By 2026, running a crypto business without proper KYC and AML systems isn’t just risky-it’s impossible. What used to be a gray area, where some exchanges turned a blind eye to user identities, is now a legal minefield. Regulators worldwide have locked down the rules, and the penalties for skipping compliance aren’t just fines-they’re shutdowns, criminal charges, and lost banking access. If you’re operating a crypto exchange, wallet service, DeFi gateway, or even a stablecoin issuer, you need to understand exactly what’s required-and where.

What KYC and AML Actually Mean for Crypto

KYC stands for Know Your Customer. In crypto, that means verifying who your users are before they can trade, deposit, or withdraw. This isn’t just asking for an email. It’s collecting government-issued ID, proof of address, and sometimes even a selfie holding the document. AML, or Anti-Money Laundering, is the system that watches transactions for signs of fraud, drug trafficking, sanctions evasion, or terrorist financing. Together, they form the backbone of legal crypto operations today.The shift started with the Financial Action Task Force (FATF), the global watchdog for financial crime. In 2019, they updated Recommendation 15 to make it clear: crypto companies are financial institutions. That meant they had to follow the same rules as banks. By 2025, every major country had adopted these standards. If you’re not doing KYC and AML, you’re not just breaking the rules-you’re operating illegally.

The FATF Travel Rule: The Game Changer

The most impactful rule in crypto compliance is the FATF Travel Rule. It doesn’t just apply to banks anymore-it applies to every crypto platform that moves money. Here’s what it demands: when a user sends more than $1,000 worth of crypto, the sender’s name, account number, and address must be sent along with the transaction. The receiver’s info must also be collected and verified.This used to be ignored by most DeFi platforms and peer-to-peer wallets. Now, if you’re a VASP (Virtual Asset Service Provider), you’re legally required to capture and store that data. That includes centralized exchanges, custodial wallets, and even some DeFi bridges that act as on-ramps. Blockchain analytics firms like Chainalysis and Elliptic now work directly with regulators to trace these flows. Missing one piece of data? You could be flagged for non-compliance.

How Different Countries Handle It

There’s no single global rulebook, but most major economies are aligned on the basics. Here’s how the biggest players are enforcing it:- United States: The GENIUS Act (passed June 2025) and STABLE Act now require stablecoin issuers to register as money transmitters. Every user must be KYC’d. The FinCEN has increased audits and fined firms like Binance and Kraken over $1 billion combined for past failures. The IRS now cross-references crypto transaction data with tax returns.

- European Union: MiCAR, fully active since December 2024, forces all crypto asset issuers and service providers to meet strict AML standards. The new Anti-Money Laundering Authority (AMLA) in Frankfurt now monitors compliance across all 27 member states. No more loopholes-each country must enforce the same rules.

- United Kingdom: The FCA requires all crypto firms to register and submit detailed AML policies. The UK also enforces the Register of Overseas Entities, which now publicly lists beneficial owners of crypto holdings held through offshore trusts. Whistleblower protections were strengthened in June 2025, meaning insiders can report non-compliance without fear of retaliation.

- Japan: The Financial Services Agency (FSA) requires all exchanges to use certified KYC providers and report all transactions over ¥1 million. Non-compliant platforms are removed from the official registry, making it impossible to operate legally.

- Singapore and Australia: Both have adopted FATF standards with zero tolerance. Singapore’s MAS requires real-time transaction monitoring, while Australia’s AUSTRAC conducts random audits and has frozen assets of non-compliant firms.

Even countries with looser regulations, like the UAE and Switzerland, now require registration and basic KYC. If you’re targeting global users, you’re not choosing your compliance level-you’re choosing which set of rules to follow.

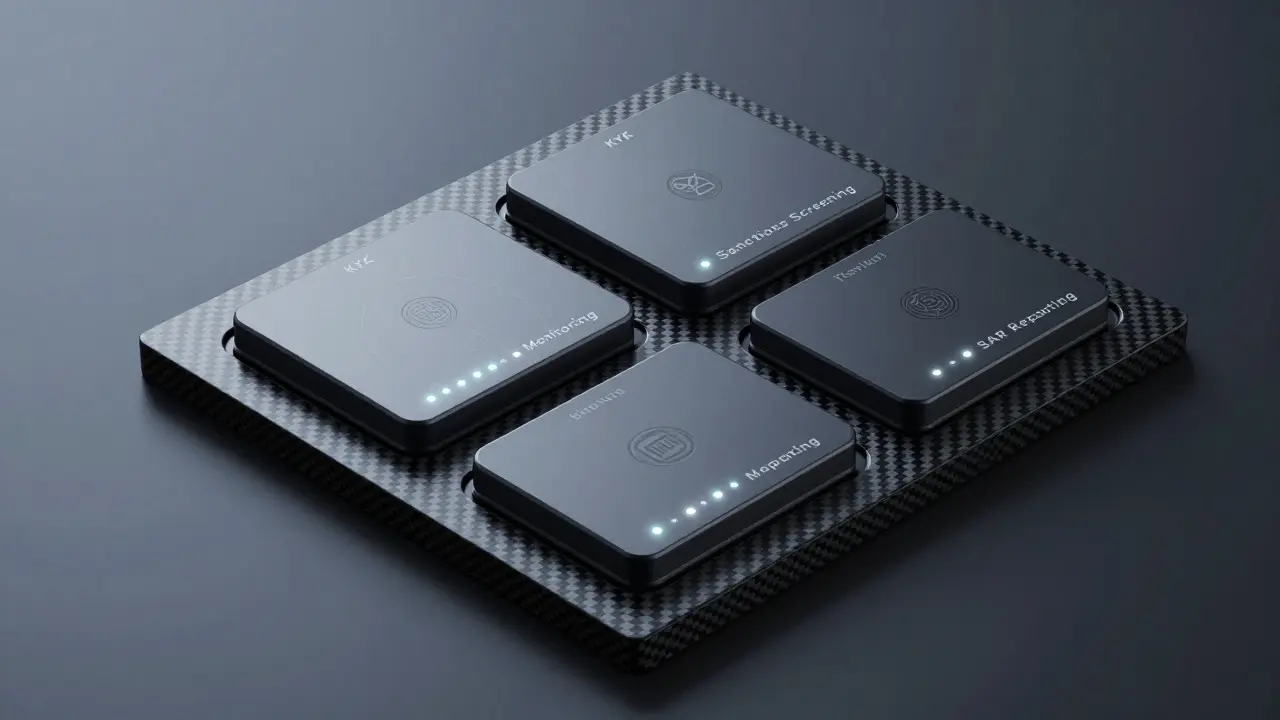

What Your System Needs to Run Legally

You can’t just hire someone to manually check IDs anymore. At scale, you need automated, AI-driven systems. Here’s what works in 2026:- Automated KYC Onboarding: Tools like Jumio, Onfido, or KYC-Chain verify IDs in seconds using facial recognition and document authenticity checks. They flag fake IDs, stolen documents, and synthetic identities.

- Transaction Monitoring (KYT): Real-time systems scan every transaction against global sanctions lists, high-risk wallets, and darknet addresses. If a user sends funds to a wallet linked to ransomware, the system freezes the transfer and flags it.

- Sanctions Screening: The U.S. Treasury’s OFAC list changes daily. Your system must update in real time. Missing a new sanction? You could be fined $10 million overnight.

- Record Keeping: All KYC data, transaction logs, and alerts must be stored for at least five years. Cloud storage isn’t enough-you need encrypted, auditable archives.

- Suspicious Activity Reporting (SAR): If something looks off, you must file a report with your country’s financial intelligence unit. In the U.S., that’s FinCEN. In the UK, it’s the NCA. Delayed or missing reports are treated as criminal negligence.

Most successful crypto firms now use integrated platforms like ComplyAdvantage or Trulioo that bundle all these tools. The cost? Around $50,000 to $200,000 per year for mid-sized operations. But skipping it? That could cost you millions in fines-or your entire business.

Why Compliance Isn’t Just a Cost-It’s a Competitive Edge

Many crypto startups still see KYC and AML as a barrier to growth. That’s a mistake. In 2026, compliance is the fastest way to build trust. Banks won’t work with you without it. Institutional investors won’t touch you without it. Even users are starting to prefer platforms that show their compliance badges.Look at Coinbase and Kraken. They don’t just comply-they advertise it. Their websites have clear sections on security and regulation. That’s why they’re the go-to for pension funds and family offices. Meanwhile, platforms that dodged rules are either shut down, operating offshore with no banking access, or stuck in legal limbo.

Compliance also unlocks new markets. In the EU, MiCAR allows compliant firms to offer services across all 27 countries with one license. That’s a massive advantage over smaller players who still operate country-by-country.

What Happens If You Don’t Comply

The consequences aren’t theoretical. In 2025, the U.S. fined Binance $4.3 billion for failing to implement AML controls. The UK shut down a crypto firm for using fake KYC software. South Korea arrested the CEO of a local exchange for laundering over $100 million in stolen crypto.It’s not just about money. Your personal assets can be seized. Your employees can face jail time. Your reputation? Gone. Once you’re on a regulator’s watchlist, no bank will touch you. No payment processor will work with you. No investor will fund you.

And the crackdown is getting worse. Regulators now use AI to scan social media, forums, and dark web markets to find unregistered platforms. If you’re advertising services without KYC, you’re already on their radar.

The Future: Global Harmonization Is Coming

The good news? The chaos is ending. In 2025, FATF launched its first global compliance audit program, sending teams to review how countries enforce the rules. Countries that lag behind are being publicly named. That pressure is forcing even the most resistant nations to act.By 2027, we’ll likely see a global standard for crypto compliance-similar to how banking works today. That means less confusion for businesses, fewer loopholes for bad actors, and more stability for users.

For anyone building or running a crypto business today, the message is clear: build compliance into your product from day one. Don’t wait for a regulator to knock on your door. Don’t assume you’ll get a grace period. The Wild West is over. The rulebook is open. And everyone’s watching.

Do I need KYC if I run a personal crypto wallet?

No-if you’re just storing crypto for yourself and never exchanging it, trading it, or letting others use your wallet, you don’t need KYC. But if you operate a wallet service that lets others deposit, withdraw, or trade crypto, you’re a VASP and must comply. The line is in the function, not the technology.

Can I use one KYC system for all countries?

Not fully. While tools like KYC-Chain or Jumio support global ID verification, each country has its own data privacy rules. The EU requires GDPR-compliant storage. Japan demands local data centers. The U.S. requires specific document types. You need a platform that can adapt to local laws, not just one-size-fits-all software.

What if my users are in countries with no crypto regulations?

You still need to comply with the rules of your own jurisdiction. If your company is based in the U.S. or EU, you must follow their laws regardless of where your users live. Ignoring your home country’s rules because users are overseas is a common mistake-and a fast track to fines.

Are DeFi platforms required to do KYC?

Yes-if they act as a VASP. That means if your DeFi platform offers on-ramps, off-ramps, or custody services, you’re legally required to implement KYC and the Travel Rule. Pure peer-to-peer protocols without intermediaries are still unregulated, but any platform that holds user funds or facilitates trades on behalf of users is fair game for regulators.

How often do KYC requirements change?

Constantly. Sanctions lists update daily. New ID fraud techniques emerge weekly. Regulatory bodies release guidance every quarter. You need a compliance system that auto-updates and alerts you to changes. Manual reviews won’t keep up.