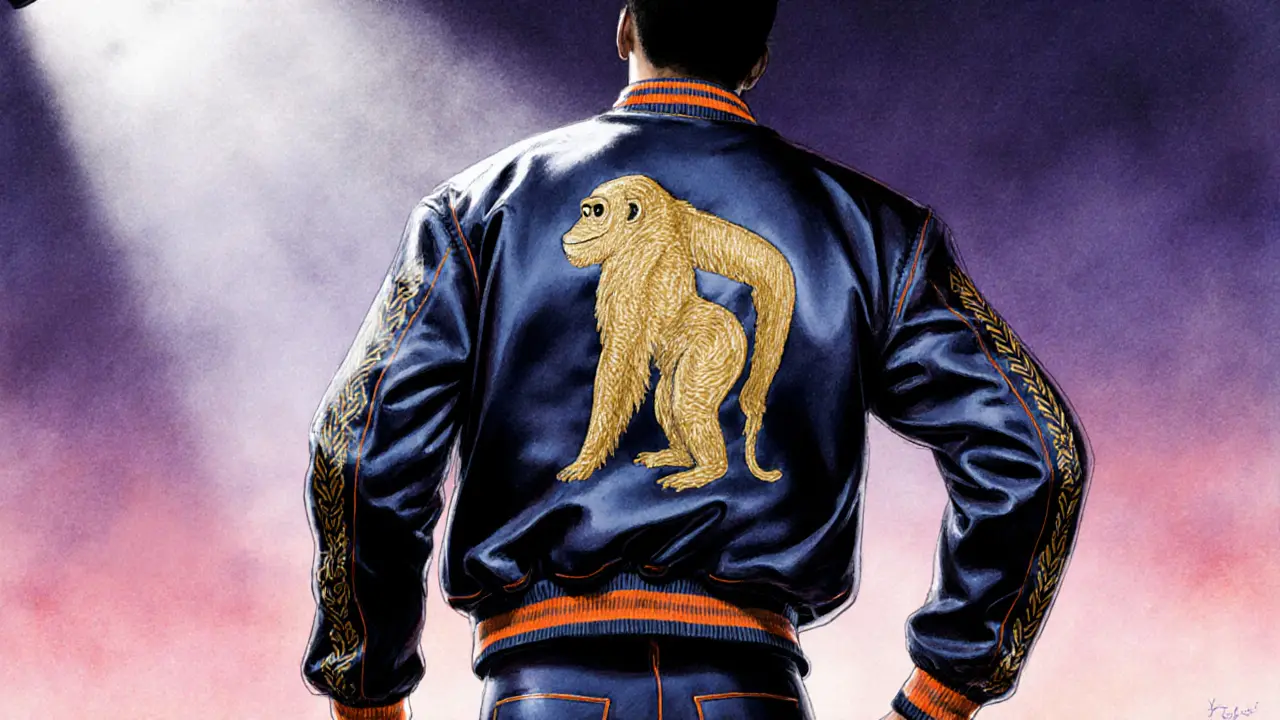

Bored Ape Yacht Club (BAYC)

Bored Ape Yacht Club a 10,000‑ape PFP collection created by Yuga Labs in 2021, offering exclusive community perks has amassed $3.16bn in total sales. Beyond the eye‑catching artwork, BAYC grants members privileged access to virtual events, merch drops, and even real‑world parties. That utility tailors the collection for both collectors and brand collaborators.

Beeple’s Landmark Sale

Beeple the artist behind ‘Everydays: The First 5000 Days’, a digital collage that sold for $69.3million at Christie’s proved that digital art could command traditional auction house prices. While not a collection per se, Beeple’s success boosted confidence in the broader NFT market and set a benchmark for future single‑piece sales.

Gaming‑Centric Titans

Not all top‑valued NFTs are purely visual. Some derive worth from in‑game mechanics.

Axie Infinity

Axie Infinity a blockchain‑based game where players collect, breed and battle fantasy creatures called Axies has generated $4.27bn in total sales, making it the highest‑grossing NFT collection to date. Its tokenomics reward active players with ‘Smooth Love Potion’ (SLP) tokens, creating a real‑world income stream that fuels demand for its NFTs.

Bitcoin Ordinals - The New Frontier

2024‑2025 saw Bitcoin branches into NFTs via Ordinals. Despite higher transaction fees, the network’s cachet attracts collectors seeking permanence.

Taproot Wizards

Taproot Wizards a Bitcoin‑based Ordinal series released in 2024, featuring hand‑drawn wizard avatars stored directly on the Bitcoin blockchain hit a floor of 0.2368BTC (≈$28,190) in July2025, with a single‑day surge of over 30%. The community’s “Wizard Manifesto” frames these NFTs as cultural artifacts, not just speculative assets.

NodeMonkes

NodeMonkes a Bitcoin Ordinal project launched in late 2023, sold out in 30 minutes via a Dutch auction raising ~240BTC showcases the speed at which Bitcoin‑based collections can gain traction. Despite some internal controversy over funding decisions, the project’s floor now sits near 0.15BTC, proving strong resale demand.

Record‑Breaking Single Pieces

Individual NFTs, while not collections, set valuation precedents that lift entire ecosystems.

"The Merge" by Pak

Pak’s experiment, The Merge, sold for $91.8million in December2021. Rather than a single token, the piece was split into nearly 30,000 “mass units” that buyers could acquire. The model demonstrated how fractional ownership can democratize access to ultra‑high‑value art, and it remains the most expensive NFT ever sold.

Ringers #109

Ringers #109 a generative artwork from the Art Blocks platform, fetched $6.93million, the highest sale on Art Blocks. Its creator, Dmitri Cherniak, proved that algorithmic art can rival traditional pieces in price when the code itself is regarded as the artist.

How to Evaluate a High‑Value NFT Collection

Before you drop six figures, run through this quick checklist.

- Verify provenance. Look up the contract address on Etherscan (or a Bitcoin explorer for Ordinals). Confirm the creator’s verified status.

- Check floor price trends. A steady upward trajectory over 30days suggests healthy demand.

- Assess community health. Active Discord, regular Twitter AMAs, and on‑chain holder distribution (avoid collections where a few wallets own >50%).

- Identify utility. Does the NFT unlock events, exclusive merch, or in‑game advantages?

- Calculate total cost. Include gas fees (Ethereum can add $200‑$500 per transaction), marketplace commissions, and storage solutions.

Storing and Securing Premium NFTs

Security isn’t an afterthought-you’re protecting digital assets worth tens of thousands to millions of dollars.

- Hardware wallets. Devices like Ledger Nano X or Trezor ModelT keep private keys offline.

- Multi‑signature vaults. Split ownership across 2‑3 devices; two signatures needed to move the token.

- Backup seed phrases. Store in a fire‑proof safe and a separate geographic location.

- Marketplace whitelists. Some platforms let you approve only specific contract addresses for buying/selling, reducing phishing risk.

Future Outlook: What’s Next for Top NFT Collections?

Industry analysts see three key trends shaping the next wave of value.

- Cross‑chain interoperability. Protocols like Wormhole and LayerZero will let a CryptoPunk appear in a Solana‑based metaverse, expanding utility.

- AI‑generated art. As generators get better, we’ll see AI‑curated collections that blend creativity with algorithmic scarcity.

- Regulatory clarity. 2024‑2025 legislation in the US and EU is tightening KYC/AML for high‑value transfers, which could bring institutional money but also add compliance costs.

For collectors, the sweet spot remains blue‑chip projects that already meet the four value drivers while experimenting with new utilities.

Frequently Asked Questions

Which NFT collection has the highest floor price right now?

As of July2025, CryptoPunks leads with a floor of about 47.5ETH (≈$180k). On Bitcoin, Taproot Wizards sits near 0.2368BTC (≈$28k), making it the most expensive ordinal collection.

Do I need to pay gas fees to buy an NFT on Ethereum?

Yes. Even a simple transfer can cost $150‑$500 depending on network congestion. Premium collections often see higher fees because the contracts are more complex.

What makes a collection “blue‑chip”?

Blue‑chip NFTs have proven history, strong community, recognizable brand, and often some utility beyond the image. CryptoPunks, BAYC, and Axie Infinity fit this definition.

Can I store NFTs on a regular hard drive?

No. NFTs live on the blockchain. What you store locally is the private key that lets you access them. That’s why hardware wallets are the safest option.

How does fractional ownership work, like with Pak’s "The Merge"?

The artwork is split into many tokens that each represent a share of the whole. Owners can trade their pieces independently, and the combined ownership still represents the original piece.