Back in 2021, if you wanted to move ETH from Ethereum to Solana, you were stuck. You had to sell, wait for settlement, buy again on another chain, and hope no one front-ran your trade. Today, you click once and your tokens appear on the other side in under a second. That’s the power of cross-chain bridges in 2025 - and not all of them are created equal.

Why Cross-Chain Bridges Matter More Than Ever

Blockchain networks aren’t islands anymore. They’re cities connected by highways. Ethereum has its DeFi, Solana its speed, Polygon its low fees, and Cosmos its interoperability. But if you’re holding assets on one chain and want to use them on another, you need a bridge. Without it, your tokens are locked in place - useless for yield, trading, or staking elsewhere. In 2025, the best bridges don’t just move tokens. They route liquidity, reduce slippage, eliminate wrapping, and cut fees. Some are built for pros. Others are made for beginners. The key is knowing which one fits your needs.Symbiosis Finance: The Power User’s Swiss Army Knife

If you’re doing complex multi-chain swaps - like moving USDT from Arbitrum to Solana, then swapping it for AVAX on Fantom - Symbiosis is your go-to. It supports over 30 chains and 430+ trading pairs. What sets it apart is that it’s not just a bridge. It’s a DEX aggregator with bridge functionality baked in. You don’t need to go through three separate steps. Symbiosis finds the cheapest path across chains in one transaction. Its integrated swap routing slashes fees by combining liquidity pools and minimizing gas waste. Transfers usually finish in under five minutes, and fees are among the lowest you’ll find. It’s not the fastest, but for users juggling multiple chains, it’s the most efficient.Stargate (LayerZero): Speed Without Compromise

Stargate is the fastest bridge in 2025. For most routes, transfers complete in under one second. That’s not a typo. It uses LayerZero’s oracle-and-relayer system to verify transactions across chains without relying on third-party validators. The result? Instant finality. It supports 40+ chains, including Ethereum, BSC, Polygon, Avalanche, and even newer ones like Sei and Base. Unlike older bridges that use wrapped tokens, Stargate does native asset transfers. That means your ETH on Solana is real ETH, not a tokenized version. Fees are around 0.06% per transfer - low for the speed you get. Professional traders use Stargate because it’s reliable, fast, and has deep liquidity pools that keep slippage near zero.Wormhole: The Bridge That Connects the Non-EVM World

If you’re bridging between Ethereum and Solana, Sui, Aptos, or Cosmos, Wormhole is your best bet. It supports 30+ chains - more than most - and handles non-EVM networks better than anyone else. It uses a lock-and-mint model: your tokens get locked on the source chain and an equivalent is minted on the destination. Transfers cost less than $0.01, making it the cheapest option for small transactions. Finality is fast, usually under 30 seconds. Developers love Wormhole because it’s not just a bridge - it’s a messaging protocol. That means dApps can send data across chains, not just tokens. If you’re building a cross-chain NFT game or a multi-chain DeFi app, Wormhole’s infrastructure is the backbone.

Synapse Protocol: Best for Stablecoins and Newcomers

Synapse is the bridge for people who just want to move USDC, DAI, or USDT without paying $5 in gas. It’s up to 80% cheaper than competitors for stablecoin transfers. That’s huge when you’re moving $10,000 instead of $100. It supports 20+ chains, including Ethereum, Arbitrum, Optimism, Polygon, Avalanche, and Fantom. Transfers take under a minute. The interface is clean, simple, and doesn’t overwhelm you with options. It’s perfect if you’re new to DeFi or just want to move stablecoins between chains without thinking too hard. Security is a priority here. Synapse gets audited regularly and publishes operational reports. It’s not flashy, but it’s trustworthy - the kind of bridge you can leave running in the background while you go grab coffee.Rubic: The Aggregator That Does It All

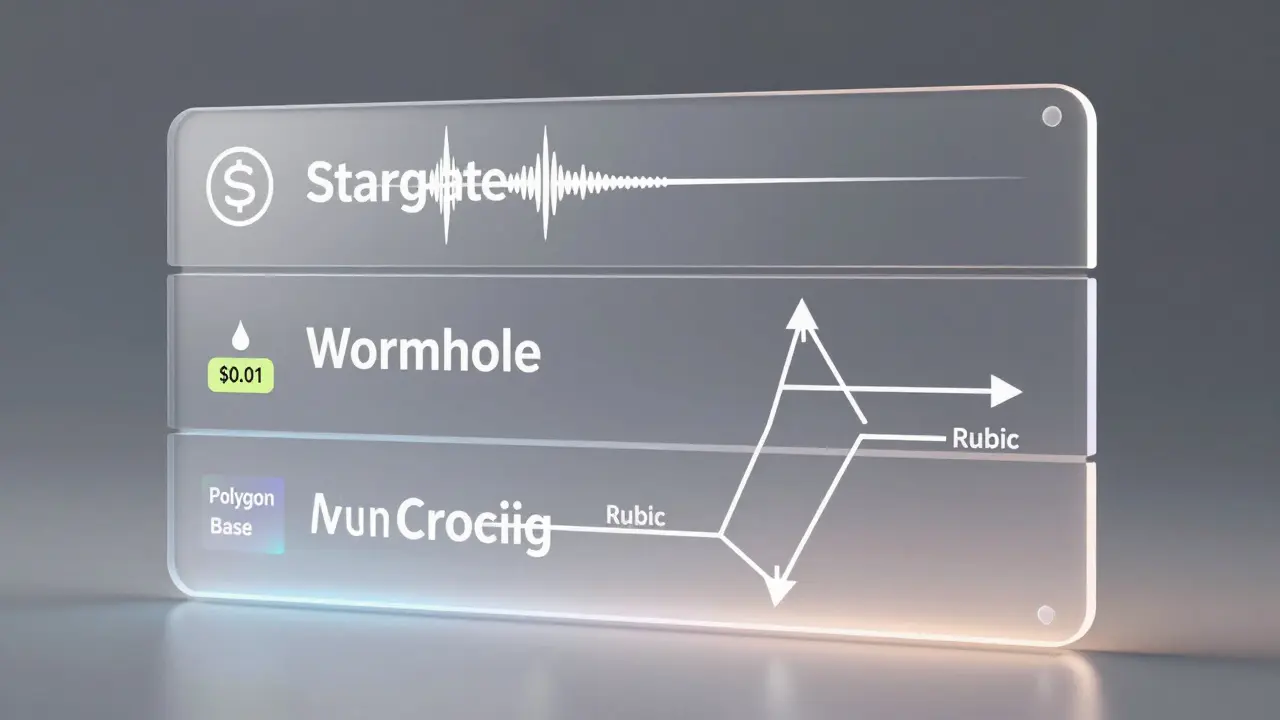

Rubic doesn’t run its own bridge. Instead, it connects to over 30 different bridges - including Stargate, Synapse, and Wormhole - and finds you the best route. Think of it like Google Flights for crypto transfers. It supports 90+ blockchains and 15,500+ assets. You can swap ETH on Base to MATIC on Polygon, then to AVAX on Avalanche - all in one click. No protocol fees. You only pay the gas on the source chain. That makes it ideal for users who want maximum flexibility without getting lost in options. It’s fully decentralized, with audited smart contracts and no central point of failure. If you’re tired of choosing between bridges, Rubic picks for you - and usually picks the cheapest and fastest one.THORChain: Native Swaps, No Wrapping

THORChain (via THORSwap) is the outlier. It doesn’t wrap anything. When you swap BTC for ETH, your BTC is locked in a liquidity pool, and ETH is sent from another pool. No tokens are created. No bridges. Just pure peer-to-pool swaps. It supports 16 chains, including Bitcoin, Ethereum, Litecoin, and BNB Chain. Fees are around 0.5%, which sounds high - but you’re getting true decentralization. There’s no custodian. No validator set you have to trust. It’s a fully non-custodial, permissionless system. If you care more about control than speed, THORChain is your bridge. It’s slower - swaps take a few minutes - but it’s the closest thing to a trustless cross-chain swap you’ll find.Specialized Picks: When You Need More Than Just a Bridge

Not every bridge is built for everyone. Some are laser-focused:- Allbridge Core is the best for stablecoin swaps between EVM and non-EVM chains, using native liquidity pools.

- Defiway is the top choice for Base blockchain users, especially for bridging USDC and ETH. It’s fast, cheap, and supports Solana, TON, and Tron.

- Axelar dominates Cosmos ecosystem bridging, offering secure cross-chain messaging for developers.

- Crypto.com App has a built-in bridge that’s faster than most third-party options - transfers finish in under a minute - but it only supports a handful of chains.

Security: What You Can’t Afford to Ignore

Bridges have been hacked for billions of dollars. In 2022, the Ronin Bridge breach lost $625 million. That’s why security isn’t optional - it’s the first filter. Top bridges in 2025 have three things in common:- Regular audits - Synapse, Axelar, and Stargate publish audit reports quarterly.

- Decentralized validation - Wormhole and Axelar use multi-sig and threshold signatures. Stargate uses LayerZero’s decentralized relayers.

- Transparent operations - Rubic and Symbiosis run fully on-chain with public contract addresses you can verify.

Speed vs. Cost vs. Control: How to Choose

Here’s a quick guide:- Need speed? Go with Stargate. Under one second on most routes.

- Want the lowest fees? Use Wormhole for small transfers or Synapse for stablecoins.

- Doing complex swaps? Symbiosis or Rubic. They route through multiple chains automatically.

- Want no wrapping? THORChain is your only real option.

- On Base or Solana? Defiway or Allbridge Core.

- Building a dApp? Axelar or Wormhole for messaging.

The Future of Cross-Chain in 2025 and Beyond

The next wave isn’t just about moving tokens. It’s about moving state - data, NFT ownership, smart contract logic - across chains. That’s why protocols like Axelar and Wormhole are building messaging layers, not just bridges. Native asset transfers are replacing wrapped tokens. More bridges are integrating with DEXs to offer swaps in one click. Fees are dropping as liquidity pools grow. And aggregation platforms like Rubic are making it easy to avoid choosing the "right" bridge - because the system picks for you. By 2026, you won’t think about chains at all. You’ll just say: "Send this to my wallet on Solana." The bridge will handle the rest.Are cross-chain bridges safe in 2025?

Yes, but only if you choose the right ones. Top bridges like Stargate, Synapse, and Wormhole have been audited multiple times and use decentralized security models. Avoid bridges that don’t publish audit reports or rely on centralized relayers. Always check the contract address on Etherscan or a similar explorer before sending funds.

Which bridge has the lowest fees?

Wormhole offers the lowest fees - under $0.01 per transfer - ideal for small transactions. Synapse is cheapest for stablecoins, with savings up to 80% compared to other bridges. Rubic has no protocol fees; you only pay the gas on the source chain, which can be the most cost-effective for larger transfers.

What’s the fastest crypto bridge?

Stargate (LayerZero) is the fastest, with most transfers completing in under one second. It uses a decentralized oracle and relayer system that ensures instant finality across 40+ chains. Other bridges like Synapse and Wormhole take a few seconds to a minute, while THORChain and Symbiosis can take a few minutes depending on network congestion.

Do I need to wrap my tokens when using a bridge?

Not anymore - at least not with the best bridges. Older bridges like Polygon PoS Bridge required wrapped tokens (like wETH), which added risk and complexity. Modern bridges like Stargate and THORChain support native transfers. Your ETH stays ETH on Solana, your BTC stays BTC on Ethereum. This reduces counterparty risk and makes assets more usable across DeFi protocols.

Can I use a bridge to move NFTs?

Yes, but only if the bridge supports the NFT standard on both chains. Wormhole and Axelar are the most reliable for NFT transfers because they handle cross-chain messaging, not just token transfers. Platforms like Symbiosis and Rubic also support NFT bridging on select chains. Always verify that both the source and destination chains support the same NFT standard (like ERC-721 or SPL) before attempting a transfer.

Is there a bridge for Base chain?

Yes. Defiway is the top choice for Base, especially for bridging USDC and ETH. It’s fast, has low fees, and supports Solana, TON, and Tron. Crypto.com’s app also has a built-in bridge for Base with transfers under a minute, though it supports fewer chains. Always use a trusted bridge - Base is still new, and some third-party bridges have unreliable liquidity.

What’s the difference between a bridge and a DEX aggregator?

A bridge moves tokens between blockchains. A DEX aggregator finds the best price to swap tokens on a single chain. Rubic and Symbiosis do both. They’re hybrid platforms: they bridge your tokens and swap them on the destination chain in one transaction. That’s why they’re called "cross-chain DEX aggregators." If you just want to move ETH from Ethereum to Polygon, use a simple bridge. If you want to move ETH to Solana and instantly swap it for SOL, use Symbiosis or Rubic.