Token Eligibility: How to Know If You Qualify for Crypto Airdrops & Sales

When dealing with Token Eligibility, the set of conditions that decide if a wallet or user can receive a specific crypto token. Also known as Eligibility Criteria, it plays a crucial role in airdrops, token sales, and reward programs. Airdrop Eligibility, the rules that define who can claim free tokens from a project is a common subset, while KYC Requirement, the identity verification step many platforms demand before distribution can gate access for regulated offerings. Together they shape the Token Distribution Model, the way a project allocates its tokens across participants and ultimately who ends up holding the asset.

In practice, Token Eligibility encompasses Airdrop Eligibility because every free‑drop must first decide if your address meets the snapshot criteria. It also requires you to pass any KYC Requirement when the drop is tied to a security‑type token or a jurisdiction with strict AML rules. The relationship can be summed up as: Token Eligibility encompasses Airdrop Eligibility; KYC Requirement influences Token Eligibility; and Token Distribution Model determines the pool of eligible participants.

Most projects publish a checklist: hold a minimum amount of the native coin, interact with a smart contract, or join a community channel. Those checkpoints are concrete attributes of eligibility – for example, holding at least 100 VRA tokens qualifies you for the Verasity airdrop, while staking NEURON on Cerebrum DAO unlocks governance voting rights. When you see a tweet promising free tokens, it’s usually a shortcut to the full eligibility list. Skipping the fine print means you might miss the snapshot or get blocked by KYC later.

Why Understanding Eligibility Saves Time and Money

Knowing the exact criteria helps you avoid wasted gas fees. If a token’s distribution model reserves 70 % for early supporters, latecomers will never qualify, no matter how many transactions they send. Similarly, projects that require a KYC step often have a verification window; missing it can disqualify you permanently. By mapping the eligibility attributes before you act, you can focus on tokens where you meet the conditions, reducing trial‑and‑error and protecting your assets.

Eligibility isn’t static either. Some token sales update their rules based on community feedback or regulatory changes. A recent example is the WELL token airdrop, where the team added a “wallet age” factor after the initial announcement. Keeping an eye on official channels – Discord, Telegram, or the project’s blog – ensures you stay aware of any adjustments that could affect your status.

If you’re new to crypto, start with simple criteria: check if the project requires a snapshot, verify the minimum holding amount, and see whether a KYC form is mandatory. For seasoned traders, dive deeper into the distribution schedule, vesting periods, and any anti‑whale measures that might limit large holders. Both approaches rely on the same core idea: clarity around token eligibility translates into smarter participation.

Below you’ll find a curated set of articles that break down specific tokens, their eligibility rules, and how to claim them safely. From Verasity’s Proof‑of‑View based airdrop to the WELL token’s 2025 distribution, each guide walks you through the exact steps, pitfalls to avoid, and tips for maximizing your chance of success. Use these resources as a roadmap, apply the eligibility checklist we discussed, and you’ll be better equipped to navigate the ever‑changing crypto landscape.

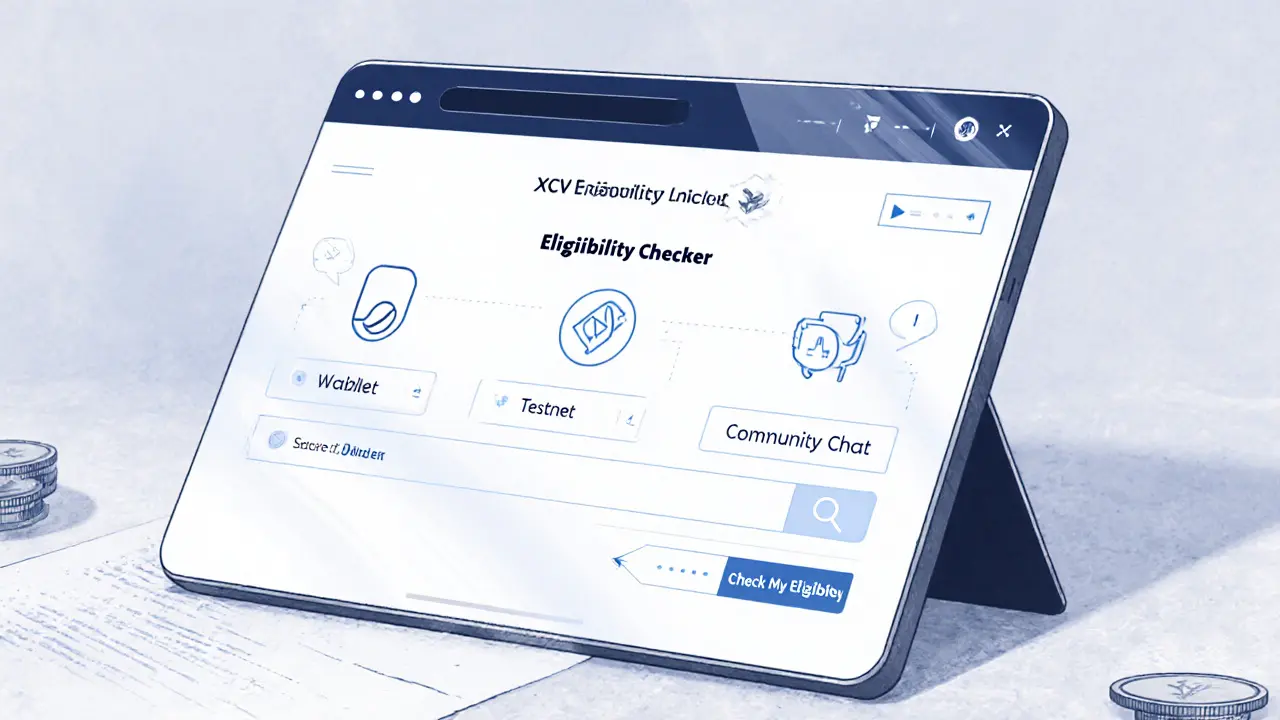

XCV Airdrop by XCarnival: What You Need to Know (2025)

Learn what you need to know about a potential XCV airdrop by XCarnival, including eligibility, wallet setup, scam warnings, and how to verify official announcements.