When Ethereum gas fees hit $70 during the 2021 NFT boom, developers and users needed a way out. The network couldn’t handle the load. That’s when sidechains and Layer 2 solutions stepped in - not as competitors, but as two very different answers to the same problem: How do we make blockchain faster and cheaper without breaking security?

What Exactly Is a Layer 2 Solution?

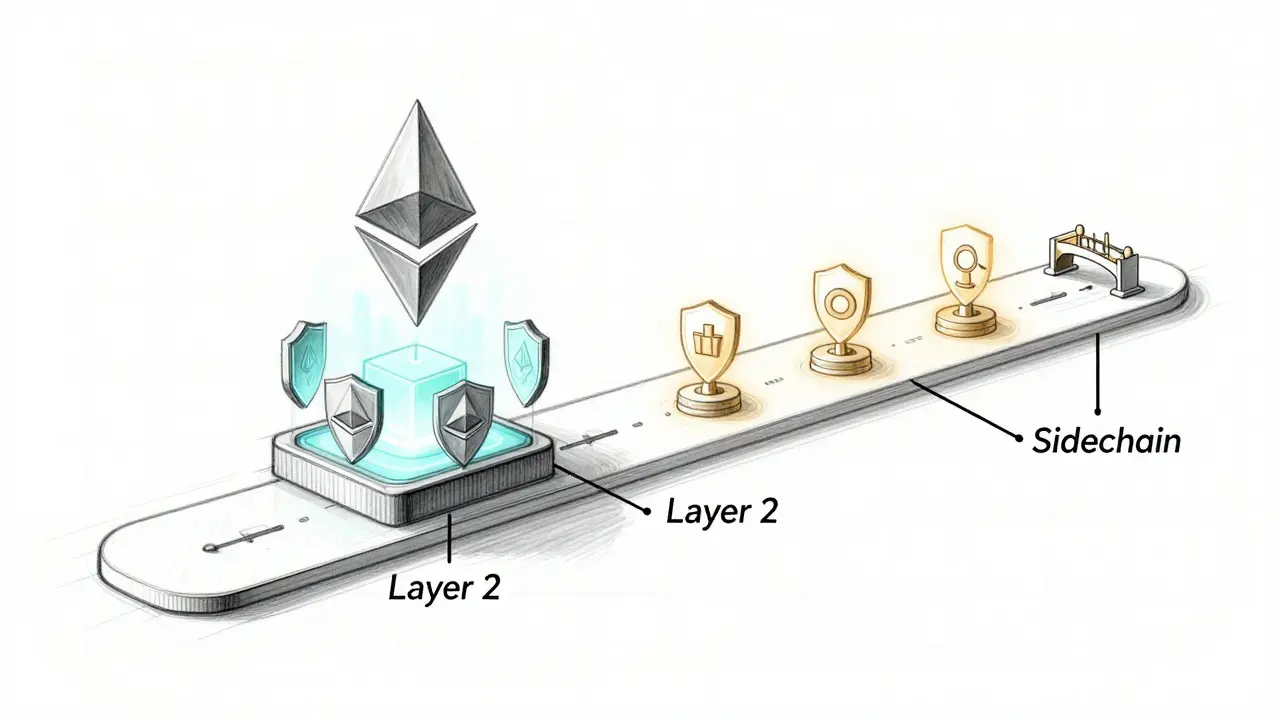

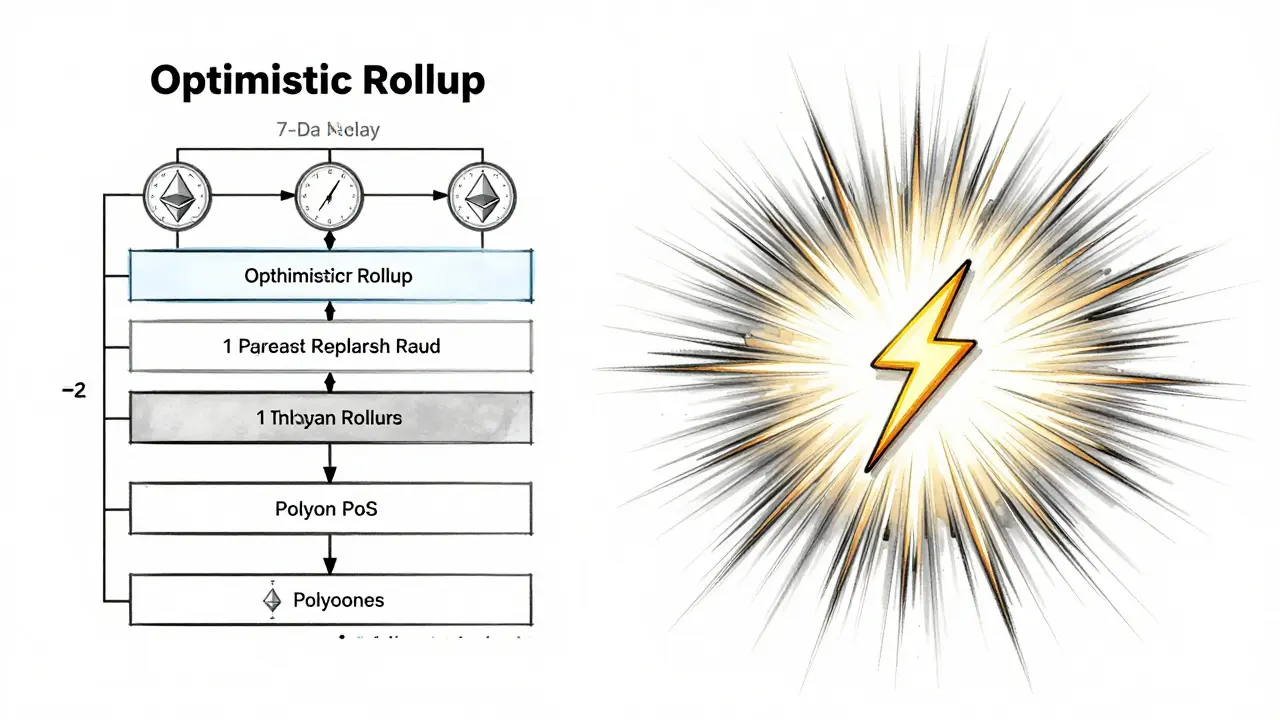

Layer 2 solutions are like adding extra checkout lanes inside a busy supermarket. They don’t rebuild the store - they just let more people move through without clogging the main entrance. These protocols run on top of Ethereum, using its security like a safety net. Every transaction gets summarized and posted back to Ethereum, so even if the Layer 2 system fails, Ethereum can step in and correct it.There are three main types: Optimistic Rollups, ZK-Rollups, and state channels. Optimistic Rollups - used by Arbitrum and Optimism - assume transactions are valid unless someone proves otherwise within a 7-day window. ZK-Rollups, like zkSync and StarkNet, use math-heavy zero-knowledge proofs to verify transactions instantly. State channels, such as the old Raiden Network, let users transact privately between each other before settling on-chain.

Because they publish data to Ethereum, Layer 2s inherit its security. As of September 2024, over $42.7 billion in value is secured across all major Layer 2 networks. Arbitrum alone holds $12.4 billion. Ethereum’s 800,000+ stakers back this system, making it extremely hard to attack.

What Is a Sidechain?

Sidechains are independent blockchains that connect to Ethereum through a two-way bridge. Think of them as separate stores that accept Ethereum money - but they run their own rules, their own validators, and their own consensus. Polygon PoS and Gnosis Chain are the biggest examples.Unlike Layer 2s, sidechains don’t rely on Ethereum to verify every transaction. Instead, they use their own Proof-of-Stake validators - Polygon has about 100, for example. That means they can process transactions faster and cheaper. Polygon PoS handles 30-40 million weekly transactions, far more than any single Layer 2. Fees are often 100-200 times lower than Ethereum’s mainnet, dropping to as little as $0.005 per transaction.

But here’s the trade-off: if Polygon’s validators get compromised, or if the bridge between Ethereum and Polygon is hacked, the damage stays on the sidechain. There’s no Ethereum safety net. The $625 million Wormhole hack in 2022 and the $600 million Harmony breach in 2022 both targeted sidechain bridges - not Layer 2s.

Security: Layer 2 Wins, But Sidechains Have Trade-Offs

Security is the biggest difference. Layer 2s are designed to be as secure as Ethereum itself. If someone tries to cheat on Arbitrum, anyone can submit a fraud proof to Ethereum and reverse the transaction. That’s why 78% of Fortune 500 companies building blockchain apps choose Layer 2s - they need the same trust level as the mainnet.Sidechains, by contrast, depend entirely on their own validator sets. Polygon PoS has 100 validators. Ethereum has over 800,000. That’s a massive difference in decentralization. Experts like Vitalik Buterin argue this makes sidechains inherently riskier. He called rollups “the present and future of Ethereum scaling” in early 2023.

But sidechains aren’t just insecure - they’re intentionally flexible. Developers can experiment with new consensus models, block times, or tokenomics without asking Ethereum’s permission. That’s why gaming and NFT platforms like Axie Infinity and The Sandbox moved to Polygon early on. They needed speed, not just security.

Speed and Cost: Sidechains Are Faster, Layer 2s Are Cheaper - But Not by Much

If raw speed is your goal, sidechains win. Polygon PoS finalizes transactions in 2-3 seconds. Layer 2s? Optimism takes about an hour (after the 7-day challenge period). Arbitrum is faster - around 10-15 minutes - but still slower than sidechains.Transaction throughput follows the same pattern. Sidechains can hit 5,000-10,000 TPS. Layer 2s max out at 2,000-4,000 TPS. That’s why sidechains dominate gaming, where every second counts.

Cost-wise, sidechains are cheaper. Layer 2s cut Ethereum fees by 5-50x - bringing costs down to $0.05-$0.50 per transaction. Sidechains drop fees even further, to $0.005-$0.02. But here’s the catch: Layer 2s are getting cheaper fast. With Ethereum’s Proto-Danksharding (launched in late 2024), Layer 2 costs are expected to fall another 80-90%. That could make sidechains’ cost advantage disappear within a year.

Interoperability and Developer Experience

Layer 2s integrate seamlessly with Ethereum. Wallets like MetaMask treat Arbitrum and Optimism like just another network. You can swap tokens, use DeFi apps, and stake ETH - all without leaving your usual interface. Smart contracts written for Ethereum usually work on Layer 2s with less than 5% code changes.Sidechains require more work. Polygon PoS uses a modified EVM. You can deploy Ethereum contracts, but you’ll need to adjust for gas limits, validator rules, and bridge behavior. Developers report it takes 4-6 weeks to get comfortable with Polygon’s setup - compared to 2-3 weeks for Layer 2s.

Documentation is better on Layer 2s too. Arbitrum and Optimism score over 95% on technical documentation completeness. Sidechains average 82%. GitHub activity reflects this: 65% of Ethereum scaling discussions happen around Layer 2 projects. There are 12,000+ active contributors to Layer 2 codebases versus 4,500 for sidechains.

Real-World Use Cases: Where Each One Shines

If you’re building DeFi - Uniswap, Aave, Compound - Layer 2 is the only real choice. Over 92% of DeFi TVL is on Layer 2s. Why? Because money moves fast, and mistakes cost millions. You can’t afford to trust a 100-validator network with your liquidity.For gaming, NFT marketplaces, and social apps? Sidechains still lead. 68% of gaming DApps run on sidechains. Why? High throughput, low fees, and instant finality matter more than Ethereum-grade security when you’re spinning up a new NFT drop or letting users trade skins in real time.

Enterprise adoption leans heavily toward Layer 2s. Gartner’s 2024 report found 78% of Fortune 500 blockchain projects use Layer 2 solutions. Regulators also treat them more favorably. The U.S. SEC’s July 2024 guidance said most Layer 2s fall under Ethereum’s existing regulatory umbrella. Sidechains? They’re often treated as separate securities offerings - meaning more compliance work.

The Future: Convergence, Not Competition

The future isn’t “Layer 2 wins” or “sidechains win.” It’s both - but in different roles.Layer 2s are becoming the backbone of Ethereum’s scaling. With SUAVE (a new shared sequencing protocol announced in July 2024), they’re starting to work together. Instead of 30+ fragmented Layer 2s, we might soon see a unified, interoperable network of rollups - all secured by Ethereum.

Sidechains are evolving too. Polygon’s AggLayer (launched June 2024) lets users move liquidity between multiple sidechains as if they were one. It’s not security inheritance - it’s liquidity aggregation. That’s a smart workaround for their biggest weakness.

Consensys predicts Layer 2s will capture 90% of Ethereum scaling by 2027. Binance Research thinks sidechains will hold onto 25-30% of the market - mostly for gaming, enterprise experimentation, and private chains.

The real winner? Users. Between these two approaches, Ethereum has gone from $70 gas fees to sub-penny transactions. That’s a revolution.

Which One Should You Use?

Ask yourself three questions:- Is security your top priority? (DeFi, institutional funds, high-value assets) → Choose Layer 2.

- Do you need speed and low cost above all? (Gaming, social apps, high-frequency NFT drops) → Sidechain might be better.

- Are you building something that might need to scale to millions of users? → Layer 2 gives you a longer runway.

If you’re just starting out, try Arbitrum or Optimism. They’re the most mature, well-documented, and secure. If you’re building a game or a social platform where users don’t care about Ethereum’s security model - and just want fast, cheap transactions - test Polygon PoS.

Don’t pick one because it’s trendy. Pick it because it fits your use case. Layer 2s aren’t perfect - bridging can be slow, and gas estimates are tricky. Sidechains aren’t unsafe - they’re just riskier. The difference isn’t black and white. It’s about trade-offs.

Are sidechains safer than Layer 2 solutions?

No. Layer 2 solutions inherit Ethereum’s security, meaning transactions can be challenged and reversed on the main chain if fraud is detected. Sidechains rely on their own validator sets, which are smaller and more centralized. If those validators are compromised, or if the bridge is hacked, funds can be lost permanently. The $625 million Wormhole hack and $600 million Harmony breach both targeted sidechain bridges - not Layer 2s.

Can I use the same wallet for both sidechains and Layer 2s?

Yes. Wallets like MetaMask, Rainbow, and Coinbase Wallet support both. You just need to add the network manually. For Layer 2s like Arbitrum or Optimism, you select them from the network list. For sidechains like Polygon PoS, you add the RPC URL and chain ID yourself. Once added, you can send ETH, tokens, and NFTs between them - but you’ll need to use a bridge to move assets from Ethereum to a sidechain.

Why are Layer 2s more expensive than sidechains?

Layer 2s aren’t inherently more expensive - they’re just not as cheap as sidechains. They publish transaction data to Ethereum, which costs gas. Even with compression, that adds up. Sidechains store everything on their own chain, so they avoid Ethereum’s gas fees entirely. That’s why sidechains can offer fees as low as $0.005, while Layer 2s typically cost $0.05-$0.50. But with Ethereum’s Proto-Danksharding upgrade, Layer 2 costs are dropping fast - possibly making sidechains’ cost advantage irrelevant soon.

Do sidechains have better performance than Layer 2s?

Yes, in raw speed and throughput. Sidechains like Polygon PoS finalize transactions in 2-3 seconds and handle 5,000-10,000 TPS. Layer 2s are slower: Optimism takes about an hour for finality, Arbitrum takes 10-15 minutes, and they max out at 2,000-4,000 TPS. But performance isn’t everything. Layer 2s sacrifice some speed for security. If you’re running a game or social app where speed matters more than absolute security, sidechains win. For DeFi or high-value transfers, Layer 2s are the better choice.

Is Polygon a Layer 2 or a sidechain?

Polygon PoS is a sidechain. It runs its own Proof-of-Stake consensus with 100 validators and stores transaction data on its own chain. It connects to Ethereum via a bridge. However, Polygon also offers Polygon zkEVM, which is a true Layer 2 ZK-rollup. So when people say "Polygon," they might mean either. Always check: if it’s Polygon PoS, it’s a sidechain. If it’s Polygon zkEVM, it’s a Layer 2.