BTCNEXT Exchange Review – Security, Fees & User Experience

When assessing BTCNEXT exchange review, an in‑depth look at the BTCNEXT crypto exchange platform, it helps to see how it measures up against other crypto exchanges, online services that enable buying, selling and swapping digital assets. The review also dives into security, the set of protocols and safeguards protecting user funds and data, examines fees, the cost structure for deposits, withdrawals and trades, and checks regulatory compliance, how the platform adheres to legal and licensing requirements in its operating jurisdictions. BTCNEXT exchange review brings these pieces together so you can decide if the platform fits your needs.

First off, security is non‑negotiable. BTCNEXT uses two‑factor authentication, cold‑wallet storage for the bulk of assets, and regular third‑party audits. In practice, that means the exchange’s security framework encompasses both technical safeguards and procedural checks. The platform’s incident‑response plan requires swift action in case of suspicious activity, and its transparency reports influence user confidence. If you’ve ever worried about your crypto being hacked, you’ll appreciate how BTCNEXT’s layered approach reduces that risk.

Fees, Liquidity & User Experience

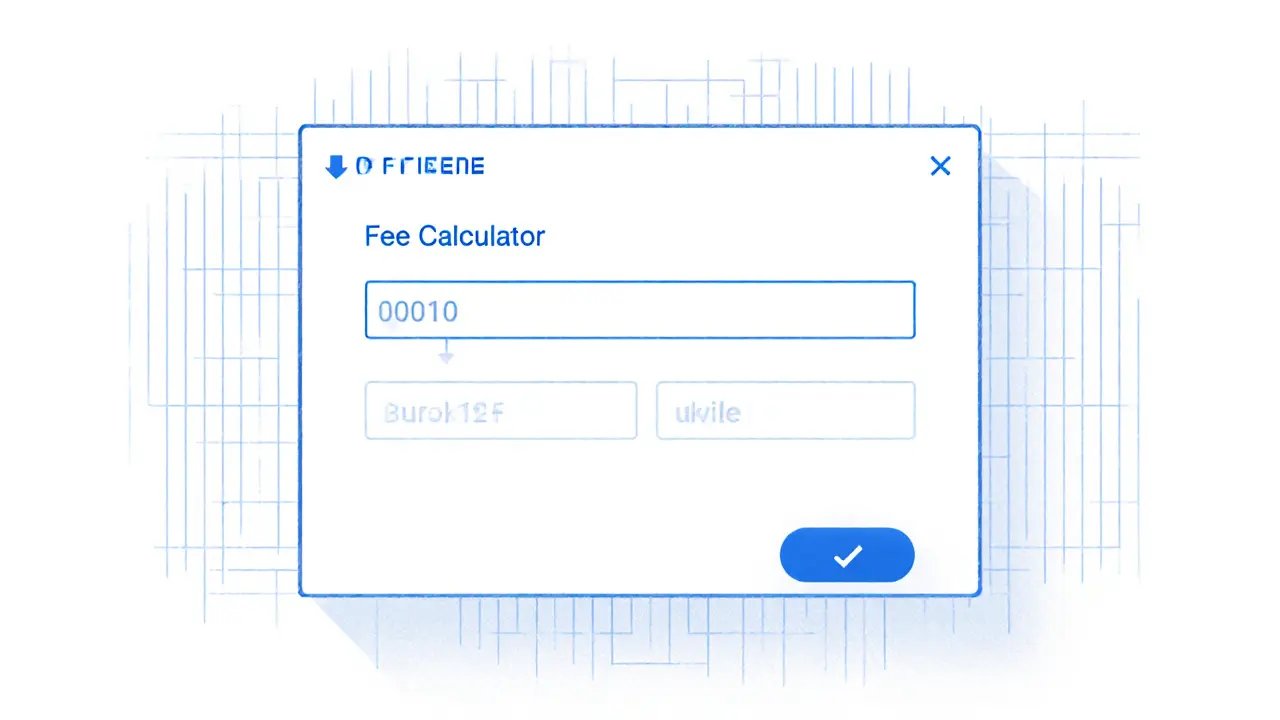

Fees are another make‑or‑break factor. BTCNEXT charges a flat 0.15% maker fee and 0.20% taker fee, with lower rates for high‑volume traders. Those numbers require you to calculate your trading cost based on expected volume, and they influence the overall profitability of your strategy. Compared to many rivals that levy up to 0.30% on taker trades, BTCNEXT’s structure is competitive, especially for day traders who churn large amounts.

Liquidity matters because it determines how quickly you can enter or exit positions without slippage. BTCNEXT aggregates order books from several partner venues, giving it depth across major pairs like BTC/USD and ETH/BTC. This liquidity network encompasses both spot and margin markets, meaning you’ll rarely hit a wall when the market moves fast. For beginners, the platform’s clean UI and built‑in educational widgets also make the user experience feel more intuitive than some older exchanges.

Regulatory compliance rounds out the picture. BTCNEXT holds a license from the Malta Financial Services Authority and follows KYC/AML procedures aligned with EU standards. This compliance requires users to submit ID verification, but it also means the exchange is less likely to face sudden shutdowns that can trap funds. In jurisdictions where crypto regulation is tightening, operating under a reputable license influences the platform’s long‑term stability.

Putting it all together, this collection of articles below gives you a practical roadmap: you’ll find a security deep‑dive, a fee‑by‑fee breakdown, UI walkthroughs, and a compliance checklist. Whether you’re a seasoned trader looking for tighter spreads or a newcomer needing a safe entry point, the insights in the posts will help you make an informed decision about using BTCNEXT.

BTCNEXT Exchange Review 2025: Fees, Security & Supported Coins

A detailed 2025 review of BTCNEXT Exchange covering fees, security, supported coins, mobile app, and who should consider using it.