Cryptocurrency vs CBDC Comparison Tool

Understanding Digital Currencies

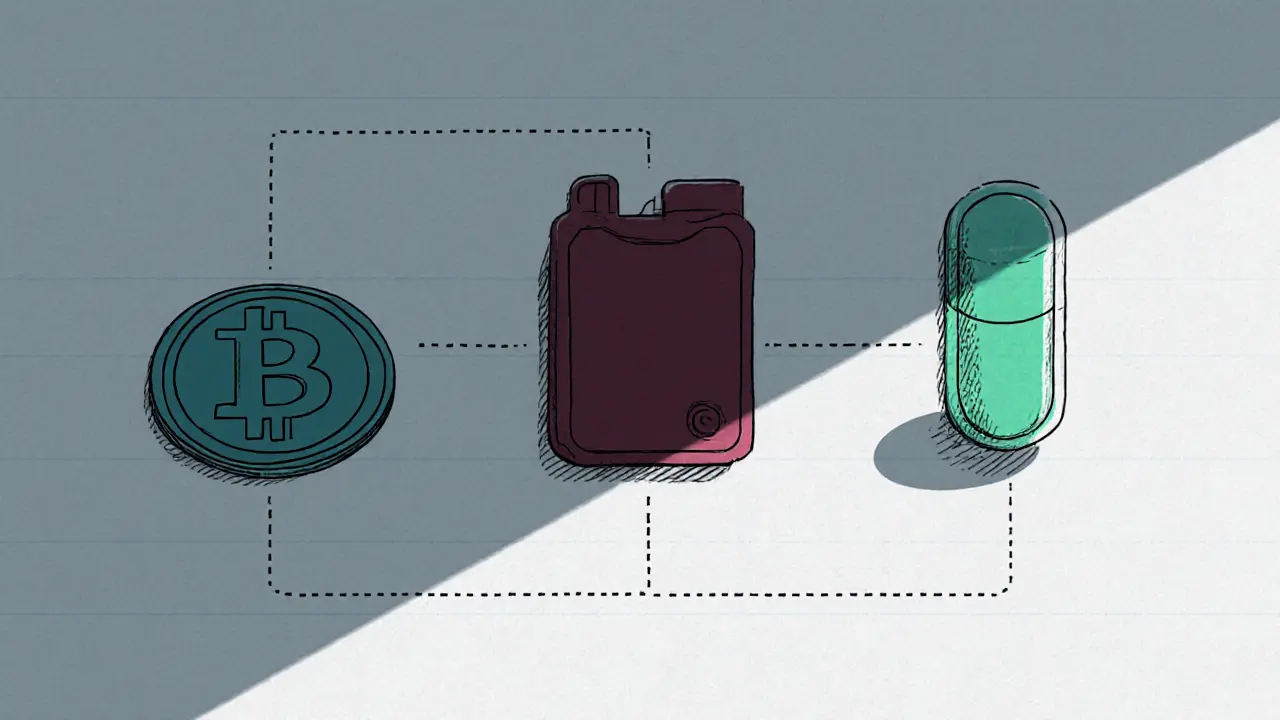

This tool helps compare key aspects of cryptocurrencies, Central Bank Digital Currencies (CBDCs), and stablecoins to better understand their roles in the future of digital payments.

₿ Cryptocurrencies

Decentralized digital assets with market-driven value and high volatility. Offer censorship resistance but require technical knowledge.

🏦 CBDCs

Government-issued digital versions of fiat money. Provide stability, instant settlement, and programmable features.

💵 Stablecoins

Digital tokens pegged to fiat currencies. Combine crypto-like speed with price stability for everyday transactions.

| Feature | Cryptocurrencies | CBDCs | Stablecoins |

|---|---|---|---|

| Issuer | Decentralized community | Central bank/government | Private firms (backed by fiat reserves) |

| Value Stability | Market-driven, often volatile | 1:1 with national currency | Pegged to fiat, low volatility |

| Transaction Privacy | Pseudonymous, varying degrees | Full audit trail, identity-linked | Typically KYC-required, limited privacy |

| Control Over Funds | User sole authority; no freezes | Can be frozen or programmed | Issuer can pause or blacklist |

| Energy Consumption | High (Proof-of-Work blockchains) | Negligible | Minimal |

| Regulatory Stance (2025) | Mixed - some supportive, others restrictive | Growing adoption, >28 countries piloting | Rapid expansion; $27.6 trillion 2024 volume |

Which Type of Digital Currency Should You Use?

Select your use case below to get personalized recommendations.

Recommended Digital Currency Type

Cryptocurrencies are digital assets that rely on decentralized networks to verify transactions, while Central Bank Digital Currency (CBDC) represents a government‑issued version of fiat money that lives on a digital ledger. Both aim to reshape how we pay for coffee, send money abroad, or receive a welfare check, but they sit on opposite ends of control, volatility, and user experience. This article unpacks where each stands today, why the gap matters, and what the next few years could bring for everyday spenders and big‑ticket traders alike.

Quick Summary

- Cryptocurrencies offer censorship‑resistant, market‑driven value but suffer from price swings and technical barriers.

- CBDCs provide stability, instant settlement, and programmable features, yet they give governments full visibility and control.

- Stablecoins act as a bridge, giving crypto‑like speed with fiat‑backed stability.

- Major pilots (China’s e‑yuan, EU’s digital euro) are slated for full rollout by 2025‑2026.

- The most likely outcome: a multi‑currency ecosystem where each type serves its sweet spot.

How Cryptocurrencies Work

At its core, a cryptocurrency uses a distributed ledger-often a blockchain-to record who owns what. Miners or validators add new blocks, earning native tokens as a reward. Because no single entity decides the supply, price formation is driven by market participants, leading to the notorious volatility you see in Bitcoin’s price spikes.

Bitcoin, the pioneer launched in 2009, caps supply at 21million coins, a rule baked into its code. This scarcity narrative fuels its perception as “digital gold,” especially during economic uncertainty. Other chains like Ethereum broaden functionality through smart contracts, enabling programmable money, decentralized finance (DeFi), and non‑fungible tokens (NFTs).

From a user standpoint, you need a wallet, a private key, and a basic grasp of security practices. Lose the key, lose the funds-there’s no “reset password” button. That autonomy is the very selling point for privacy‑focused users, but it also raises the entry barrier for the average consumer.

What CBDCs Are and Why Governments Want Them

A Central Bank Digital Currency is a digital claim on the central bank, backed 1:1 by the national fiat. Think of it as an electronic version of cash that lives on a ledger managed by the central bank or a designated operator. Unlike crypto, a CBDC’s value never drifts because it mirrors the official currency.

China’s e‑yuan is the most advanced example. After four years of pilots involving merchants, households, and even Olympic ticketing, the People’s Bank of China can push payments directly to phones without a traditional bank account. The European Central Bank aims to launch a digital euro by the end of 2025, following extensive public consultations.

Key motivations include:

- Lower transaction costs compared with card‑network fees.

- Faster cross‑border settlements.

- Direct distribution of stimulus or social benefits.

- Programmable features-think automatic tax deduction or conditional spending limits.

But every advantage comes with a surveillance trade‑off: every transfer is traceable, and authorities could freeze accounts in seconds.

Key Differences at a Glance

| Feature | Cryptocurrencies | CBDCs | Stablecoins |

|---|---|---|---|

| Issuer | Decentralized community | Central bank/government | Private firms (backed by fiat reserves) |

| Value stability | Market‑driven, often volatile | 1:1 with national currency | Pegged to fiat, low volatility |

| Transaction privacy | Pseudonymous, varying degrees of anonymity | Full audit trail, identity‑linked | Typically KYC‑required, limited privacy |

| Control over funds | User‑sole authority; no freezes | Can be frozen or programmed by authorities | Issuer can pause or blacklist accounts |

| Energy consumption | Proof‑of‑Work blockchains can be energy‑intensive | Negligible; centralized settlement | Minimal, depends on underlying blockchain |

| Regulatory stance (2025) | Mixed - some jurisdictions supportive, others restrictive | Growing adoption, with pilot programs in >28 countries | Rapid expansion; $27.6trn 2024 transaction volume |

Future Scenarios: What Could Happen by 2030

Analysts paint three plausible paths:

- Government‑led dominance: Most retail payments shift to CBDCs, especially in economies with strong digital infrastructure. Cryptocurrencies survive as a niche for cross‑border transfers and store‑of‑value assets.

- Hybrid coexistence: CBDCs handle domestic wages, taxes, and public services, while stablecoins and major cryptos power international trade, DeFi lending, and privacy‑focused transactions. Consumers juggle multiple wallets seamlessly.

- Decentralized resurgence: Widespread distrust of surveillance fuels a migration to privacy‑first networks (e.g., Monero, Zcash) and layer‑2 solutions that lower fees. CBDCs remain limited to government circles.

Which path wins will hinge on two forces: the public’s appetite for convenience versus privacy, and how regulators balance innovation with control.

The Role of Stablecoins in the New Ecosystem

Stablecoins like USDC or Tether sit in the middle, offering crypto‑like speed with a fiat peg. Their 2024 transaction volume of $27.6trillion signals real‑world utility-think paying freelancers in a borderless way or settling B2B invoices instantly.

Because they’re issued by private entities, they inherit some regulatory risk (e.g., reserve transparency). Yet they also provide a bridge for CBDC ecosystems: a digital euro could be wrapped into a stablecoin for easy integration with existing DeFi protocols.

Practical Takeaways for Users and Businesses

- Don’t put all your money in one digital format. Keep a portion in a CBDC‑compatible account for everyday bills, and a separate crypto wallet for cross‑border or privacy‑focused needs.

- Watch regulatory updates. The Bank for International Settlements reports over 68 central banks in CBDC development-policy shifts could affect tax treatment of crypto gains.

- Consider stablecoins as a transactional layer. If you need instant settlement without price risk, a regulated stablecoin often beats using Bitcoin directly.

- For merchants, prepare to accept multiple digital currencies. Payment gateways are already adding plug‑ins for e‑yuan QR codes and USD‑pegged stablecoins.

- Security still matters. Even though CBDCs may feel like traditional banking, a compromised phone can still expose your digital wallet.

What to Watch in the Next 12‑Month Window

• The European Central Bank’s final technical specifications for the digital euro, expected Q3 2025.

• China’s rollout of e‑yuan merchant terminals in Tier‑2 cities, slated for early 2026.

• The U.S. Treasury’s draft guidance on stablecoin reserve audits, due by the end of 2025.

• New privacy‑focused blockchain upgrades (e.g., Ethereum’s zk‑Rollup) that could lower the barrier for crypto adoption.

Final Thought

The battle isn’t “cryptos vs CBDCs” but rather “how do we blend decentralized freedom with government‑guaranteed stability?” The answer will likely be a layered digital payments stack where each token type fills a role. Your job? Stay informed, diversify your digital holdings, and pick the tool that matches the transaction you’re about to make.

Frequently Asked Questions

What is the main advantage of a CBDC over a traditional bank transfer?

A CBDC can settle in seconds, 24/7, with lower fees because it skips the intermediary layers that banks and card networks use. It also supports programmable rules, such as automatic tax withholding.

Are cryptocurrencies truly anonymous?

Most are pseudonymous-addresses don’t contain personal names, but every transaction is public on the blockchain. Advanced analytics can link addresses to real people, especially when exchanges enforce KYC.

Will stablecoins replace fiat money?

Not likely as a full replacement. They excel as a bridge for digital commerce and cross‑border payments, but regulators still view them as complementary to fiat, not a substitute.

How can I protect my crypto wallet from hacks?

Use hardware wallets for long‑term storage, enable two‑factor authentication on any web‑based wallet, and never share your private key or seed phrase.

Will my government be able to freeze my CBDC balance?

Yes. Because a CBDC is issued by the central bank, authorities can place holds, enforce negative interest, or restrict spending categories through programmable rules.