Crypto Exchange Scam Risk Calculator

Evaluate Exchange Risk

Red flags detected:

Quick Takeaways

- Negocie Coins was a Brazil‑focused exchange that let users trade only four coins against the real (BRL).

- It offered basic and premium account tiers; the premium tier required a hefty BRL 30,000 or BTC 50 minimum deposit.

- Security basics like 2FA and SSL were present, but there was no proof of rigorous audits.

- Trading volume data was missing from major trackers, a red flag that later led to a scam designation.

- By the end of 2020 the platform became inaccessible, and today it is considered defunct.

If you’ve stumbled upon the name Negocie Coins review while hunting for a Brazil‑centric crypto broker, you’re probably trying to decide whether the service is still alive, safe, or a money‑losing trap. This article pulls together the fragmented data from regulatory filings, user comments, and third‑party analyses to give you a clear picture of what Negocie Coins was, where it fell short, and why you should stay away - unless you’re studying the crypto‑exchange market history.

What Is Negocie Coins?

Negocie Coins was a Brazilian cryptocurrency exchange launched by Grupo Bitcoin Banco (GBB). The company registered under CNPJ 20.692.244/0001‑90 and operated out of Curitiba, Brazil. Its core promise was simple: let Brazilian users buy and sell a handful of major crypto assets directly with the local currency, the Brazilian Real (BRL), without needing an international platform that forces currency conversion.

Platform Features at a Glance

During its short life the exchange offered a stripped‑down set of features:

- Supported coins: Bitcoin (BTC), Litecoin (LTC), Bitcoin Cash (BCH), Bitcoin Gold (BTG). No Ethereum, no altcoins, no coin‑to‑coin pairs.

- Trading pairs: Each coin was only available against BRL (e.g., BTC/BRL, LTC/BRL).

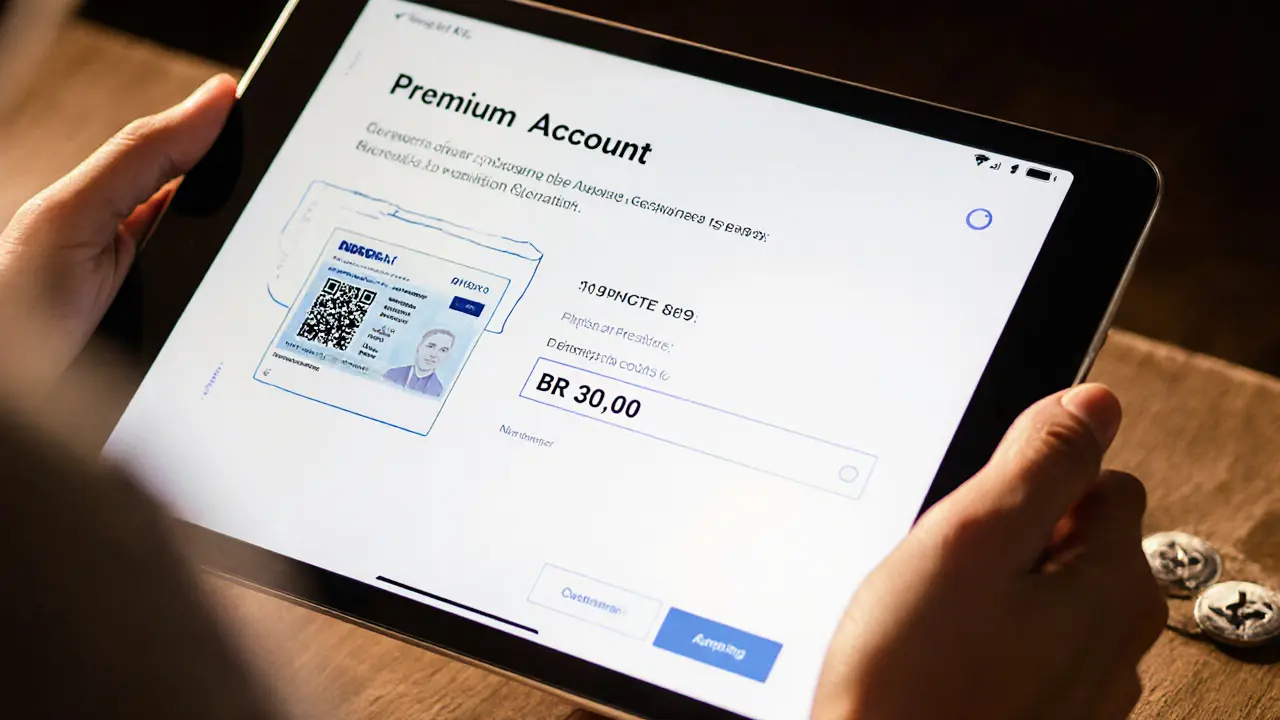

- Account tiers:

- Basic - no minimum, low daily limits.

- Premium - required a minimum deposit of BRL 30,000 or BTC 50, unlocking higher limits and faster verification.

- Deposit method: Only bank transfers in BRL. No crypto deposits, no fiat other than BRL.

- Security: SSL encryption for web traffic and optional two‑factor authentication (2FA) via authenticator apps.

Security, Compliance, and Transparency

On paper, Negocie Coins ticked a few basic security boxes. The platform used standard HTTPS encryption and allowed users to enable 2FA. However, the exchange never published a third‑party security audit, and there was no evidence of cold‑storage practices for user funds.

Regulatory compliance in Brazil tightened after the Central Bank issued Circular 3.922 in 2019, demanding clearer reporting from exchanges. While GBB claimed to be transparent, the lack of listed 24‑hour trading volume on CoinMarketCap or CoinGecko (as of March 30 2020) suggested the exchange was not meeting emerging transparency norms.

Trading Experience - What Users Actually Got

Because the offering was limited to four coins, the user experience resembled a niche fiat‑to‑crypto gateway rather than a full‑blown exchange. The BTC/BRL pair reportedly had decent liquidity, but the other three pairs suffered thin order books, leading to slippage on larger trades.

Premium accounts promised “higher limits” but also required substantial capital upfront, effectively pricing out most retail traders in Brazil. The onboarding process was straightforward: a KYC form, a Brazilian‑issued ID, and a bank‑account verification step. No advanced charting tools, no API access for bots, and no staking or lending services were offered.

Pros and Cons - A Balanced Look

| Pros | Cons |

|---|---|

| Direct BRL integration eliminates conversion fees. | Only four cryptocurrencies supported; no ETH or altcoins. |

| Simple UI suited for beginners who only want BTC‑family coins. | No coin‑to‑coin trading; limits on diversification. |

| Basic security features (SSL, optional 2FA). | Absence of publicly verified trading volume. |

| Premium tier offers higher limits for high‑net‑worth traders. | High entry barrier for premium tier (BRL 30k or BTC 50). |

| Localized customer support promised quick response. | Later marked as a scam; platform became inaccessible. |

How Does Negocie Coins Stack Up Against Other Brazilian Exchanges?

To understand whether Negocie Coins was ever a viable option, compare it with the biggest domestic players as of 2020‑2021.

| Feature | Negocie Coins | Foxbit | MercadoBitcoin | NovaDAX |

|---|---|---|---|---|

| Supported coins | BTC, LTC, BCH, BTG | BTC only (early 2020) | ~15 coins incl. ETH | ~30 coins incl. DeFi tokens |

| Fiat pairs | BRL only | BRL only | BRL, USD, EUR | BRL, USD |

| Trading volume transparency | Not listed on major aggregators | Listed on CoinMarketCap | Listed on CoinGecko | Listed on both |

| Account tiers | Basic & Premium (high minimum) | Single tier, low minimum | Multiple tiers, moderate minimum | Multiple tiers, low‑to‑high minimum |

| Security | SSL, optional 2FA | SSL, 2FA, cold‑storage | SSL, 2FA, insurance fund | SSL, 2FA, regular audits |

In short, Negocie Coins offered a marginal edge over Foxbit (extra three coins) but fell far behind MercadoBitcoin and NovaDAX in terms of asset diversity, volume visibility, and security guarantees.

Red Flags and the Scam Designation

Multiple independent sources raised alarms before the platform vanished:

- Missing volume data: Cryptowisser noted on March 30 2020 that neither CoinMarketCap nor CoinGecko reported any 24‑hour volume for Negocie Coins-a classic red flag for thin or fabricated markets.

- Rapid shutdown: By December 27 2020 Cryptowisser updated its database to label Negocie Coins as a scam, citing the inability to access the site.

- Conflicting user reviews: Cryptogeek gave the exchange a 4.3/5 rating from only nine reviews, while Revain.org posted a mixed comment that still called the platform “restricted.” The scarcity of genuine community discussion suggested a low‑traffic, possibly manipulated reputation.

- Regulatory gray area: No public filing showed the exchange complied with Brazil’s 2019 transparency requirements, which could have contributed to its removal by authorities.

All these pieces point to an operation that never achieved the scale or trust needed to survive in Brazil’s growing crypto market.

Final Verdict - Should You Use Negocie Coins?

For anyone looking to actively trade crypto today, the answer is a clear no. The exchange is offline, flagged as a scam, and lacks any verifiable audit or volume data. Even if it were still running, the narrow asset list, high premium‑tier barrier, and lack of modern features would make it unattractive compared with alternatives like Binance, Coinbase, or Brazil‑based NovaDAX.

That said, the Negocie Coins story is useful as a case study. It shows why transparency, diversified offerings, and robust security are non‑negotiable for any exchange that wants to survive regulatory scrutiny and user trust in a competitive market.

Key Takeaway Checklist

- Only four crypto assets, all paired with BRL.

- Premium tier required BRL 30k or BTC 50.

- Basic security (SSL, optional 2FA) but no public audits.

- Trading volume never listed on major trackers.

- Shut down by end‑2020; now marked a scam.

Is Negocie Coins still operational?

No. As of December 2020 the platform became inaccessible and reputable sites like Cryptowisser listed it as a scam. There are no recent listings on exchange ranking sites.

What cryptocurrencies could I trade on Negocie Coins?

Only four: Bitcoin (BTC), Litecoin (LTC), Bitcoin Cash (BCH), and Bitcoin Gold (BTG). All trades were against the Brazilian Real (BRL).

Did Negocie Coins have any security certifications?

The exchange used SSL encryption and offered optional two‑factor authentication, but it never released a third‑party audit or proof of cold‑storage for user funds.

How does Negocie Coins compare to NovaDAX?

NovaDAX supports dozens of cryptocurrencies, multiple fiat pairs (BRL, USD), and provides transparent volume data on CoinMarketCap. Negocie Coins offered only four coins, a single fiat pair, and no public volume figures, making NovaDAX a far stronger choice for most traders.

Can I still withdraw funds if I had an account?

Since the site is offline, there is no official way to retrieve funds. Users who still hold assets would need to contact Brazilian financial authorities or seek legal counsel.