Market Cycle Identifier

This tool helps you determine which phase of the market cycle we're currently in by analyzing key indicators. Knowing the phase allows you to adjust your investment strategy accordingly.

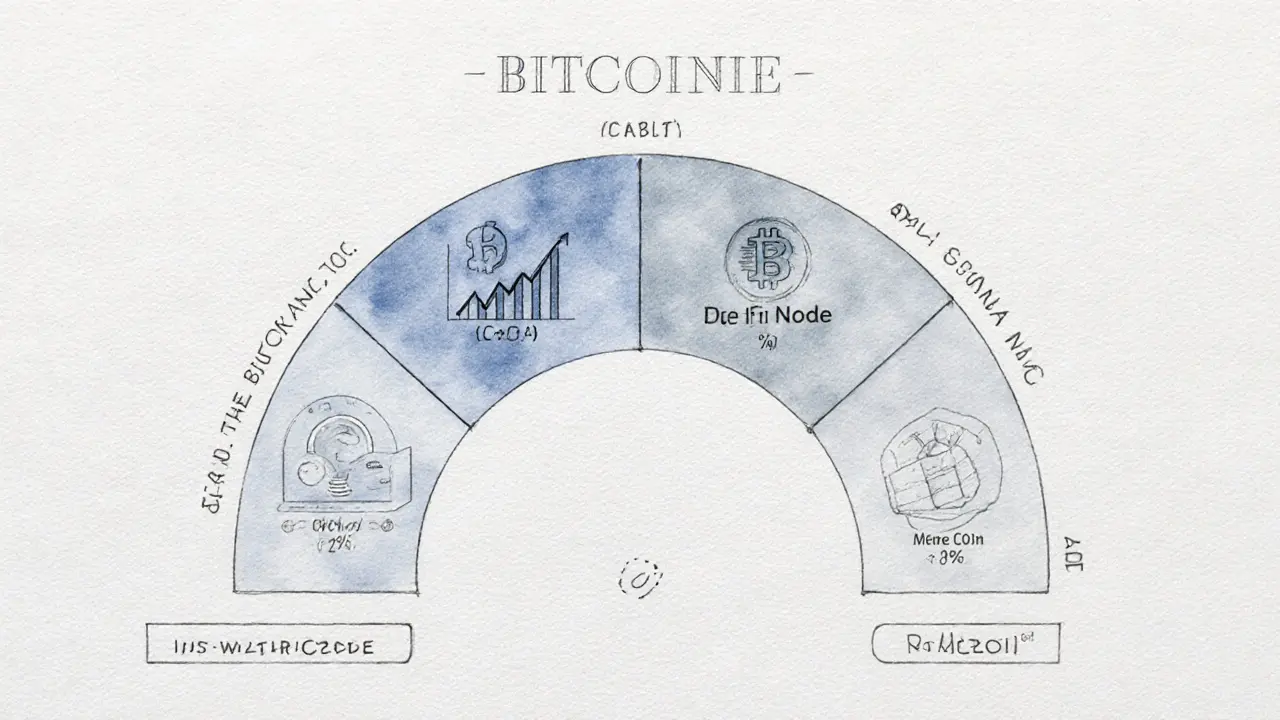

Identify Current Market Phase

Market Phase Analysis

Unknown

Early Cycle

Characteristics: Bitcoin at $20K-$30K after major drop. Fear high, volume low. Smart money accumulating.

Recommended Strategy: Invest 50-60% in Bitcoin & Ethereum. 20-30% in mid-cap altcoins with strong fundamentals. Use dollar-cost averaging.

Mid Cycle

Characteristics: Bitcoin rising, altcoins catching up. Strong volume, positive sentiment. Economic data improving.

Recommended Strategy: Rebalance portfolio. Take profits on top performers. Lock in gains on altcoins. Reinvest in projects with real adoption.

Late Cycle

Characteristics: Prices stretched, FOMO high. Rising rates, inflation concerns. New meme tokens hitting massive caps.

Recommended Strategy: Reduce altcoin exposure to 10-15%. Increase Bitcoin allocation to 70%+. Hold stablecoins for liquidity. Avoid leverage.

Trough

Characteristics: Bitcoin stable near support levels. Volume low, news negative. Smart money quietly accumulating.

Recommended Strategy: Be patient. Wait for recovery signs. Buy quality projects in tranches. Focus on audited code and strong teams.

When the crypto market crashes and everyone panics, it’s not always because something broke. More often, it’s because the market cycle shifted - and most investors didn’t see it coming. The same thing happened in 2018, 2022, and even in 2020 during the pandemic sell-off. Whether you’re holding Bitcoin, Ethereum, or a portfolio of altcoins, your strategy needs to change depending on where we are in the cycle. This isn’t about guessing the future. It’s about recognizing patterns, adjusting your exposure, and protecting your capital when it matters most.

Understanding the Four Phases of a Market Cycle

Markets don’t move in a straight line. They breathe. They expand. They contract. And they recover. The four phases - early cycle, mid-cycle, late cycle, and trough - repeat across stocks, bonds, real estate, and yes, crypto. Each phase has its own behavior, and knowing which one you’re in helps you decide what to buy, hold, or sell.Early cycle is when things start turning around. After a crash, prices are low, fear is high, and most people are still scared to jump back in. That’s when smart investors start buying. In crypto, this phase often follows a 60-80% drop from the peak. Bitcoin might be trading near $20K after hitting $68K. Volume is low, but whales and institutional players are quietly accumulating. This is the time to build positions in strong projects with real use cases - not hype coins.

Mid-cycle is when growth kicks in. Economic data improves, inflation cools, and confidence returns. In crypto, this means more retail investors jump in, exchanges see record trading volumes, and DeFi protocols start growing again. This is the phase where Bitcoin and Ethereum lead the charge. But it’s also when riskier altcoins start to pop. You don’t need to chase every one - focus on projects with strong fundamentals, active development, and growing user bases.

Late cycle is when things get stretched. Prices rise fast, FOMO kicks in, and everyone’s talking about making a quick buck. Crypto memes surge. New tokens with no code or team hit $100M market caps overnight. This is the danger zone. Interest rates are rising, inflation might be creeping back, and central banks are tightening. In 2021, this was when Solana, Shiba Inu, and other high-beta assets exploded - then crashed hard in 2022. If you’re in this phase, it’s time to take profits, reduce leverage, and start moving some capital into safer assets.

Trough is the bottom. This is when the market stops falling. Volume dries up. News is all negative. But behind the scenes, smart money is buying. In crypto, this often means Bitcoin holding support near key levels like $25K or $30K, while major exchanges report steady wallet growth. This is when value investing pays off. Look for projects that survived the crash, kept building, and now trade at a fraction of their peak valuation.

How Asset Classes Perform in Each Phase

Different assets behave differently in each cycle phase. In traditional markets, bonds do well during recessions. Stocks thrive in expansion. Crypto follows similar logic - but with more volatility.Early cycle: High-risk, high-reward assets outperform. In crypto, this means mid-cap altcoins with strong fundamentals - think Chainlink, Polkadot, or Avalanche. Bitcoin leads the recovery. In traditional markets, small-cap stocks and cyclical sectors like tech and industrials bounce back first.

Mid-cycle: Broad market strength. Bitcoin and Ethereum continue to lead. Blue-chip DeFi tokens like Aave and Uniswap see steady growth. In stocks, growth stocks like NVIDIA or Microsoft shine. This is the time to hold your core positions and let compounding work.

Late cycle: Inflation and rising rates hurt growth assets. Crypto’s high-yield DeFi protocols see capital flight as rates rise. Stablecoins and stable assets become more attractive. In traditional markets, commodities like gold and oil rise. TIPS (Treasury Inflation-Protected Securities) and dividend stocks outperform. In crypto, consider holding Bitcoin as a digital store of value - it’s become the closest thing to digital gold.

Trough: Defensive assets win. Stablecoins like USDC and DAI see inflows. Bitcoin holds its value better than altcoins. Utility tokens and infrastructure projects - like those building Layer 2s or oracle networks - start gaining traction again. This is the time to buy quality at a discount, not chase the next 100x meme coin.

Proven Strategies for Each Phase

You don’t need to predict the future. You just need a plan for each phase.Early cycle: Start with a core holding. Allocate 50-60% of your portfolio to Bitcoin and Ethereum. Use dollar-cost averaging - invest a fixed amount every month, regardless of price. This smooths out volatility. Then, allocate 20-30% to mid-cap altcoins with strong fundamentals. Keep 10-20% in cash or stablecoins to deploy when opportunities arise.

Mid-cycle: Rebalance. Take some profits off the table on your top performers. Lock in gains on altcoins that have doubled or tripled. Reinvest into projects with real adoption - not just price action. Consider staking ETH or other PoS tokens to earn yield. Keep your core positions intact. Avoid overexposure to speculative tokens.

Late cycle: Shift toward safety. Reduce altcoin exposure to 10-15%. Increase Bitcoin allocation to 70% or more. Hold stablecoins for liquidity. Consider allocating 5-10% to gold-backed tokens or tokenized Treasuries if available. Avoid leverage. Stop chasing new launches. This is the time to protect capital, not chase returns.

Trough: Be patient. Don’t rush to buy everything. Wait for signs of recovery - rising on-chain activity, increasing wallet addresses, and institutional interest returning. When you do buy, focus on projects with strong teams, audited code, and clear roadmaps. Buy in tranches - don’t put all your cash in at once. This reduces the risk of buying too early.

What Doesn’t Work

Trying to time the exact top or bottom is a fool’s game. Even the best analysts get it wrong. In 2021, many called the crypto peak. In 2022, many said Bitcoin would never recover $20K. Both were wrong.Another mistake? Moving entirely to cash during downturns. You lock in losses. You miss the recovery. Bitcoin rose 150% in 2023 after hitting $16K in late 2022. If you sold at the bottom, you lost that gain.

And don’t ignore fundamentals. Just because a token is cheap doesn’t mean it’s a good buy. Many projects died in the last cycle. Their tokens are now worthless. Always ask: Does this project still have a team? Is it being used? Is there real demand?

Long-Term Discipline Beats Timing

The most successful investors don’t try to predict cycles. They build systems that work across them.Dollar-cost averaging works because it forces you to buy low and sell high - without emotion. If you invest $100 every month, you’ll buy more coins when prices are low and fewer when they’re high. Over time, your average cost drops.

Diversification matters too. A portfolio with 60% Bitcoin, 30% Ethereum, and 10% stablecoins has historically had 40% less volatility than a 100% crypto portfolio - while keeping most of the returns.

And remember: over the long term, crypto markets trend upward. Bitcoin has delivered an average annual return of over 120% since 2010. That’s not because every year was up. It’s because the winners outweighed the losers - and disciplined investors stayed in.

How to Know Where We Are Right Now

You don’t need a PhD in economics to tell which phase we’re in. Look at these simple signals:- Price action: Is Bitcoin breaking new highs? Or stuck in a range after a big drop?

- On-chain data: Are active wallets rising? Is network activity growing? (Check Glassnode or CryptoQuant)

- Market sentiment: Are people talking about getting rich? Or are they afraid to invest?

- Macro trends: Are interest rates rising or falling? Is inflation cooling?

If Bitcoin is rising, altcoins are catching up, and new projects are launching daily - you’re likely in mid-cycle. If prices are flat, volume is low, and everyone’s quiet - you might be in the trough. If everyone’s talking about 10x returns and meme coins are exploding - you’re probably in late cycle.

Don’t rely on one signal. Look at the pattern.

What to Do Next

Start by reviewing your portfolio. Ask yourself:- What phase am I in?

- Am I overexposed to risky assets?

- Do I have enough liquidity to buy when others are scared?

- Am I holding assets that still have real value - or just hype?

Then adjust. Not dramatically. Just enough. Maybe shift 5-10% from altcoins to Bitcoin. Maybe move 10% to stablecoins. That’s it. You don’t need to overhaul your portfolio. You just need to align it with the cycle.

Markets will keep cycling. Crashes will happen. Booms will follow. The goal isn’t to avoid the downturns. It’s to survive them - and come out stronger.

How do I know if we’re in a crypto bull or bear market?

A bull market is marked by rising prices, growing adoption, and strong investor confidence. Bitcoin typically breaks previous all-time highs, altcoins surge, and new projects attract funding. A bear market shows falling prices, low volume, and fear. Wallets shrink, trading slows, and many projects pause development. The key is duration - bull markets last 12-24 months, bear markets 18-36 months. Look at Bitcoin’s price trend over 6-12 months, not daily swings.

Should I sell my crypto during a market downturn?

Only if you need the cash right now. Selling during a downturn locks in your losses. History shows that crypto markets recover - often strongly. Bitcoin fell 80% in 2018 and rose 1,000% by 2021. If you believe in the long-term potential of your holdings, holding through the downturn is usually the better move. Use downturns to buy more at lower prices, not to panic-sell.

What’s the best asset to hold during a crypto recession?

Bitcoin is the safest bet. It’s the most liquid, widely held, and recognized crypto asset. During the 2022 bear market, Bitcoin lost less than 70% of its value, while many altcoins lost 90%+. Stablecoins like USDC and DAI also perform well - they preserve value and give you cash to buy when prices drop. Avoid low-cap altcoins with no real use case - they’re the first to collapse.

Can I use dollar-cost averaging in crypto?

Yes - and it’s one of the most effective strategies. By investing a fixed amount regularly - say $50 every week - you buy more when prices are low and less when they’re high. This lowers your average cost over time. In 2022, investors who DCA’d into Bitcoin averaged around $28K per coin. By mid-2023, that same coin was worth over $35K. DCA removes emotion and works across all market cycles.

How often should I rebalance my crypto portfolio?

Every 3-6 months is ideal. Rebalancing means adjusting your allocations to stay aligned with your target. For example, if Bitcoin grew from 50% to 70% of your portfolio during a rally, sell 10-15% to bring it back to 50%. Use the proceeds to buy other assets or hold in stablecoins. This forces you to sell high and buy low - without trying to time the market.