Unifi Protocol DAO: What It Is, How It Works, and What You Need to Know

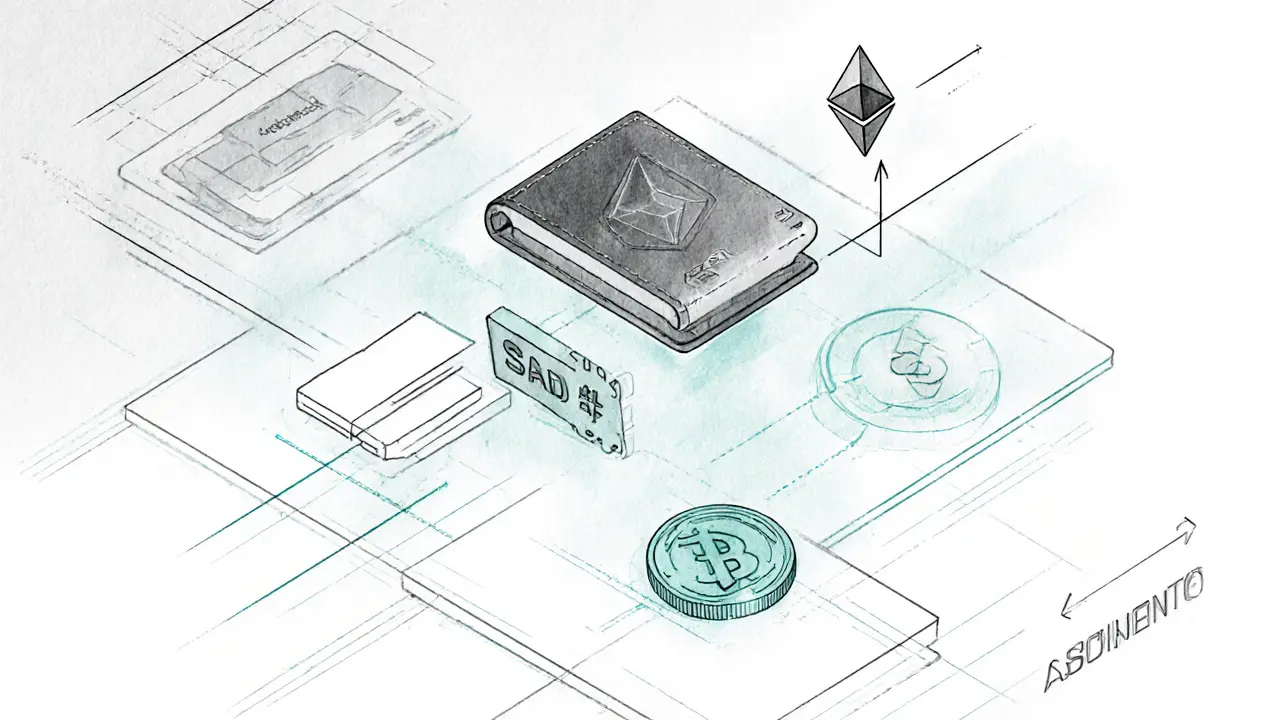

When you hear Unifi Protocol DAO, a decentralized finance protocol that combines liquidity pools, staking, and governance into one unified system. It's not just another DeFi project—it's a community-run engine that lets holders vote on upgrades, fee structures, and token distribution. Unlike top-down platforms, Unifi Protocol DAO runs on smart contracts and user votes. There’s no CEO, no secret roadmap—just code and collective decisions.

This system relies on DeFi governance, the process where token holders propose and vote on changes to a blockchain protocol. If you hold UNFI tokens, you get voting power. That means you can influence things like which new chains get added, how much reward users earn from staking, or whether to burn tokens to reduce supply. It’s not theoretical—real changes have been made this way. You’re not just holding a coin; you’re helping shape the future of a financial system.

Related to this are blockchain DAO, a digital organization that operates through rules encoded on a blockchain, without traditional management. Unifi Protocol DAO fits right in. It’s one of many DAOs trying to replace banks, exchanges, and fund managers with automated rules and user control. But what sets it apart? It’s built to unify fragmented DeFi tools. Instead of jumping between 5 different apps for swaps, staking, and yield farming, Unifi brings them together under one roof—controlled by its community.

And it’s not just for experts. Even if you’re new to crypto, you can start earning by staking UNFI or providing liquidity. The rewards aren’t huge, but they’re steady—and you’re helping secure the network while you earn. The protocol has been around long enough to prove it’s not a flash in the pan. It’s survived bear markets, smart contract exploits, and token dumps. That’s rare.

What you’ll find in the posts below aren’t just marketing blurbs. These are real user experiences, breakdowns of tokenomics, and honest takes on whether Unifi Protocol DAO still holds value in 2025. Some people made money. Others got burned. No one’s sugarcoating it. You’ll see how it compares to other DAOs, what the fees really look like, and whether the governance votes actually mean anything. This isn’t hype. It’s the raw, unfiltered truth from people who’ve been there.

Unifi Protocol DAO Crypto Exchange Review: What It Actually Is and How uTrade Works

Unifi Protocol DAO isn't a crypto exchange-it's a DeFi ecosystem with uTrade as its decentralized swap platform. Learn how UNFI works, why liquidity is low, and whether it's worth using in 2025.