Asproex Fees: What You Really Pay to Trade on Asproex Exchange

When you trade on Asproex, a crypto exchange that targets traders looking for low fees and fast execution. It's known for its simple interface and claims of competitive pricing, but what you see on the homepage isn't always what you pay. Many users assume low fees mean free trading—but that’s rarely true. Hidden costs like withdrawal fees, maker-taker spreads, and inactivity charges can add up fast. Asproex isn’t the only exchange with tricky pricing, but it’s one where the fine print matters more than the headline.

Asproex fees vary depending on whether you’re making or taking liquidity, which is standard across most exchanges. But unlike bigger platforms like Binance or Kraken, Asproex doesn’t offer clear volume tiers or fee discounts for holding native tokens. That means if you’re trading small amounts, you’re likely paying the full standard rate—often around 0.1% per trade. Withdrawals? They charge a flat fee in crypto, not USD, so if the coin’s price spikes, your withdrawal cost spikes too. And if you leave funds idle for months? Some users report account inactivity fees, though Asproex doesn’t always make that obvious upfront.

Compare this to other exchanges like Merchant Moe, a zero-fee DEX on the Mantle Network, or WingRiders, Cardano’s leading DeFi DEX with transparent fee structures, and Asproex starts to look less appealing for casual traders. It’s not a scam, but it’s not transparent either. You won’t find clear fee schedules on their site, and customer support rarely gives exact numbers without asking for your trading volume first.

What’s worse? Asproex doesn’t offer staking rewards or fee discounts through token holdings like many competitors do. That puts you at a disadvantage if you’re trying to minimize costs over time. If you’re serious about keeping more of your profits, you need to track every fee—deposit, trade, withdrawal, even currency conversion. One user reported paying $12 in fees on a $500 trade because they didn’t realize the withdrawal fee was 0.0005 BTC, and Bitcoin had jumped 20% since they deposited.

And here’s the kicker: Asproex isn’t regulated in major markets like the U.S. or EU. That means there’s no legal requirement for them to disclose fees clearly. You’re trusting their word—and their word has changed before. In 2023, they quietly increased withdrawal fees on several altcoins without notice. Users only found out when they tried to cash out.

So if you’re considering Asproex, ask yourself: Are you trading large volumes where 0.1% matters less? Or are you a small trader trying to stretch every dollar? If it’s the latter, there are better options. The posts below dig into real user experiences, compare Asproex fees to other platforms, and show you how to spot hidden costs before you deposit a cent.

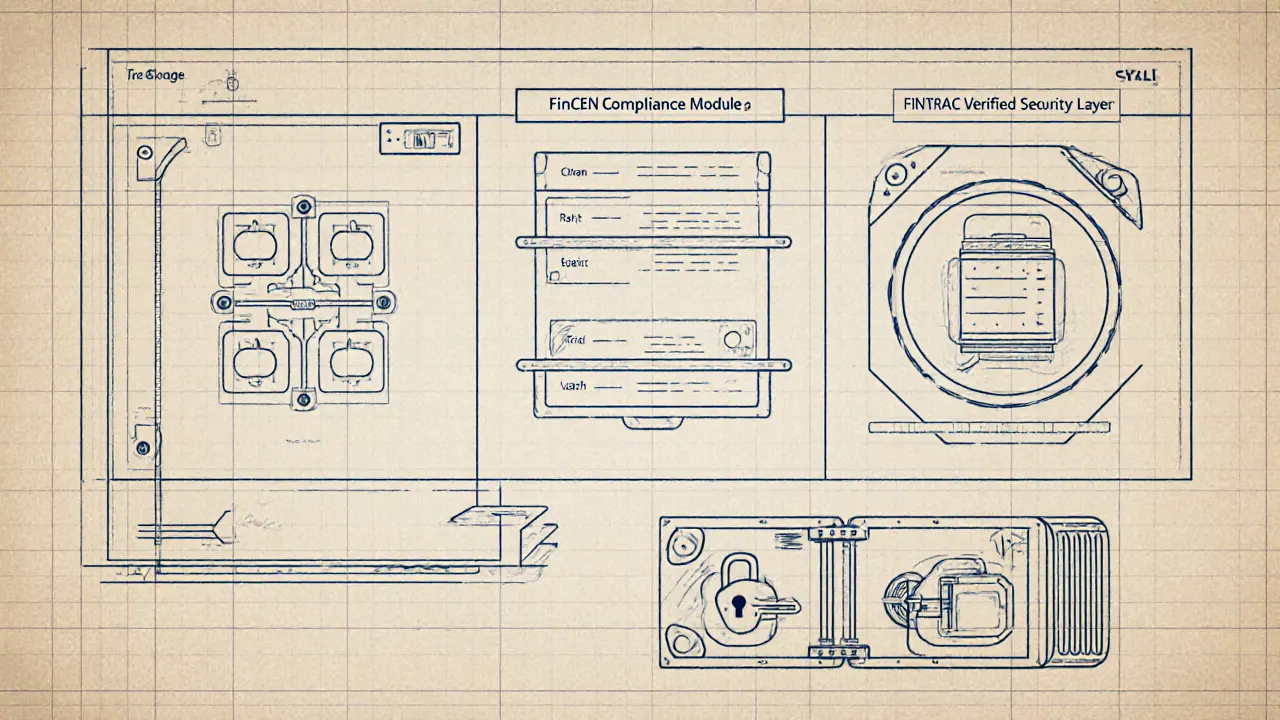

Asproex Crypto Exchange Review: Security, Regulations, and What You Need to Know

Asproex is a regulated crypto exchange with FinCEN and FINTRAC licenses, offering strong security via cold storage and 2FA. It's ideal for experienced traders prioritizing compliance over features - but lacks transparency on fees, supported coins, and mobile access.