Serenity Exchange Review: Is This Crypto Platform Safe or a Scam?

When you hear Serenity Exchange, a crypto trading platform that promises low fees and high liquidity but lacks public regulatory oversight. Also known as Serenity.io, it's one of many obscure exchanges popping up with flashy ads and no verifiable track record. The name sounds calm, maybe even trustworthy—but in crypto, names don’t guarantee safety. What matters is who’s behind it, where it’s registered, and whether users can actually withdraw their funds.

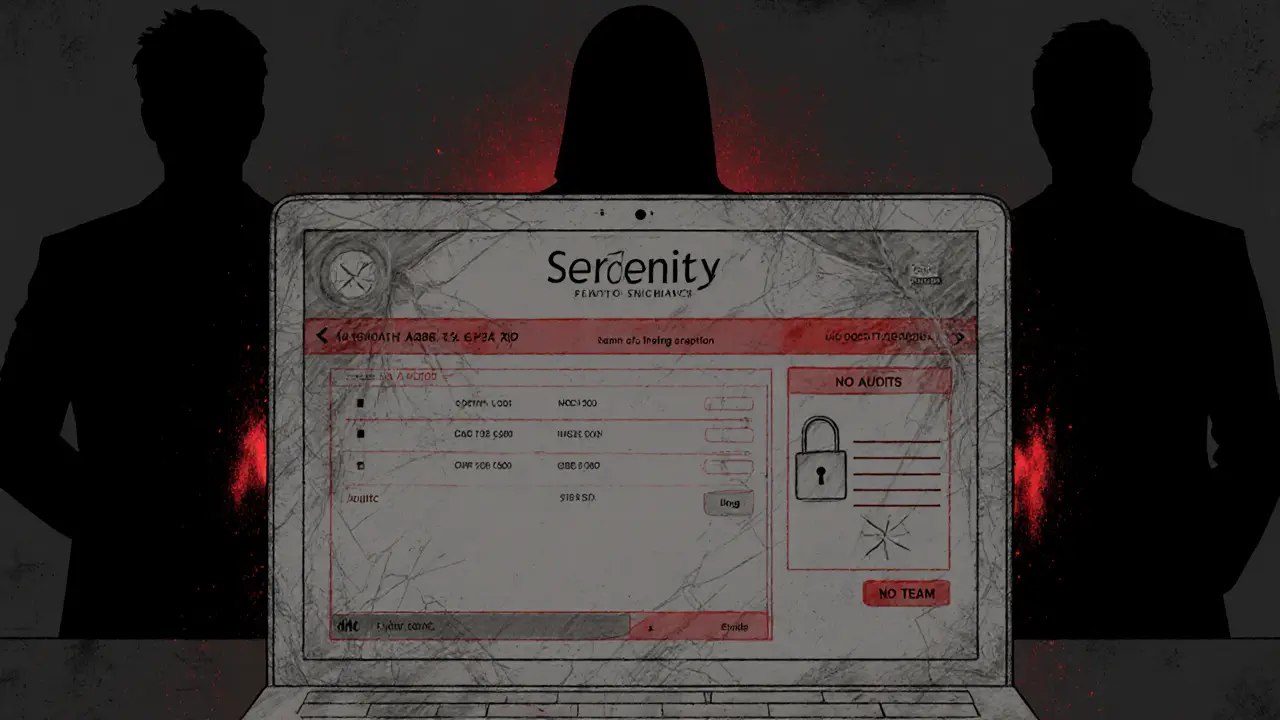

Real crypto exchanges like Binance, Kraken, or even smaller regulated ones like Bitstamp carry licenses, publish audits, and have customer support that answers emails. Serenity Exchange does none of that. It’s not registered with the SEC, FCA, or any major financial authority. No public team. No physical address. No history of regulatory compliance. That’s not just risky—it’s a textbook warning sign. Look at similar platforms like MaskEX or Negocie Coins in our collection: they all shared the same pattern—high leverage, low transparency, and then silence when users tried to cash out.

Trust scores matter. Platforms like MaskEX got a 1/100 trust rating because users reported frozen accounts and ghosted support. Serenity Exchange shows the same red flags: anonymous ownership, no KYC documentation published, and a website that looks like a template bought for $50. If you’re considering depositing even $50, ask yourself: would you hand cash to someone on the street who won’t show you an ID? Crypto is the same. The crypto exchange scam, a fraudulent platform designed to collect deposits and vanish without delivering trades or withdrawals is alive and well—and Serenity is just another name on the list.

There’s a bigger issue too: unregulated crypto exchange, a trading platform operating without legal oversight, making it impossible to seek recourse if things go wrong isn’t just dangerous—it’s illegal in many countries. The U.S., EU, and Australia have cracked down hard on these platforms. If Serenity lets you trade without verifying your identity, it’s already breaking the law. That means your money has zero legal protection. No chargebacks. No insurance. No recourse.

So what should you do? Skip it. Use exchanges that publish their licenses, have been around for years, and have real user reviews on independent sites—not just glowing testimonials on Telegram. If you’re looking for low fees, try Merchant Moe on Mantle or BXHSwap. If you want security, stick with platforms that answer to regulators, not just marketing hype. The crypto world has plenty of legit options. You don’t need to gamble on a name that sounds like a spa.

Below, you’ll find real reviews of exchanges that actually work—some with high leverage, some with zero fees, but all with transparency. No guesswork. No scams. Just what users experienced, in their own words.

Serenity Crypto Exchange Review: Is It Safe to Trade Here in 2025?

Serenity crypto exchange is risky and unregulated. With no team transparency, no app, and ties to a hacked project, it's not safe for trading. Avoid it in 2025 and choose established platforms instead.