Dutch Auction Simulator

Learn how Divergence Protocol distributed DIVER tokens through a Dutch auction. This tool demonstrates how the price drops over time and how tokens are sold at different price points.

How Dutch Auctions Work

Unlike airdrops that give tokens for free to specific wallets, Dutch auctions start at a high price and gradually drop until all tokens sell. This ensures fair market pricing.

For DIVER tokens: Started at $0.10, ended at $0.05, with 20 million tokens sold over time.

There’s a lot of noise online about a Divergence airdrop. You’ve probably seen posts claiming you can claim free DIVER tokens just by signing up, connecting your wallet, or sharing a tweet. But here’s the truth: Divergence never ran a traditional airdrop. Not one. Not even a small one.

What you’re seeing is confusion. People are mixing up the project’s Initial DEX Offering (IDO) with an airdrop. They’re seeing people trade DIVER tokens and assuming those tokens were given away for free. That’s not how it happened.

How DIVER Tokens Were Actually Distributed

Divergence Protocol launched its DIVER token through a Dutch auction, not an airdrop. This isn’t just semantics-it’s a major difference in how value is assigned.

The auction started at $0.10 per DIVER token, with a total of 20 million tokens available. The price dropped over time until all tokens were sold. The lowest price reached was $0.05. That means the first buyers paid $0.10. The last buyers paid $0.05. Everyone paid what the market said was fair at the time they bought.

This system was designed to be fair. No insiders got special access. No early whales bought at a discount. No wallets were pre-selected. Anyone with an internet connection and a crypto wallet could participate. And that’s the opposite of an airdrop, where tokens are handed out to a pre-chosen group.

After the auction ended, the proceeds went into a liquidity pool on SushiSwap. That’s where DIVER started trading. Today, as of November 2025, DIVER trades around $0.010686-far below the original auction price. That’s normal for early DeFi projects. It doesn’t mean the token is worthless. It just means the market has moved on.

So Where Do People Get DIVER Tokens Now?

If you want DIVER tokens today, you buy them. On SushiSwap. Or wherever else they’re listed. There’s no free claim page. No wallet connect button. No countdown timer.

But here’s where things get interesting. Divergence does reward people-but not with a one-time airdrop. It rewards them with ongoing token distributions for participating in the ecosystem.

If you provide liquidity to Divergence’s options markets, you earn DIVER tokens over time. If you trade synthetic binary options on the platform, you can earn rewards based on volume and activity. If you hold DIVER tokens and vote on governance proposals, you’re also part of the reward system.

This isn’t a giveaway. It’s a user incentive. It’s how the protocol keeps people engaged. It’s how it grows organically. You don’t get tokens for doing nothing. You get them for doing something that helps the platform work better.

Why People Still Think There’s an Airdrop

There are three big reasons this myth keeps spreading.

First, most people don’t understand Dutch auctions. They hear “token sale” and think “free tokens.” They see someone holding DIVER and assume they got it for free.

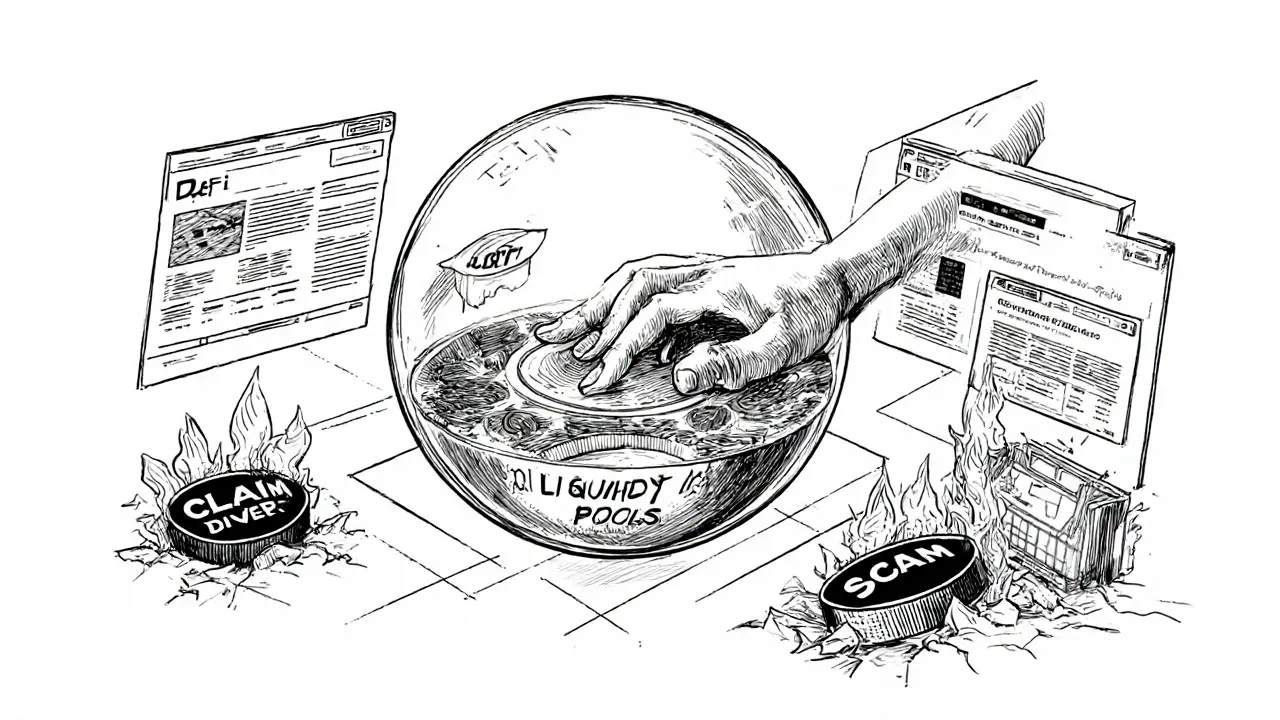

Second, scam sites are everywhere. You’ll find fake Divergence airdrop pages that ask you to connect your wallet, approve a transaction, or send a small amount of ETH to “unlock” your tokens. These are phishing traps. They steal your private keys or drain your wallet. If a site asks you to pay anything to claim DIVER, it’s a scam.

Third, some influencers and YouTube channels still promote “DIVER airdrop” as if it’s real. They’re either misinformed or deliberately misleading people to drive traffic. Always check the official source: divergence.finance. If it’s not there, it’s not real.

What Divergence Actually Does

Divergence isn’t just another DeFi token. It’s a protocol built for hedging volatility in crypto. Think of it like insurance for your DeFi positions.

Let’s say you’re holding ETH in a liquidity pool. You’re worried the price might crash next week. Instead of selling, you can buy a synthetic binary option on Divergence. You bet that ETH will drop below $3,000 by Friday. If you’re right, you get paid. If you’re wrong, you lose your premium. It’s like options trading on Wall Street, but fully decentralized.

This is useful for DeFi users who can’t just sell their assets without breaking their yield farming positions. Divergence gives them a way to protect themselves without leaving the ecosystem.

The DIVER token powers everything: governance, rewards, and fees. Holders vote on upgrades, fee structures, and new asset listings. Liquidity providers earn a share of trading fees. Traders pay fees in DIVER or other tokens. It’s a self-sustaining system.

Should You Still Care About DIVER in 2025?

Maybe. But not because of a fake airdrop.

If you’re into DeFi derivatives, Divergence is one of the few protocols focused purely on volatility trading. Most other platforms offer perpetual swaps or futures. Divergence offers binary options-something much simpler and more intuitive for new users.

It’s also one of the few DeFi projects that didn’t raise venture capital. All funding came from the public auction. That means no VCs are calling the shots. The community owns it.

But here’s the reality: trading volume is low. Liquidity is thin. You won’t find DIVER on Binance or Coinbase. It’s still a niche product. If you’re looking for a quick flip, skip it. If you’re looking to understand how DeFi hedging works, it’s worth exploring.

How to Stay Safe and Avoid Scams

If you’re looking for DIVER tokens, follow these rules:

- Never connect your wallet to a site that says “Claim DIVER Airdrop.”

- Only buy DIVER on SushiSwap or verified DEXs linked from divergence.finance.

- Never send ETH, USDC, or any token to claim free DIVER.

- Check the official Twitter and Discord for updates. No official channel ever mentions an airdrop.

- If it sounds too good to be true, it is. Free crypto is almost always a trap.

The only legitimate way to earn DIVER is by using the platform: providing liquidity, trading options, or participating in governance. No shortcuts. No magic links. Just work.

What Comes Next for Divergence?

The team has said they’re working on listings on larger exchanges. That could bring more attention and liquidity. But there’s no timeline. No announcement. No date.

They’re also exploring new asset pairs for binary options-maybe Bitcoin, Solana, or stablecoin volatility. But again, nothing concrete.

If you’re interested, keep an eye on their official channels. But don’t wait for a free token. Build something useful on the platform instead. That’s how real value is made in DeFi.

Final Thoughts

Divergence isn’t a get-rich-quick scheme. It’s a tool for experienced DeFi users who want to hedge risk. The DIVER token isn’t a lottery ticket. It’s a utility token with a clear role in the protocol.

There was no airdrop. There won’t be one. And chasing one will only cost you money.

Want DIVER? Buy it. Earn it by using the platform. Or leave it alone. But don’t fall for the myth.