Bolivia Crypto Savings Calculator

Protect Your Savings From Inflation

Bolivia's inflation rate is 8% annually. If you hold your money in Bolivian Boliviano (BOB), you lose value over time. Stablecoins like USDT maintain value because they're pegged to the U.S. dollar. This calculator shows how much you could save.

Why this matters: With the crypto ban lifted in Bolivia, stablecoins offer a way to protect your savings from Bolivia's currency devaluation.

Your Results

For over a decade, Bolivia was one of the few countries in the world where buying, selling, or even holding cryptocurrency was illegal. The Central Bank of Bolivia banned digital assets in 2014, calling them a threat to financial stability. By 2020, the ban was reinforced again - banks couldn’t process crypto transactions, exchanges were shut down, and people who tried to use Bitcoin or Ethereum risked fines or legal trouble.

But everything changed on June 26, 2024. Bolivia didn’t just loosen its rules - it flipped them entirely. Resolution No. 82/2024 officially lifted the ban. Suddenly, what was once a criminal act became a legal financial tool. And by 2025, Bolivia became one of the fastest-growing crypto markets in Latin America.

Why Did Bolivia Change Its Mind?

The answer isn’t ideology. It’s survival.

Bolivia’s economy had been crumbling under inflation and a lack of U.S. dollars. The local currency, the boliviano, lost value fast. People couldn’t buy imports, pay for medicine, or send money abroad. Banks were slow, expensive, and often inaccessible in rural areas. Meanwhile, neighboring countries like Argentina and Venezuela were turning to crypto as a lifeline.

By early 2024, the government realized it couldn’t stop people from using crypto - they already were, secretly, through peer-to-peer trades and foreign platforms. So instead of fighting it, Bolivia decided to get ahead of it. The Central Bank began testing USD-pegged stablecoins for cross-border payments. Within months, they were using them to pay for food imports and remittances from Bolivians living abroad.

What’s Legal Now?

As of 2025, owning, trading, and using cryptocurrency is completely legal in Bolivia - as long as you follow the new rules.

- You can buy Bitcoin, Ethereum, and other coins on international exchanges like Binance or Kraken.

- You can hold stablecoins like USDT or USDC as a store of value - many Bolivians now use them instead of keeping cash at home.

- You can send crypto to family members overseas without going through banks.

- You can trade crypto on peer-to-peer platforms like Paxful or LocalBitcoins.

The only restrictions left are on state-run companies. In May 2025, YPFB - Bolivia’s state oil company - tried to use crypto to pay for fuel imports. The government blocked it. That’s not a crypto ban. It’s a rule saying the state won’t use digital assets for official procurement... yet.

How Do Bolivians Actually Buy Crypto?

There’s no local exchange yet. No Bolivian-based app lets you buy Bitcoin with a debit card. So how do people do it?

Most use peer-to-peer (P2P) platforms. These sites connect buyers and sellers directly. A Bolivian might find someone in Colombia or Peru willing to sell USDT in exchange for cash deposited into their local bank account. The buyer sends the cash, the seller releases the crypto. It’s fast, simple, and doesn’t need a bank to approve the transaction.

Many use mobile money apps like Tigo Money or Movil Cash to transfer cash quickly. Others meet in person at cafes or markets - cash for crypto, no middleman. Some even use WhatsApp groups to coordinate trades.

For those with access to foreign bank accounts (often through family abroad), wire transfers to exchanges like Binance or Coinbase are common. The exchange sends crypto directly to their wallet.

Stablecoins are the most popular choice. Why? Because they’re tied to the U.S. dollar. In a country where inflation hits 8% annually and the boliviano keeps dropping, holding USDT is like keeping your savings in a vault that doesn’t lose value.

What About Banks?

Banks still don’t offer crypto services. But they’re not blocking transfers anymore. As long as the transaction looks like a normal payment - say, $500 sent to a foreign P2P seller - banks don’t flag it. The Central Bank has told financial institutions not to interfere with crypto-related transfers unless there’s clear evidence of fraud.

That’s a big shift. Before 2024, any crypto-linked payment would trigger an automatic freeze. Now, it’s treated like any other international transfer.

How Is the Government Supporting This?

Bolivia didn’t just remove a ban - it built a system around crypto.

In April 2025, Resolution No. 019/2025 recognized virtual asset service providers (VASPs) for the first time. That means if a company wants to offer crypto services in Bolivia, they can now apply for a license. No one has yet, but the door is open.

In May 2025, Supreme Decree No. 5384 gave the Central Bank full authority to regulate crypto. This includes anti-money laundering rules, know-your-customer checks, and reporting requirements for large transactions. It’s not perfect - but it’s real regulation, not just a ban.

The Central Bank also started public education campaigns. Billboards in La Paz and Santa Cruz now explain: "What is Bitcoin?" "Is crypto safe?" "How to avoid scams." They even released a free 10-minute video course on YouTube in Spanish.

What’s Next for Bolivia?

By October 1, 2025, crypto trading activity in Bolivia had jumped more than 500% compared to 2024. That’s one of the highest growth rates in the world.

Bolivia is now working with El Salvador - the only country in the world where Bitcoin is legal tender. They signed a long-term agreement to share tech, training, and regulatory tools. El Salvador helped Bolivia design its licensing system. In return, Bolivia is testing blockchain for land registry records.

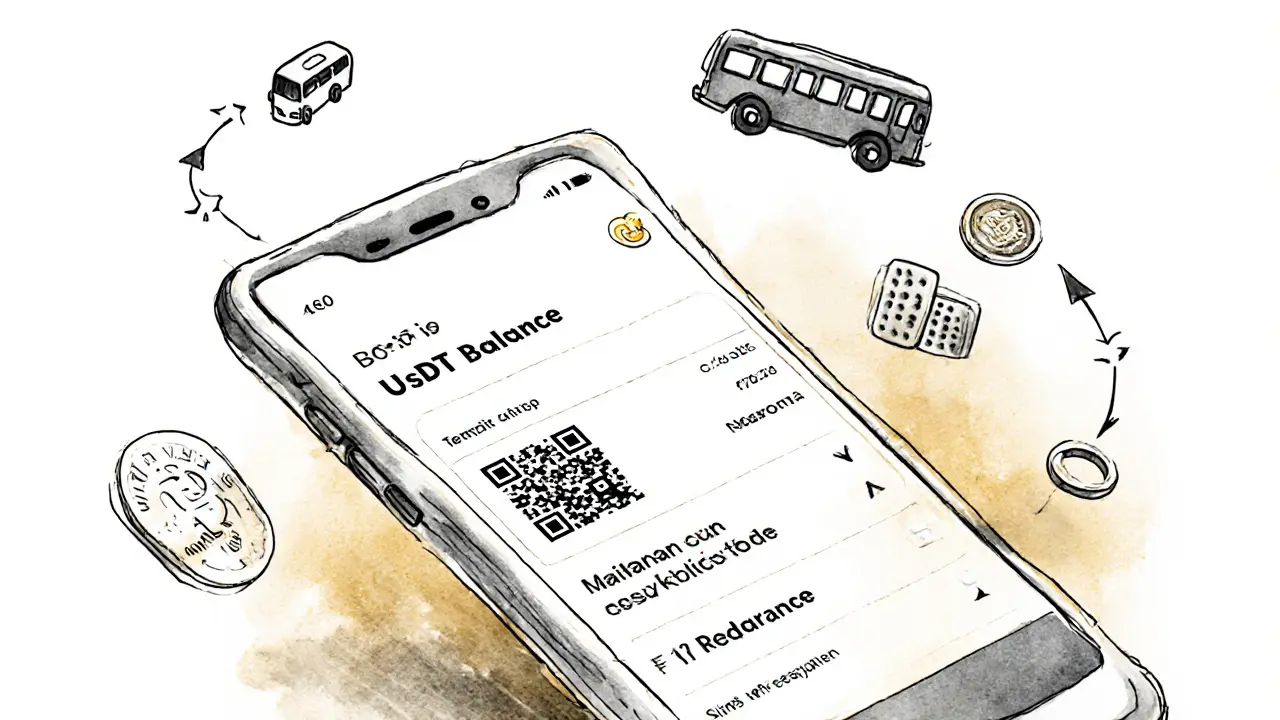

Next up? A national digital wallet for crypto payments. A pilot program is already running in Cochabamba, letting people pay for public transit and municipal services with USDT. If it works, it could roll out nationwide by 2026.

One thing’s clear: Bolivia isn’t just accepting crypto. It’s building its future around it.

What Should New Users Do?

If you’re in Bolivia and want to start with crypto, here’s how to do it safely:

- Get a non-custodial wallet - like Trust Wallet or Exodus. Don’t leave crypto on an exchange.

- Use P2P platforms like Paxful or Binance P2P. Filter for sellers with high ratings and verified ID.

- Start with stablecoins. USDT or USDC are your safest bet.

- Never send money to someone you don’t know. Always use escrow.

- Watch for scams. If someone promises 100% returns, it’s fake.

The government is watching. If you follow the rules, you’re protected. If you ignore them, you’re on your own.

Is Bolivia Still Banning Crypto?

No. Not anymore.

The ban is gone. The laws are written. The infrastructure is being built. People are using crypto every day - not because they’re breaking the law, but because it’s now the smartest way to protect their money.

Bolivia didn’t just reverse a policy. It rewrote its financial future. And it’s doing it faster than almost any country in history.

Is it still illegal to use crypto in Bolivia?

No. Bolivia lifted its cryptocurrency ban on June 26, 2024. Since then, owning, trading, and using crypto - including stablecoins like USDT - is completely legal. The Central Bank now regulates the sector under new laws passed in 2025.

Can I buy Bitcoin in Bolivia with my bank card?

Not directly through banks. Bolivian banks don’t offer crypto purchases. But you can buy Bitcoin and other cryptocurrencies using peer-to-peer platforms like Paxful or Binance P2P, where you pay with cash deposits or mobile money apps.

What’s the most popular crypto in Bolivia?

Stablecoins, especially USDT (Tether), are the most popular. Because they’re pegged to the U.S. dollar, they help Bolivians protect their savings from inflation and currency devaluation. Bitcoin and Ethereum are also traded, but mostly as long-term holds.

Are crypto exchanges allowed in Bolivia?

No local exchanges operate yet, but foreign exchanges like Binance and Kraken are accessible. In 2025, Bolivia began licensing virtual asset service providers (VASPs), meaning local exchanges could launch soon. For now, P2P trading is the main method.

Can I send crypto from Bolivia to other countries?

Yes. Sending crypto abroad is legal and widely used by Bolivians to support family overseas. Many use USDT for remittances because it’s fast, cheap, and doesn’t require a bank. The Central Bank encourages this as a way to reduce reliance on expensive wire transfers.

Is crypto safe in Bolivia?

The technology is safe, but scams are common. Since crypto is new, fraudsters target beginners with fake investment schemes. Always use reputable P2P platforms with escrow, never send money to strangers, and store your crypto in your own wallet. The Central Bank runs free education campaigns to help people avoid scams.