Cryptocurrency Compliance

When dealing with cryptocurrency compliance, the set of rules and guidelines that keep crypto activities legal and transparent. Also known as crypto compliance, it sits at the intersection of finance, technology, and law. Regulatory compliance ensures platforms follow local statutes, while anti‑money laundering (AML) measures stop illicit fund flows. Tax reporting translates transaction data into the numbers governments require. Together these pillars form the backbone of a compliant crypto ecosystem.

Why Compliance Matters for Exchanges and Users

Any crypto exchange that wants to stay open must embed KYC (Know Your Customer) checks, transaction monitoring, and regular audits. These steps are direct outcomes of regulatory compliance and AML obligations. Without them, platforms risk fines, shutdowns, or being blacklisted by payment processors. For users, compliance builds trust – you know the exchange you trade on isn’t a hidden money‑laundering hub. The recent review of the Uzyth exchange highlighted how fee structures, security features, and jurisdictional licensing all tie back to compliance checks. When a platform meets these standards, it can attract institutional investors who demand clean audit trails.

Beyond exchanges, compliance stretches into the tools that crypto users employ. Mixing services, for instance, scramble transaction trails to boost privacy. While they offer legitimate anonymity, regulators view them skeptically because they can obscure illegal activity. Countries like the United States and members of the EU have started labeling unregistered mixers as high‑risk, demanding they register as money‑service businesses. This regulatory pressure forces mixers to adopt AML protocols, such as logging source addresses and providing transaction receipts on request. The tug‑of‑war between privacy and oversight defines a large chunk of the compliance conversation.

Tax compliance adds another layer of complexity. Nations such as Portugal impose a 28% short‑term tax on crypto gains, while others offer tax‑free thresholds for long‑term holdings. Accurate tax reporting requires users to track purchase price, holding period, and disposal method for each token. Services that auto‑generate tax reports are booming because they translate raw blockchain data into the fields tax authorities demand. Ignoring these requirements can lead to audits, penalties, or even criminal investigations in strict jurisdictions. The key takeaway: compliance isn’t optional; it’s the price of participating in a growing financial system.

Compliance also differs by jurisdiction. Some regions, like Nigeria, are pushing crypto adoption despite regulatory uncertainty, while others, like Morocco, have banned crypto outright and monitor VPN usage. These geographic nuances affect how businesses design their compliance frameworks. A multinational exchange must adapt KYC forms to local ID documents, adjust AML thresholds to meet regional risk standards, and stay updated on shifting tax rules. Understanding the local regulatory climate helps avoid costly missteps and opens doors to new markets.

In practice, building a compliance program starts with risk assessment. Identify which assets you support—high‑volume tokens like Bitcoin may attract more scrutiny than niche coins. Map out the transaction flow: deposits, withdrawals, swaps, and cross‑chain bridges each introduce distinct AML checkpoints. Implement automated monitoring to flag large or suspicious moves, then set up a reporting pipeline to your compliance officer or external auditor. Regular training for staff ensures everyone knows the latest AML guidelines, KYC document requirements, and tax filing deadlines.

One emerging trend is the use of decentralized identity (DID) solutions to streamline KYC while preserving user privacy. Instead of repeatedly uploading documents, users can present a cryptographically verified credential issued by a trusted authority. This approach satisfies regulatory demands and reduces friction for the end‑user. However, regulators still want to see a clear audit trail, so DID implementations often pair with on‑chain logging of verification events. The blend of privacy tech and compliance requirements illustrates how the field keeps evolving.

Looking ahead, expect tighter integration between traditional finance compliance tools and DeFi protocols. As institutional money flows into decentralized platforms, auditors will demand proof of AML adherence, transaction provenance, and tax compliance. Projects that embed compliance hooks—like on‑chain KYC attestations or built‑in tax calculators—will have a competitive edge. Meanwhile, regulators are drafting clearer guidelines for smart contract audits and token classifications, which will further shape how compliance is built into the code itself.

Below you’ll find a curated list of articles that dig deeper into each of these areas—from exchange reviews and tax breakdowns to the tech behind mixers and decentralized identity. Dive in to see real‑world examples, practical tips, and the latest regulatory updates that can help you stay on the right side of the law while navigating the crypto market.

Legal Risks of Circumventing Crypto Sanctions

Explore the legal dangers of using cryptocurrencies to dodge sanctions, understand enforcement tools, compliance costs, and future regulatory trends.

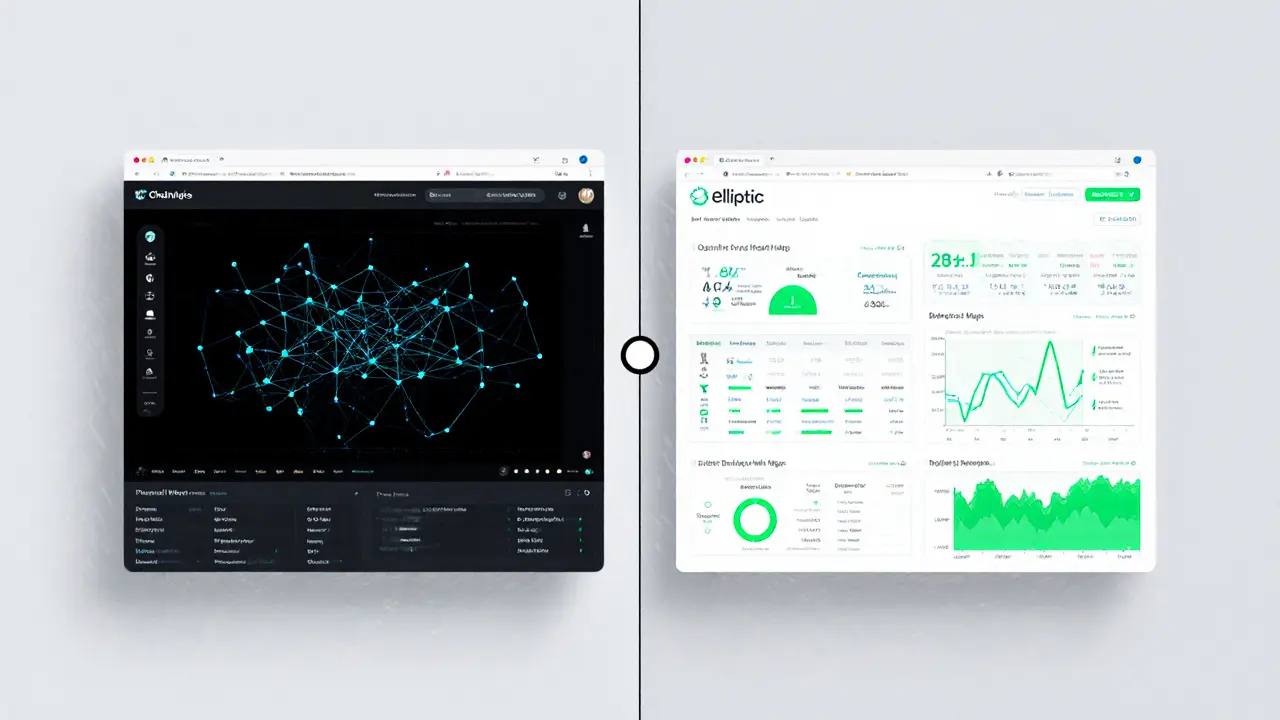

Chainalysis vs Elliptic: Top Blockchain Forensics Tools for Crypto Tracing

Explore how Chainalysis and Elliptic power crypto tracing. Learn their key features, differences, real‑world use cases, implementation steps, and which tool suits your compliance needs.