Understanding Blockchain Token Distribution

When working with blockchain token distribution, the way a crypto project allocates its native tokens to founders, investors, users and the community. Also known as crypto token distribution, it decides who gets what, when, and under what conditions. A fair distribution can boost network effects, while a skewed one often leads to price volatility and centralization concerns. Below we’ll break down the core pieces that make up a solid distribution model and why each matters for long‑term health.

Core Elements That Shape Distribution

Every robust distribution plan rests on solid Tokenomics, the study of a token’s supply, allocation and economic incentives. Tokenomics encompasses how many tokens exist, how many are reserved for the team, and how many are set aside for community rewards. It also defines the vesting schedules that prevent early investors from dumping their holdings. An effective tokenomics framework often includes an Airdrop, a free token giveaway designed to seed users and encourage network adoption. Airdrops act as both a marketing tool and a distribution mechanism, nudging new wallets onto the chain and creating early liquidity. Another key pillar is Staking, the process of locking tokens to support network security and earn rewards. Staking aligns holder interests with the protocol’s success, effectively reducing circulating supply and fostering price stability. Together, these elements form the equation: blockchain token distribution encompasses tokenomics, tokenomics requires understanding of airdrops, and airdrops influence distribution dynamics while staking affects supply.

Even with strong tokenomics, many projects employ a Token Burn, a deliberate destruction of tokens to lower total supply and boost scarcity. Burning can be tied to protocol fees, milestone achievements, or community votes, creating a direct feedback loop between usage and value. When a token burn is transparent and predictable, it adds credibility to the distribution model because participants can see a clear path to scarcity. This ties back to the central theme: a well‑designed distribution plan balances initial allocation, ongoing incentives like staking, and supply‑reduction mechanisms such as token burns. Understanding how these pieces interact helps investors evaluate risk, creators design fair launches, and community members gauge long‑term sustainability. Below you’ll find articles that dive deeper into each of these concepts, from Verasity’s Proof‑of‑View token model to real‑world airdrop case studies, giving you the tools to navigate token distribution with confidence.

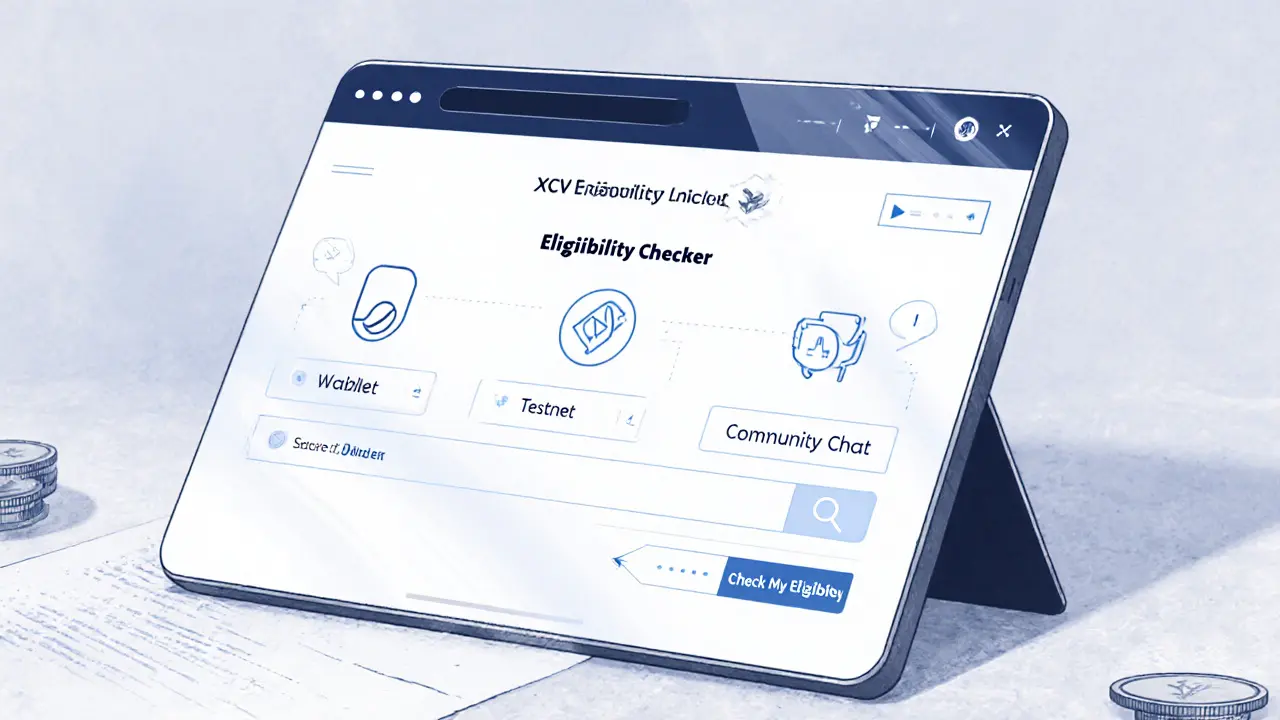

XCV Airdrop by XCarnival: What You Need to Know (2025)

Learn what you need to know about a potential XCV airdrop by XCarnival, including eligibility, wallet setup, scam warnings, and how to verify official announcements.