Quick Summary

- The U.S. lifted comprehensive sanctions on Syria in July2025, but 139 regime‑linked individuals and entities remain blocked.

- Crypto exchanges can now list Syrian users, yet they must run enhanced due‑diligence checks against lingering OFAC lists.

- Domestic Syrian law still neither authorizes nor bans crypto, creating a regulatory vacuum for businesses.

- Typical transaction limits sit at $500 per trade, with processing times 2‑3days longer than in non‑sanctioned markets.

- Analysts estimate a $420million crypto market in Syria by 2027 if clear rules emerge.

Syria cryptocurrency regulatory landscape refers to the mix of U.S. sanctions, undefined Syrian domestic rules, and practical on‑ramps that affect how digital assets are used, traded, and mined in Syria. Since the United States announced major sanctions relief on July12025, the picture has become both brighter and messier. Below we break down what actually changed, what still blocks crypto businesses, and how Syrian users are coping on the ground.

1. What the July2025 sanctions relief actually covered

The Treasury’s Office of Foreign Assets Control (OFAC) removed the Syrian Sanctions Regulations (SySR) from the Code of Federal Regulations on August262025 (press release SB0183). In plain language, that move ended the blanket economic embargo that had been in place since 2004 under Executive Order13338.

- Executive Order14312 (June302025) officially revoked the earlier sanctions, citing the post‑Assad regime change.

- The Bureau of Industry and Security (BIS) issued a final rule on September22025 that opened most EAR99 items to Syrian buyers, with only a handful of controlled technologies still needing a license.

- General Licenses24 and25 remain active, allowing certain humanitarian and reconstruction‑related activities, as well as limited crypto‑related transactions that do not involve designated persons.

However, OFAC kept the designations of 139 individuals and entities tied to the former regime under Executive Order13894. Those blocks stay on the Specially Designated Nationals (SDN) List, meaning any crypto platform must screen against them in real time.

2. The regulatory vacuum inside Syria

Unlike Iran or Venezuela, Syria has not published any law that explicitly legalizes or bans digital assets. Lightspark’s 2025 analysis notes that the Syrian government treats crypto as a “grey area” - neither prohibited nor regulated. The practical result is a reliance on existing anti‑money‑laundering (AML) rules that cover banks and traditional financial services, but these rules lack crypto‑specific provisions.

For U.S. firms, this means two layers of compliance:

- U.S. sanctions screening (OFAC, Treasury, Commerce Department) - mandatory.

- Domestic Syrian AML checks - required by the Central Bank of Syria for any fiat‑on‑ramp, even though the bank has no published crypto policy.

Failure to satisfy either layer can trigger account freezes, fines, or loss of the limited correspondent‑bank relationships that the Treasury’s May2025 exception granted to the Commercial Bank of Syria.

3. How crypto businesses are adapting

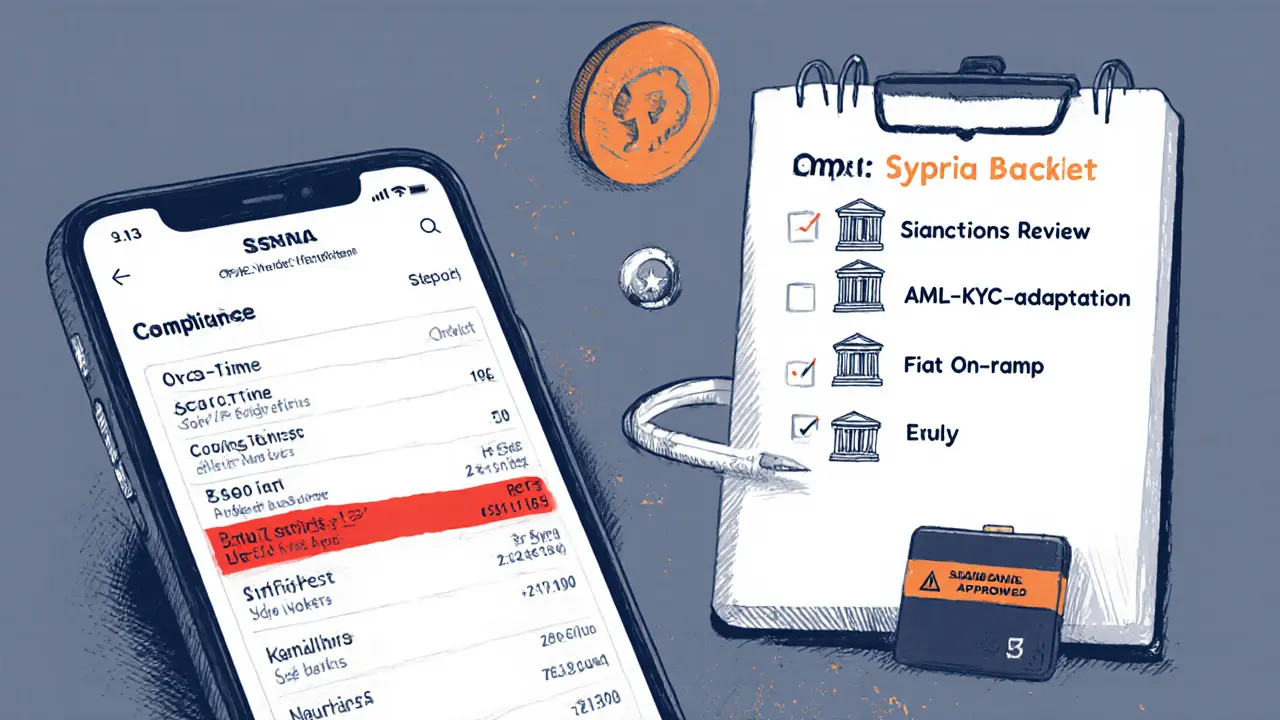

International exchanges such as Binance reopened Syrian accounts on July12025, but they quickly ran into roadblocks that are not technical but regulatory. The following checklist captures the most common compliance steps today:

| Step | What to do | Typical time frame |

|---|---|---|

| 1. Sanctions screening | Run real‑time checks against the OFAC SDN List, the EVKT List, and the 139 post‑Assad designations | 2‑3days for full integration |

| 2. Licensing review | Confirm that the activity falls under General License25 or obtain a specific BIS license for any controlled technology (e.g., mining hardware) | 1‑2weeks |

| 3. AML/KYC adaptation | Implement enhanced identity verification (video KYC, source‑of‑wealth questionnaires) for Syrian customers, as many banks require it | 1‑2weeks |

| 4. Fiat on‑ramp mapping | Partner only with the three Syrian banks that have U.S. correspondent accounts; set transaction caps at $500 | 3‑4weeks |

| 5. Monitoring & reporting | Maintain audit‑ready logs for every Syrian‑related transaction and file periodic reports to the Treasury as required | Ongoing |

Lightspark estimates the entire onboarding process now takes 14‑16weeks, almost double the 6‑8weeks needed for other emerging markets.

4. Real‑world impact on Syrian users

On the user side, the relief looks promising but is hampered by practical friction. Forum threads on r/CryptoSyria (Sept2025) highlight three recurring pain points:

- Verification hurdles: Exchanges demand video ID, proof of residence, and often a letter from a Syrian bank - documents that can take weeks to procure.

- Low transaction limits: Most platforms cap trades at $500, with some users reporting a ceiling of $200 for fiat withdrawals.

- Account instability: Approximately 30% of Syrian accounts experienced temporary freezes within the first month, usually due to automated sanctions alerts.

Trustpilot data for Binance users logging in from Syrian IPs shows an average rating of 2.8/5, with the majority of negative feedback citing “excessive verification” and “sudden account restrictions.”

Because only three of the twelve major Syrian commercial banks have active correspondent relationships with global processors, many users resort to peer‑to‑peer (P2P) markets or cross‑border remittance corridors via Lebanon and Jordan. Those workarounds carry a 22% reported loss rate, according to an informal community survey.

5. Market outlook and what could change

Chainalysis estimates that about 1.2million Syrians (roughly 6% of the population) have interacted with crypto since the sanctions lift. The bulk of activity is driven by remittances, price hedging, and buying essential goods abroad.

If Syria introduces a clear crypto legal framework - for example, licensing exchanges, defining taxable events, and setting AML standards - analysts at CoinDesk project the market could generate $420million in annual volume by 2027. Conversely, the 180‑day Caesar Act waiver, set to expire in late 2025, could be renewed or withdrawn, adding further uncertainty for long‑term investors.

Key signals to watch for:

- Legislative drafts from the Syrian Ministry of Finance outlining “digital asset service provider” registration.

- Any amendment to the BIS EAR rule expanding the limited exceptions for crypto‑related hardware.

- Renewal or expansion of the Treasury’s 180‑day waiver, which would solidify the U.S. stance on Syrian financial integration.

Until such signals materialize, crypto firms should treat Syria as a high‑risk jurisdiction, invest in robust screening tools, and keep compliance teams ready to adjust to policy shifts.

6. Practical tips for businesses and users

For crypto businesses:

- Integrate a real‑time OFAC API that includes the 139 post‑Assad designations.

- Adopt a risk‑based AML program that treats every Syrian transaction as “high‑risk” and applies enhanced monitoring.

- Maintain a whitelist of the three Syrian banks with U.S. correspondent accounts; avoid routing funds through any other local banks.

- Document every step of the licensing review to demonstrate good‑faith effort if regulators ask for proof.

For Syrian users:

- Gather official ID, utility bills, and a letter from your bank before starting KYC - it reduces back‑and‑forth with the exchange.

- Start with low‑volume trades to build a clean transaction history before attempting larger withdrawals.

- Consider using reputable P2P platforms that escrow funds, and always verify the counterparty’s reputation.

- Keep records of every crypto‑fiat conversion; future tax or audit requirements could surface as the Syrian government tightens AML rules.

7. Bottom line

The July2025 sanctions relief opened the door for crypto activity in Syria, but the door is still partly blocked by lingering designations and a complete lack of domestic regulation. Businesses can tap the market, but only if they invest in thorough sanctions screening, accept higher compliance costs, and stay ready for policy changes. Syrian users enjoy newfound access to global exchanges, yet they must navigate steep verification walls and low transaction limits. The next few months will be decisive: clear Syrian crypto laws could unleash a multi‑hundred‑million‑dollar market, while continued ambiguity will keep the space a compliance minefield.

Frequently Asked Questions

Has the U.S. completely lifted all sanctions on Syria?

No. While the blanket Syrian Sanctions Regulations were removed in July2025, 139 individuals and entities linked to the former regime remain on the OFAC SDN List, and the Caesar Act still imposes a 180‑day waiver that can be renewed or withdrawn.

Can I legally buy Bitcoin in Syria today?

There is no Syrian law explicitly permitting or forbidding crypto, so technically it is a grey area. International exchanges allow Syrian accounts, but they enforce strict KYC and transaction limits to stay compliant with U.S. sanctions.

What compliance steps must a U.S. crypto exchange take to serve Syrian users?

The exchange must (1) screen all users against the OFAC SDN and the 139 post‑Assad designations, (2) ensure any crypto‑related technology complies with the BIS EAR rule (or obtain a license), (3) apply enhanced AML/KYC procedures, (4) only use the three Syrian banks with U.S. correspondent accounts for fiat on‑ramps, and (5) keep audit‑ready records for Treasury reporting.

Why are transaction limits so low for Syrian accounts?

Low limits help exchanges mitigate the risk of accidentally processing a transaction that involves a sanctioned person or entity. They also reflect the limited fiat‑on‑ramp capacity of the three Syrian banks that have U.S. correspondent relationships.

What could trigger a new round of sanctions on Syrian crypto activity?

If the Caesar Syria Civil Protection Act waiver is not renewed, or if the U.S. identifies crypto flows funding designated terrorist groups or sanctioned entities, OFAC could re‑impose broader restrictions. Any violation of General License25 could also prompt targeted sanctions.