When someone sends Bitcoin or Ethereum, it doesn’t vanish into thin air. Every transaction is permanently recorded on a public ledger - the blockchain. That means, even if you think your crypto is private, it’s not. On-chain crypto transaction tracing is how experts follow those digital footprints, step by step, to figure out where money came from and where it went. It’s not magic. It’s math, patterns, and smart tools working together.

Why On-Chain Tracing Matters

Most people assume crypto is anonymous. It’s not. It’s pseudonymous. That means your wallet address isn’t tied to your name - but every time you send or receive funds, it’s visible to anyone with the right tools. This openness is what makes tracing possible.

Law enforcement, exchanges, and banks use tracing to stop crime. In 2024, about 0.34% of all crypto transactions were linked to illegal activity, according to Chainalysis. That might sound small, but it’s still billions of dollars. Ransomware gangs, darknet market sellers, and money launderers all leave trails. Tracing helps freeze assets, identify suspects, and shut down operations.

But it’s not just about crime. Legitimate businesses use tracing too. Exchanges need to check if incoming funds are clean before allowing withdrawals. Banks monitoring crypto exposure use it to avoid regulatory fines. Even traders watch suspicious flows to avoid getting caught up in scams.

How Tracing Works: The Three Main Methods

There are three big ways experts trace crypto transactions - each with strengths and limits.

Heuristic-Based Tracing

This is the oldest and simplest method. It uses rules of thumb based on how people actually use crypto. For example: if one wallet sends small amounts to many different wallets, then those wallets send the money to a single exchange, it’s likely a “peel chain” - a common money laundering trick.

Heuristic tools look at timing, block height, and transaction size. They assume that wallets sending to the same exchange at the same time probably belong to the same person. TRM Labs found this method works with 89% accuracy on Ethereum transactions in 2024.

But it falls apart when users mix things up. If someone sends funds through multiple chains or waits days between transfers, the patterns break. Accuracy drops to 63% for cross-chain tracing.

Rule-Based Tracing

This method builds custom rules for spotting bad behavior. Analysts study past criminal transactions - like how ransomware payments move - and create detection rules. For example: if a wallet receives an unsupported token, then sends out the same amount in ETH a few minutes later, it might be a bridge swap used to launder funds.

Nansen’s 2025 analysis showed rule-based systems catch peel chains with 92% accuracy. They’re great for known patterns. But criminals adapt. If a new mixing service pops up, the rules become outdated. Analysts must constantly update them.

Graph Learning-Based Tracing

This is the most advanced method. Instead of relying on fixed rules, it uses machine learning to find hidden patterns in massive transaction networks.

Imagine a spiderweb of thousands of wallet addresses, all connected by transfers. A human can’t see the full picture. But a neural network can. It learns which clusters of addresses behave like exchanges, mixers, or scam operations - even if they’ve never been flagged before.

Merkle Science reported 85% accuracy tracing funds across 2-3 blockchains using this method in 2024. It’s powerful, but it needs huge amounts of data and computing power. Only big firms like Chainalysis or TRM Labs can afford it.

Cross-Chain Tracing: The Biggest Challenge

One of the biggest tricks criminals use today is jumping between blockchains. Send ETH → convert to BSC → move to Tron → swap to Solana. Each hop adds confusion.

Each blockchain has its own explorer, its own rules, its own tools. Tracing across chains used to mean switching between five different platforms, manually following each step. Now, platforms like TRM Labs and Nansen offer automated cross-chain tracing. They track how funds move through bridges - the services that connect blockchains.

But bridges aren’t perfect. Some use “lock-mint” systems (lock ETH on Ethereum, mint wETH on BSC). Others use swaps. If an analyst doesn’t understand the bridge type, they lose the trail.

Cryptoisac.org’s 2024 report says: “If the trail becomes too convoluted - multiple simultaneous hops or obscure chains - consider seeking expert help.” That’s because even the best tools hit walls when funds bounce through five or more networks.

Tools of the Trade

You can’t trace crypto with a spreadsheet. You need specialized tools.

- Blockchain explorers - Etherscan, BscScan, Solana Explorer - let you see raw transaction data. Free, but limited.

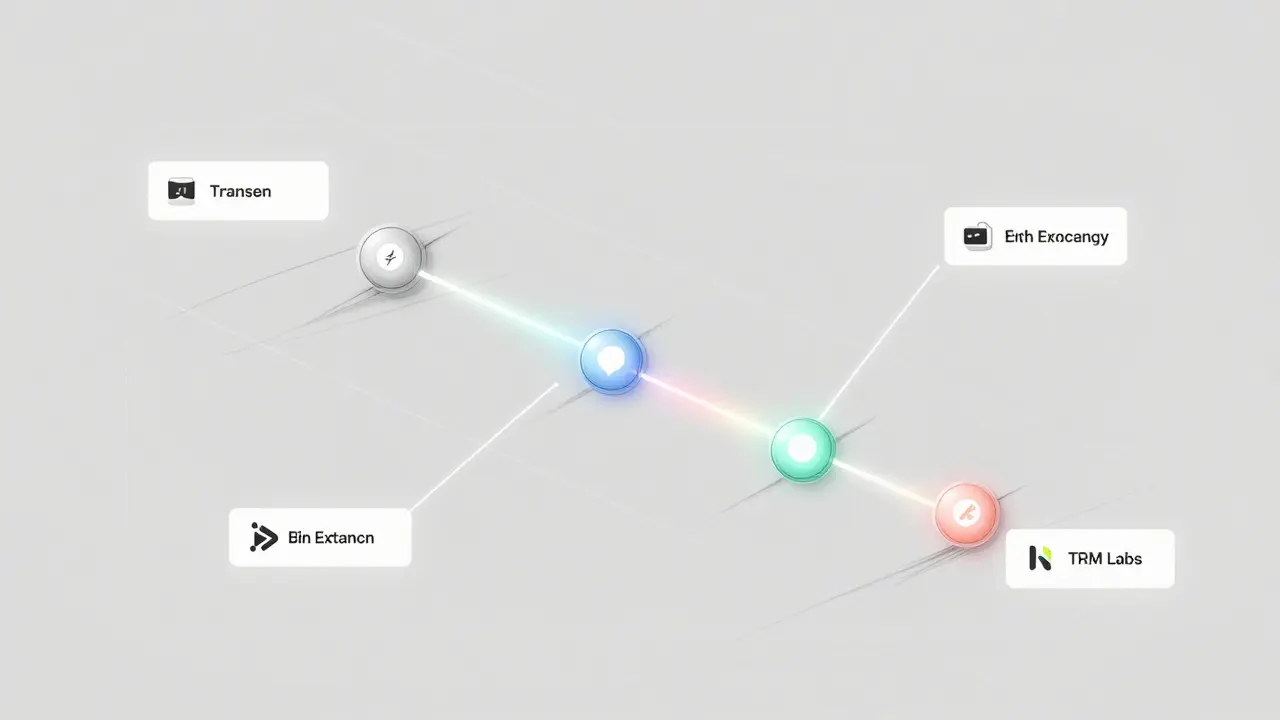

- Professional platforms - Nansen, Elliptic, TRM Labs - combine data from dozens of chains, cluster addresses, flag suspicious activity, and show fund flows in visual graphs.

- Open-source tools - BlockSci, Chainalysis Reactor - used by researchers and forensic teams for deep analysis.

These tools don’t come cheap. As of Q1 2025, a single license for a full analytics suite costs between $15,000 and $50,000 per year. Cross-chain tracing add-ons run another $27,500 annually.

Training takes time too. Arkham’s 2024 guide says analysts need 3-6 months of full-time learning to become proficient. You need to understand transaction formats, gas fees, smart contracts, and how exchanges handle deposits.

What Tracing Can’t Do

Even the best tools have limits.

First, they can’t tell you who owns a wallet. They can cluster addresses that act like one entity - say, a single exchange or a drug dealer’s operation. But linking that cluster to a real person? That requires outside evidence: KYC data from an exchange, an IP address, a confession, a seized device.

Dr. Sarah Meiklejohn from University College London puts it plainly: “The attribution problem remains fundamentally unsolved.” You can trace the money. You can’t always trace the person.

Second, privacy coins break tracing entirely. Monero and Zcash are designed to hide sender, receiver, and amount. In 2024, they made up 7.2% of all illicit crypto volume, according to CipherTrace. No current tool can trace them on-chain.

Third, decentralized mixers like Tornado Cash (now banned in the U.S.) scramble transaction links. In 2024, they were used in 18.3% of illegal crypto flows. Even graph learning struggles here - because the mixing process intentionally destroys patterns.

The Regulatory Push

Tracing didn’t grow because it’s cool. It grew because governments forced it.

The Financial Action Task Force (FATF) ruled in 2019 that crypto exchanges must track and share sender/receiver info for transfers over $1,000 - the “Travel Rule.” That turned blockchain analytics from a niche tool into a compliance necessity.

Now, the EU’s MiCA regulation and the U.S. Executive Order 14067 require exchanges to use tracing tools. As of 2025, 87% of crypto exchanges use them. Sixty-three of the top 100 global banks have adopted blockchain monitoring.

But there’s pushback. The Electronic Frontier Foundation warns that these tools can be misused to spy on ordinary users. “We must ensure these tools aren’t used to surveil legitimate financial activity,” said Jeremy Gillula in May 2024.

The tension is real: security vs. privacy. Tracing stops criminals. But it also makes every crypto user more visible.

The Future: AI and the Arms Race

Tracing is evolving fast. Researchers at MIT and Stanford are building neural networks that predict fund flows before they happen. Gartner predicts that by 2027, 70% of enterprise tools will use generative AI to detect anomalies.

TRM Labs added 15 new chains in February 2025, bringing total coverage to 47. Nansen says the next frontier is tracing across privacy networks - but that’s still science fiction today.

Meanwhile, criminals are getting smarter. New decentralized mixers, zero-knowledge protocols, and chain-hopping techniques are emerging. As David Jevans of CipherTrace says: “The tracing arms race will continue indefinitely.”

For now, tracing works - but only if you have the right tools, the right data, and the right expertise. It’s not foolproof. It’s not perfect. But it’s the best system we have.

What You Can Do

If you’re a crypto user, the best advice is simple: avoid reuse. Don’t use the same wallet for everything. Don’t send small “dust” amounts to test networks - that’s how people link your addresses. Don’t use mixers unless you understand the legal risks.

If you’re a trader, watch for sudden spikes in inflows to a token you’re holding. That could mean a scammer is dumping. If you’re a business, use a reputable analytics tool. Compliance isn’t optional anymore.

On-chain tracing isn’t going away. It’s here to stay. The question isn’t whether it works - it’s whether you understand how it works, and what it means for you.

Can you trace Bitcoin transactions to a real person?

You can trace Bitcoin to a wallet address, but not directly to a person. To link a wallet to a real identity, you need outside information - like KYC data from an exchange where the user deposited funds. Blockchain data alone doesn’t reveal names, addresses, or IDs.

Are all crypto transactions traceable?

Most are - but not all. Privacy coins like Monero and Zcash hide transaction details by design. Decentralized mixers like Tornado Cash scramble links between addresses. These make tracing extremely difficult or impossible with current tools.

How accurate is on-chain tracing?

Accuracy varies. Heuristic methods work at 89% on single chains like Ethereum. Rule-based systems catch known patterns like peel chains with 92% accuracy. Graph learning tools reach 85% accuracy across 2-3 chains. But accuracy drops sharply with cross-chain hops, privacy coins, or complex mixing.

Do I need special tools to trace crypto?

Yes. Free explorers like Etherscan show basic data, but they can’t cluster wallets, detect patterns, or trace across chains. Professional tools like Nansen, TRM Labs, or Elliptic are required for serious tracing. These cost $15,000-$50,000 per year per user.

Is on-chain tracing legal?

Yes, for law enforcement and regulated businesses. Exchanges and banks are required by law to use tracing tools to prevent money laundering. However, using these tools to spy on private individuals without cause may violate privacy laws in some countries. The legality depends on how and why the data is used.

Can I avoid being traced?

You can reduce traceability by using new wallets for each transaction, avoiding address reuse, and not interacting with known scam or mixer addresses. But you can’t fully avoid it unless you use privacy coins - and even those come with legal and liquidity risks. Complete anonymity on public blockchains is nearly impossible.