UNFI Token: What It Is, Where It’s Used, and What You Need to Know

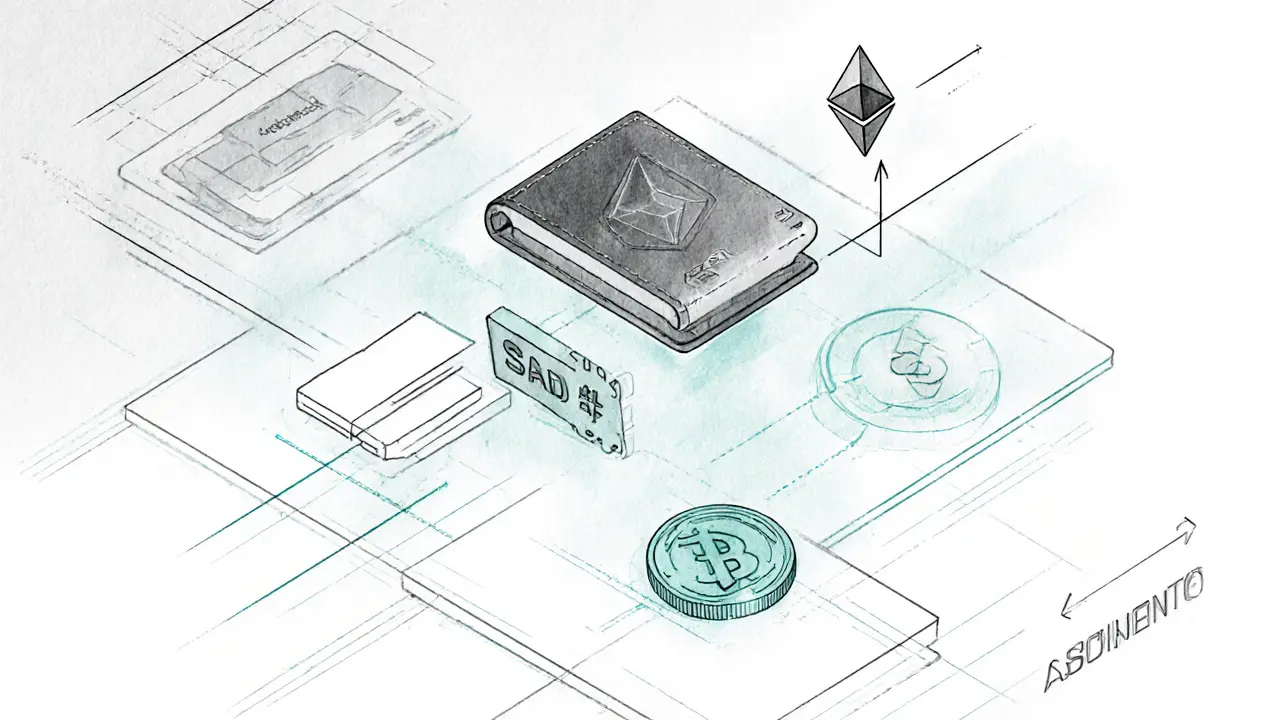

When you hear UNFI token, the native cryptocurrency of the Unifi Protocol, a decentralized finance platform built for cross-chain liquidity and community governance. Also known as Unifi Protocol token, it enables users to vote on protocol upgrades, earn rewards from trading fees, and stake across multiple blockchains like Ethereum, Binance Smart Chain, and Polygon. Unlike many meme coins that vanish after a pump, UNFI has real utility—it’s not just a speculation play. It’s the fuel behind a working DeFi system that’s been active since 2020.

The Unifi Protocol isn’t just another DeFi project. It’s a multi-chain aggregator that lets you swap tokens without needing to move assets between networks manually. That means you can trade ETH for BNB without leaving your wallet, and UNFI holders get a cut of every swap fee. This isn’t theoretical—it’s live, with real volume and real users. The token also powers governance: if you hold UNFI, you can propose changes or vote on things like fee structures, new chain integrations, or how treasury funds are used. That’s rare in crypto, where most projects are controlled by a small team.

Related to UNFI are other DeFi tokens like CRV, Curve Finance’s governance token that rewards liquidity providers, and AAVE, a lending protocol token that lets users earn interest and vote on risk parameters. But UNFI stands out because it doesn’t just focus on lending or swapping—it connects them. It’s a bridge token, built for interoperability. That’s why it shows up in guides about cross-chain DeFi, not just generic crypto lists.

You’ll find UNFI mentioned in posts about airdrops, because early users got tokens for providing liquidity on supported chains. You’ll see it in exchange reviews, because platforms like Uniswap and PancakeSwap list it. And you’ll notice it in discussions about tokenomics, since UNFI has a capped supply and regular burns to reduce inflation. It’s not a giant like Bitcoin or Ethereum, but it’s been around long enough to prove it’s not a flash in the pan.

So if you’re wondering whether UNFI is worth your attention, ask yourself: Do you care about decentralized governance? Do you use multiple blockchains? Do you want to earn from trading fees without running a node? If yes, then UNFI isn’t just another coin—it’s a tool. And the collection below dives into exactly that: how people use it, where it’s traded, what risks come with staking it, and how it compares to similar tokens in the DeFi space.

Unifi Protocol DAO Crypto Exchange Review: What It Actually Is and How uTrade Works

Unifi Protocol DAO isn't a crypto exchange-it's a DeFi ecosystem with uTrade as its decentralized swap platform. Learn how UNFI works, why liquidity is low, and whether it's worth using in 2025.