CROW Token Performance Tracker

CROW Token Overview

Current Price: $0.000095

Market Cap: $66,000 USD

Total Supply: 1,000,000,000 CROW

Circulating Supply: 967,470,000 CROW

7-Day Change: +7.9%

All-Time High: $0.02626172

Technical Indicators

50-Day SMA: $0.00008747

200-Day SMA: $0.000090

RSI: 46.06

Fear & Greed Index: 54 (Neutral)

Risk Assessment

Future Outlook

Short-term: Mixed forecasts, with projections of decline to $0.000049 by Oct 2025.

Long-term: Conservative estimates suggest modest growth of 3-4% annually if ecosystem matures.

Success Factors:

- Demonstrated utility of trading signals

- Expansion of exchange listings

- Regulatory clarity on AI-driven trading bots

Investment Recommendation

CROW is a high-risk speculative asset suitable for experienced traders only.

Consider allocating only a small portion of your portfolio to this micro-cap token.

The crypto world is flooded with new projects, and it’s easy to wonder if a token like CROW token is worth a closer look. Below we break down what CROW is, how it fits into the Virtuals ecosystem, its market numbers, and what you should watch if you consider it for trading or investment.

What is the CROW token?

CROW token is an AI‑powered utility token built on the Virtuals Protocol that provides automated trading assistance and market insights to cryptocurrency traders. Launched as part of the Virtuals ecosystem, CROW serves as the native medium for accessing the platform’s smart‑money concepts and ICT‑style strategies without needing deep technical knowledge.

How the Virtuals Protocol powers CROW

Virtuals Protocol is a blockchain‑based framework designed to host AI‑driven financial tools, allowing tokens like CROW to interact with real‑time market data and execute trade signals on‑chain. The protocol handles data feeds, AI model execution, and the smart contracts that distribute trade setups to token holders.

Core features of the AI‑powered trading assistant

- Smart Money Concepts (SMC) is a methodology that tracks institutional‑level buying and selling activity to identify high‑probability trade entries.

- Inner Circle Trader (ICT) strategy is a set of technical principles focusing on market structure, liquidity pools, and time‑of‑day dynamics, adapted by CROW’s AI engine for crypto markets.

- Real‑time market data integration ensures that trade signals are generated with minimal lag, giving users a practical edge in fast‑moving markets.

- Token‑holder access: owning CROW unlocks premium signals, educational content, and community tools within the Virtuals ecosystem.

Token economics at a glance

| Metric | Value |

|---|---|

| Total Supply | 1,000,000,000 CROW |

| Circulating Supply | 967,470,000 CROW |

| Market Capitalization | $~66,000 (USD) |

| Fully Diluted Valuation | $~72,130 (USD) |

| All‑Time High Price | $0.02626172 |

| Current Price (avg.) | $0.000095 |

The token’s micro‑cap status means it’s highly speculative. With a circulating supply just under one billion and a market cap hovering in the low‑six‑figure range, price swings can be dramatic on relatively modest trading volume.

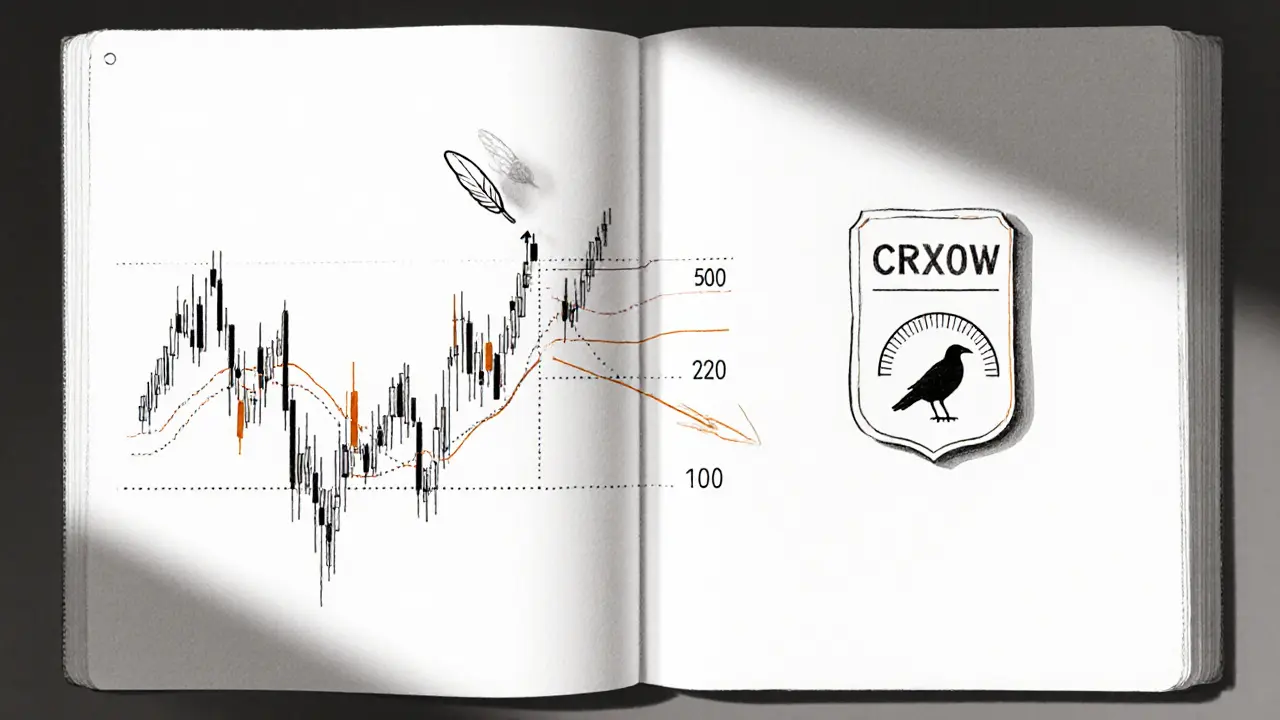

Recent market performance and technical indicators

As of the latest data, CROW trades around $0.000095, showing a modest 7.9% gain over the past seven days. Key technical metrics include:

- 50‑day Simple Moving Average (SMA) is $0.00008747, suggesting short‑term support near this level.

- 200‑day SMA is $0.000090, indicating longer‑term price pressure.

- Relative Strength Index (RSI) is 46.06, a neutral momentum reading that could tilt either way on new news.

- Fear & Greed Index reads 54 (Neutral), reflecting a market that isn’t overly bullish or bearish on the token.

Volatility remains high-over the last 24hours the price swung roughly 40%, making stop‑loss placement essential for traders.

Where to buy and track CROW

The token is listed on MEXC Exchange where users can place market or limit orders against USDT pairs. For price monitoring, platforms such as CoinGecko, CoinCodex, and 3Commas provide real‑time charts and volume data.

Risks and considerations for investors

- Liquidity constraints: Low daily volume can cause slippage, especially on larger orders.

- Regulatory uncertainty around AI‑driven trading tools may affect future development or exchange listings.

- Price volatility can amplify both gains and losses; the token’s micro‑cap nature means market sentiment swings have outsized impact.

- The project’s technical documentation on AI algorithms and SMC implementation is still limited, adding a layer of opacity.

Potential investors should treat CROW as a high‑risk, high‑reward asset and consider allocating only a small portion of a diversified crypto portfolio.

Future outlook and price predictions

Short‑term forecasts are mixed. CoinCodex projects a decline to $0.000049 by the end of October 2025, while some analysts see upside potential if the AI‑assistant gains traction among retail traders. Longer‑term models (2029) from LiteFinance and TradingBeasts estimate an average price near $0.00009, suggesting modest annual growth of 3‑4% if the ecosystem matures.

The token’s success hinges on three factors:

- Demonstrated utility: if CROW’s signals consistently outperform basic technical analysis, user adoption will rise.

- Expansion of exchange listings: broader liquidity would reduce slippage and attract institutional curiosity.

- Regulatory clarity on AI‑driven trading bots: a favorable stance could unlock new partnerships.

Until these milestones are reached, the token will likely stay within the speculative micro‑cap bracket.

Quick takeaways

- CROW is an AI‑driven utility token built on the Virtuals Protocol.

- It integrates Smart Money Concepts and ICT strategies to offer automated trade signals.

- Market cap is around $66K, with a circulating supply of ~967M tokens.

- High volatility and low liquidity make it a risky play.

- Future value depends on adoption, liquidity expansion, and regulatory environment.

Frequently Asked Questions

What does the CROW token actually do?

CROW grants holders access to an AI‑powered trading assistant that delivers real‑time trade setups based on Smart Money Concepts and ICT methodology. It also unlocks educational content and community tools within the Virtuals ecosystem.

Where can I buy CROW?

The token is primarily listed on MEXC Exchange. You can also view its price on CoinGecko, CoinCodex, and 3Commas, which pull data from various liquidity pools.

Is CROW a good long‑term investment?

Because CROW is a micro‑cap token with limited liquidity, it carries high risk. Its long‑term potential depends on adoption of the AI trading assistant, additional exchange listings, and a clear regulatory framework. Treat it as speculative and allocate only a modest portion of your portfolio.

What are the main technical indicators to watch for CROW?

Key metrics include the 50‑day SMA ($0.00008747), 200‑day SMA ($0.000090), RSI (around 46), and the Fear & Greed Index (currently neutral). These help gauge short‑term support, long‑term trend, and market sentiment.

How does the Virtuals Protocol enable AI trading?

The protocol provides on‑chain data feeds and a sandbox for AI models to process market information in real time. Smart contracts then distribute the resulting signals to CROW holders, ensuring transparent and tamper‑proof delivery.