There’s a myth going around that Norway suddenly pulled the plug on crypto mining by removing tax incentives. If you’ve heard that, you’re not alone. But here’s the truth: Norway never offered tax incentives for crypto mining in the first place.

What People Think Happened

You see headlines like "Norway Cracks Down on Crypto Mining" or "Tax Breaks for Miners Axed"-and it sounds dramatic. But those aren’t facts. They’re assumptions built on confusion. People assume that because Norway has cheap electricity and cool weather-perfect for mining-it must have given miners special tax breaks to attract them. It didn’t. And when the government didn’t hand out subsidies, some assumed it must have taken them away later.The Real Tax Rules in Norway

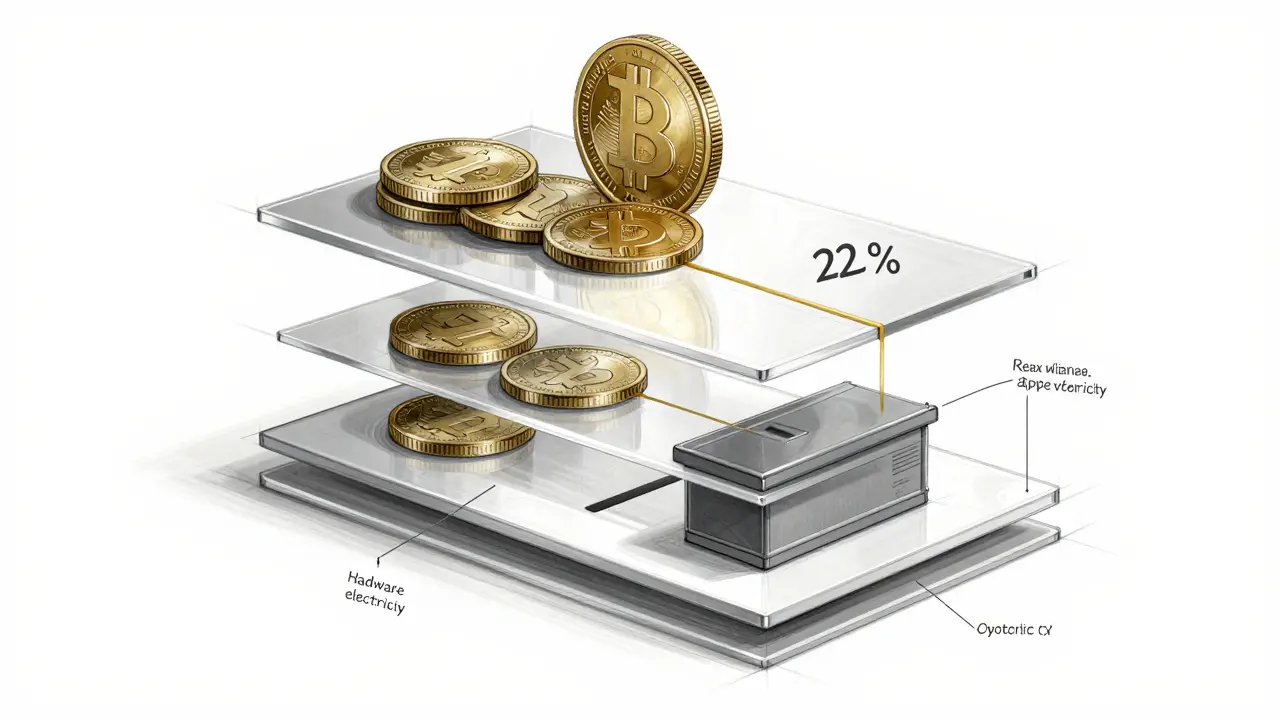

Norway treats crypto mining like any other business activity. If you mine Bitcoin, Ethereum, or any other coin, you pay income tax on the value of the coins when you receive them. That’s it. No special credits. No deductions beyond normal business expenses. The flat income tax rate is 22%, and it applies whether you’re mining in your garage or running a data center in Tromsø. You must report the Norwegian Krone (NOK) value of each coin you mine on the day you get it. If you mined 0.1 BTC on March 15, 2024, and it was worth 32,000 NOK that day, you owe tax on 32,000 NOK. No deferral. No exemption. No incentive. You can deduct costs. Equipment? Deductible. Electricity? Deductible. Software and cooling systems? Deductible. The Norwegian Tax Administration (Skatteetaten) allows you to depreciate mining hardware at 30% per year. So if you bought a rig for 100,000 NOK, you can claim 30,000 NOK off your taxable income each year until it’s fully written off. That’s standard business depreciation-not a bonus.Why the Myth Persists

Norway has the perfect setup for mining: renewable energy (mostly hydropower), low electricity prices, and cold air that naturally cools servers. Between 2020 and 2023, mining activity grew fast. Some companies opened large facilities. Investors saw opportunity. Media picked up on it. Then came the backlash. Critics said mining was using too much energy. Environmental groups raised concerns. But Norway didn’t respond by removing incentives-because there weren’t any. Instead, it doubled down on transparency. Miners were never subsidized. They were just taxed like everyone else. The real shift wasn’t in tax policy. It was in public perception. As energy prices rose slightly after 2023 and global crypto markets cooled, some mining operations closed. That wasn’t because of new taxes. It was because profits shrank. When Bitcoin’s price dropped and electricity became less cheap relative to global rates, some miners just couldn’t compete anymore.

How Norway’s System Actually Works

The Norwegian tax system for crypto is simple and consistent:- Income tax: Mining rewards taxed at 22% when received, based on market value in NOK.

- Capital gains tax: If you sell or trade mined coins later, you pay 22% on any profit (sale value minus original value when mined).

- Wealth tax: If your total crypto holdings exceed 1.7 million NOK as of December 31, you pay a 0.7% annual wealth tax on the excess.

- Deductions: Business expenses like hardware, electricity, and software are deductible.

- Reporting: You must declare your crypto holdings as of December 31 each year. Deadline: April 30.

What About Other Countries?

Compare this to places like Texas or Kazakhstan. In Texas, some miners got property tax exemptions or negotiated ultra-low electricity rates with utilities. In Kazakhstan, the government offered temporary tax holidays during a crypto boom in 2021. Those were real incentives. Norway didn’t do that. It didn’t need to. Its natural advantages-clean energy, stable infrastructure, and a transparent legal system-were enough to attract miners without subsidies. When other countries started cracking down-banning mining, imposing heavy taxes, or cutting power-Norway stayed steady. That’s why some miners moved here. Not because they got a gift. Because they got fairness.Why This Matters

The myth that Norway removed incentives is dangerous. It suggests that crypto mining is a handout industry-something governments give and take away. But in Norway, it’s treated like any other business: you pay your taxes, you track your costs, you run your operation efficiently. That’s actually a good sign. It means Norway isn’t playing favorites. It’s not betting on crypto as an economic savior. It’s just regulating it like any other digital asset. If you’re a miner thinking about moving to Norway, don’t expect a tax break. But do expect clarity. No sudden policy flips. No hidden fees. No last-minute rule changes. You’ll know exactly what you owe-and you’ll be able to plan for it.

The Bigger Picture

Crypto mining in Norway accounts for about 0.5% of GDP and uses roughly 1% of the country’s total electricity. That’s not negligible, but it’s not overwhelming. The government doesn’t see it as a threat. It sees it as a small, predictable part of the digital economy. There’s no sign of new restrictions. No pending legislation. No debate in parliament about removing tax breaks-because there’s nothing to remove. Norway’s approach is simple: if you earn income from crypto, you pay tax on it. If you spend money to earn it, you can deduct it. Everything else is business as usual.What Miners Should Do Now

If you’re mining in Norway-or thinking about it-here’s what you need to do:- Track every coin you mine. Note the date and NOK value at receipt.

- Keep receipts for all equipment, electricity bills, and software subscriptions.

- Depreciate your hardware at 30% per year. Don’t try to deduct the full cost upfront.

- Report your crypto holdings as of December 31 each year. Use Skatteetaten’s online portal.

- Don’t assume you’re getting a break. You’re not. But you’re also not being punished.

Final Thought

Norway didn’t remove tax incentives for crypto mining because it never had any. The country didn’t need to lure miners with tax breaks. It just let the market work-with clear rules and no games. That’s not a crackdown. That’s good governance.Did Norway remove tax incentives for crypto mining?

No, Norway never offered tax incentives for crypto mining. The country has always taxed mining rewards as regular income at a flat 22% rate. There were no special deductions, tax holidays, or subsidies to remove. The idea that incentives were removed is a misconception.

Is crypto mining still legal in Norway?

Yes, crypto mining is fully legal in Norway. The Norwegian Tax Administration (Skatteetaten) regulates it under standard income tax rules. Miners must report earnings and pay taxes, but there are no bans or restrictions on mining operations.

How are mining rewards taxed in Norway?

Mining rewards are taxed as income at a flat rate of 22%. The taxable amount is the Norwegian Krone (NOK) value of the cryptocurrency at the exact moment it is received. You must record the market value on the day you get each coin.

Can I deduct mining expenses in Norway?

Yes. You can deduct legitimate business expenses, including mining hardware, electricity, cooling systems, and software. Mining equipment can be depreciated at 30% per year. Expenses must be directly tied to your mining activity and properly documented.

Do I need to report my crypto holdings every year?

Yes. All crypto holdings-including mined coins, staking rewards, and purchased assets-must be reported as of December 31 each year. The deadline is April 30 of the following year. Failure to report can result in penalties.

Is there a wealth tax on crypto in Norway?

Yes. If your total crypto holdings exceed 1.7 million NOK as of December 31, you pay a 0.7% annual wealth tax on the amount above that threshold. This applies to all digital assets, regardless of how you acquired them.

Why did some mining operations shut down in Norway?

Mining operations closed because profitability declined-not because of new taxes. After 2023, Bitcoin prices fell, electricity costs rose slightly, and global competition increased. Miners who couldn’t operate efficiently or afford upgrades left. This was a market shift, not a policy change.

Does Norway favor crypto mining over other industries?

No. Norway treats crypto mining like any other business. There are no special tax breaks, grants, or infrastructure subsidies. The country’s appeal comes from low-cost renewable energy and stable regulation-not government favoritism.

Are staking rewards taxed the same as mining rewards?

Yes. Staking rewards are treated exactly like mining rewards: taxed as income at 22% based on the NOK value when received. The Norwegian Tax Administration does not distinguish between Proof of Work and Proof of Stake income.

What happens if I don’t report my mining income?

Failure to report can lead to fines, interest charges, or even criminal penalties for tax evasion. The Norwegian Tax Administration has access to blockchain data and cross-references wallet addresses with bank transactions. It’s not a risk worth taking.