Crypto Tracing

When working with Crypto Tracing, the process of following digital asset flows across blockchains to uncover origins, destinations, and patterns. Also known as crypto transaction tracing, it helps investigators, compliance teams, and investors understand who’s moving what and why. Crypto tracing isn’t just a buzzword; it’s a core pillar of modern Blockchain Analytics, the suite of data‑driven techniques that map addresses, clusters, and transaction graphs. Firms like Chainalysis and Elliptic turn raw ledger data into readable risk scores, and developers can tap open‑source libraries to build their own monitors. The goal is simple: turn opaque public keys into actionable intelligence.

The next piece of the puzzle is Transaction Monitoring, continuous surveillance of on‑chain activity to flag suspicious behavior in real time. Whether you’re a crypto exchange or a DeFi platform, automated alerts let you freeze funds before they hit a mixer or a darknet market. Pair this with Anti‑Money Laundering (AML), regulatory frameworks that require entities to report and investigate suspicious transactions, and you have a compliance loop that can keep pace with billions of daily moves. AML tools often pull in data from multiple blockchains, enrich it with off‑chain KYC info, and score each transaction on risk factors like rapid token swaps or hops through privacy‑preserving mixers.

From Theory to Practice

In real‑world cases, crypto tracing starts with a simple address lookup, expands into a graph of related wallets, and ends with a forensic report that can be handed to law enforcement. Crypto Forensics, the investigative discipline that combines blockchain analytics, network traffic analysis, and legal knowledge, turns that report into admissible evidence. For example, a recent ransomware case traced the ransom flow through a series of chain‑hopping moves, revealing a hidden exchange that later cooperated with authorities. That same flow can be visualized with tools like GraphSense or CipherTrace, showing how each hop adds a layer of anonymity and how a single‑point failure—like a reused address—breaks the chain.

Every step of crypto tracing relies on a set of attributes: data sources (node snapshots, mempool feeds), analytical methods (clustering, heuristics), and output formats (risk scores, heat maps). The more you understand these attributes, the better you can fine‑tune alerts for your specific risk appetite. For traders, tracing can surface hidden whales moving large volumes, giving a heads‑up before price swings. For regulators, it spells out the money‑laundering routes that need tighter controls. Below, you’ll find a curated collection of articles that dive deeper into each of these facets—guide‑style explainers, exchange reviews, tax breakdowns, and even geopolitical case studies. Explore them to see how the concepts we discussed play out across different blockchain ecosystems and real‑life scenarios.

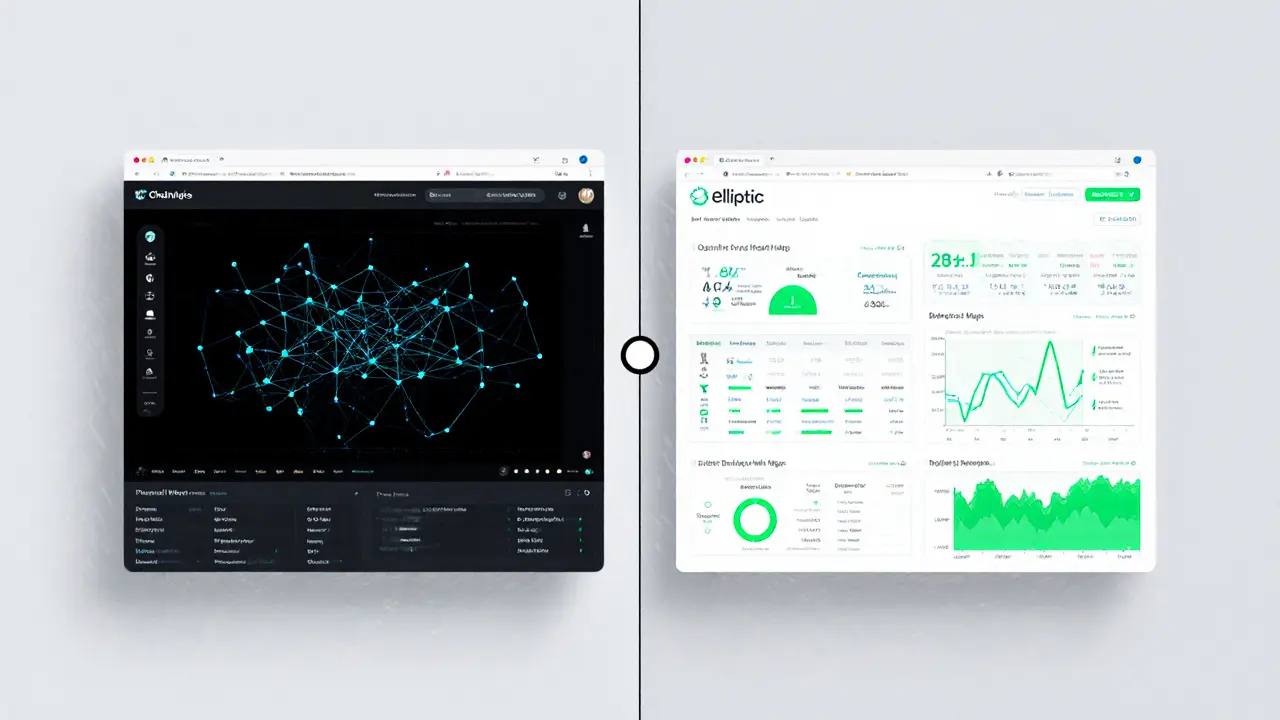

Chainalysis vs Elliptic: Top Blockchain Forensics Tools for Crypto Tracing

Explore how Chainalysis and Elliptic power crypto tracing. Learn their key features, differences, real‑world use cases, implementation steps, and which tool suits your compliance needs.