uTrade DEX: What It Is, How It Works, and Where to Find Reliable Reviews

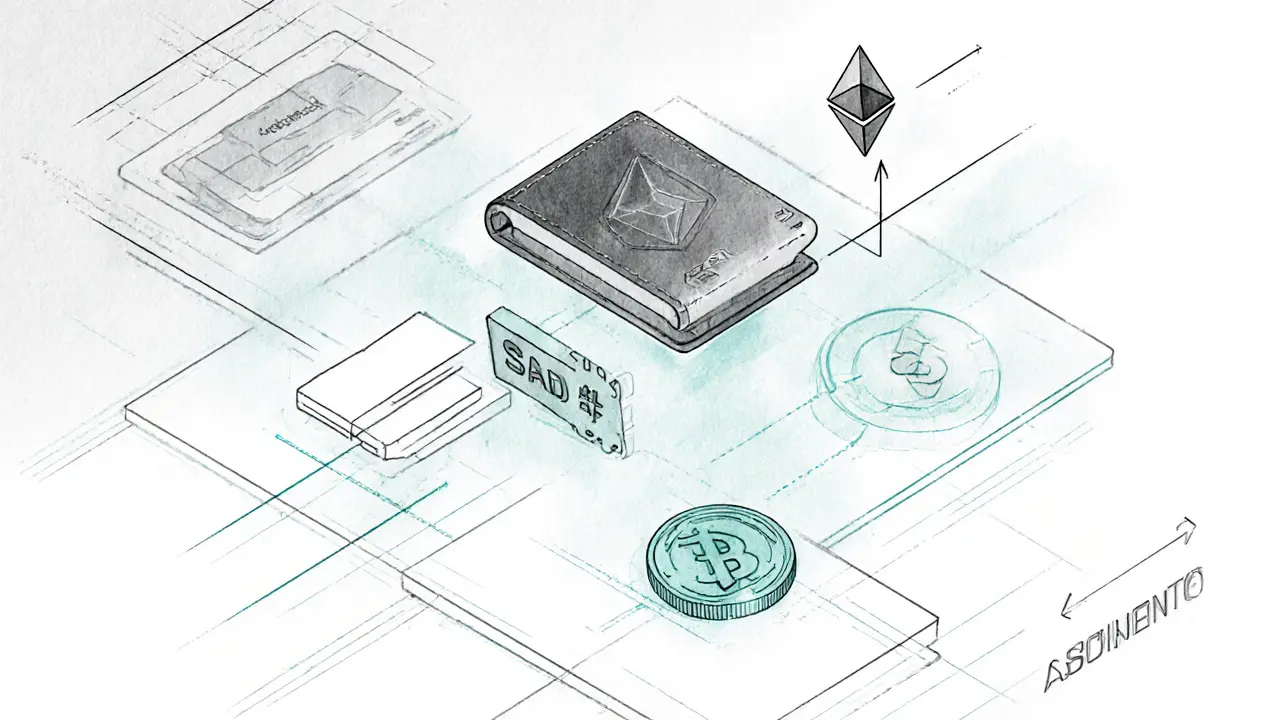

When you hear uTrade DEX, a decentralized exchange built on BNB Smart Chain for swapping tokens without intermediaries. Also known as BXHSwap, it's one of many decentralized exchange platforms trying to compete with giants like Uniswap and PancakeSwap. Unlike centralized exchanges, uTrade DEX lets you trade directly from your wallet—no KYC, no deposits, no middleman. But that freedom comes with risks: low liquidity, fake tokens, and poorly coded contracts. That’s why people search for honest reviews before they swap anything.

Most of the posts in this collection focus on crypto exchange reviews that cut through the hype. You’ll find deep dives into platforms like BXH, Uzyth, and Negocie Coins—each showing how easy it is for a DEX to look legit while hiding dangerous flaws. One review even breaks down how a Brazilian exchange vanished overnight, leaving users with zero access to their funds. These aren’t hypotheticals. They’re real cases that teach you what to watch for: hidden fees, unverified token contracts, or teams that disappear after launch.

uTrade DEX itself isn’t the only player here. It’s part of a bigger ecosystem of BNB Smart Chain DEX platforms that rely on liquidity pools, automated market makers, and community trust. But trust isn’t enough. You need to check token contracts, verify team activity, and look for audits—something most new DEXs skip to save time and money. The posts below don’t just list features. They dig into code, trace token flows, and call out red flags you won’t find on a marketing page.

Whether you’re swapping tokens for the first time or trying to spot a scam before you lose cash, this collection gives you the tools to make smarter moves. You’ll learn how to read a DEX’s liquidity depth, spot fake airdrops tied to the same platform, and understand why some swaps cost more in gas than the token is worth. No fluff. No hype. Just what works—and what gets you burned.

Unifi Protocol DAO Crypto Exchange Review: What It Actually Is and How uTrade Works

Unifi Protocol DAO isn't a crypto exchange-it's a DeFi ecosystem with uTrade as its decentralized swap platform. Learn how UNFI works, why liquidity is low, and whether it's worth using in 2025.