APRIL Token Value Tracker

Token Overview

Token Name: April (APRIL)

Blockchain: Binance Smart Chain (BEP-20)

Launch Date: April 24, 2021

Max Supply: 125,000,000 APRIL

Circulating Supply: 84,000,000 APRIL

Current Price: $0.00038

Market Cap: $50,000

Value Calculator

Your APRIL holdings are worth:

This represents a change from current value.

Supply Dynamics

The APRIL token features a deflationary mechanism where a small percentage of tokens are burned during oracle operations, reducing the total supply over time.

Total Supply: 125,000,000 APRIL

Circulating Supply: 84,000,000 APRIL

Burned Supply: 41,000,000 APRIL

Remaining Supply: 84,000,000 APRIL

Quick Facts

- Launched April242021 on Binance Smart Chain as a BEP‑20 token.

- Maximum supply: 125millionAPRIL; circulating supply varies around 84‑106million.

- Designed as an ultra‑fast blockchain oracle and governance token.

- Current price (Oct2025): roughly $0.00038, market cap under $50K.

- Listed on exchanges such as Coinbase, KuCoin, Binance, Bybit and Bitget.

When people ask “what is April (APRIL) crypto coin?”, they’re really looking for a clear picture of a tiny, ultra‑fast oracle token that lives on the Binance Smart Chain. Below you’ll find everything you need to know - from its tech DNA to real‑world trading data and the risks that come with a micro‑cap asset.

What Is April (APRIL)?

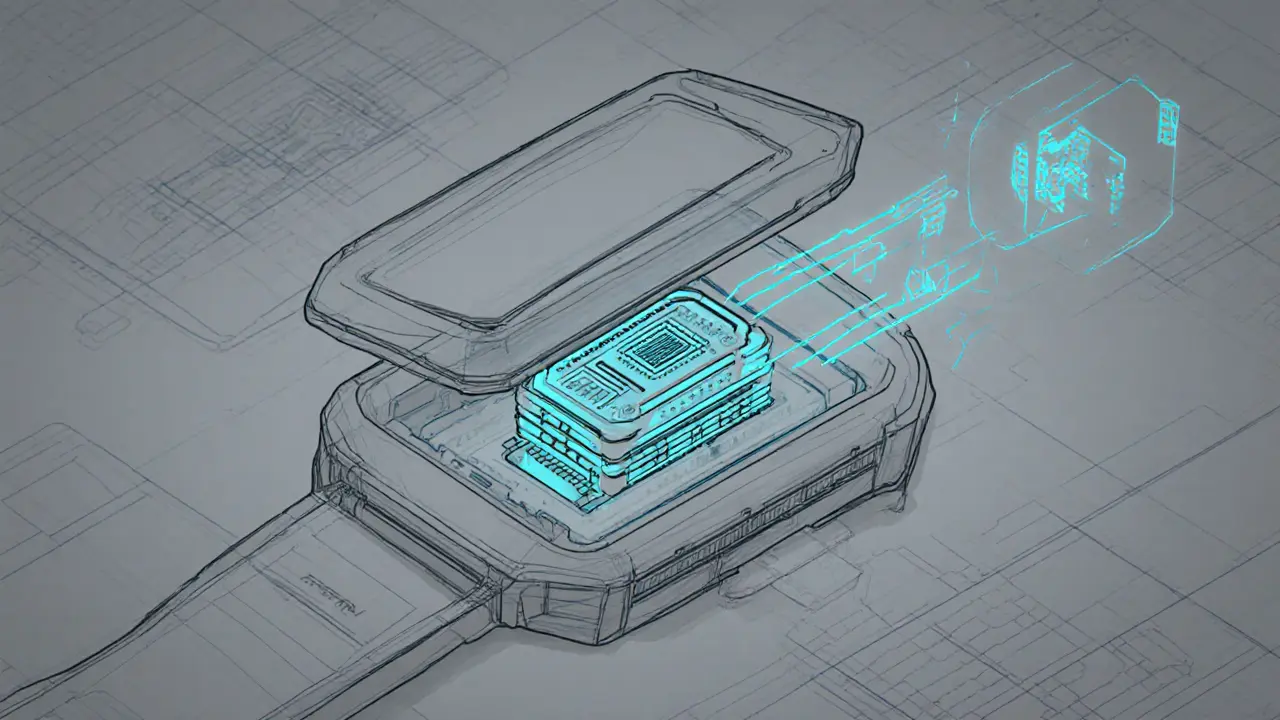

April is a blockchain‑based utility and governance token that powers the April project, an ultra‑fast oracle system aimed at the emerging "interchain" economy. The token launched on April242021, minted as a BEP‑20 asset on the Binance Smart Chain. Holders can vote on protocol upgrades and receive fee rebates when the network delivers real‑world data to smart contracts.

Technical Specs and Token Mechanics

The April token has a hard cap of 125millionAPRIL. Different data aggregators report slightly different circulating numbers - Coinbase lists about 84million, while CoinLore shows over 106million. The token is not mineable; new coins only appear via the initial mint and later distribution events.

April incorporates a built‑in deflationary burn. Whenever certain oracle operations occur, a tiny fraction of APRIL is sent to an address with no private keys, effectively removing those coins from supply. This burn aims to offset inflation and, in theory, help price appreciation over time.

As a governance token, APRIL follows a one‑token‑one‑vote model. Proposals ranging from fee structure changes to new data source integrations are submitted on‑chain, and token holders cast their votes directly through compatible wallets.

Why Does April Call Itself an “Ultra‑Fast” Oracle?

Most oracle networks-think Chainlink, Band Protocol, API3-rely on a mix of off‑chain infrastructure and on‑chain verification, which can introduce latency of several seconds to minutes. April claims sub‑second data finality by anchoring data feeds to a high‑throughput BSC sidechain that aggregates signatures from a small, pre‑selected node set. The goal is to deliver price updates, weather reports, or sports scores to DeFi contracts almost instantly, allowing arbitrage bots and high‑frequency trading strategies to react without costly slippage.

In practice, the ultra‑fast promise is hard to validate because the project’s public documentation is sparse and the node set has not been independently audited. Nevertheless, the technical design hinges on three pillars:

- Low‑cost BSC transaction fees (typically <$0.01 per operation).

- Compressed signature aggregation to reduce on‑chain data size.

- Selective node whitelisting to cut consensus time.

Market Performance - Where Is April Today?

April’s price history is a textbook case of 2021 hype followed by a prolonged bear market. The all‑time high hit $0.2016 on 1Dec2021. By early 2025 the token slumped to $0.0002464, its lowest point. Recent recovery-driven more by overall crypto market sentiment than by project milestones-has nudged the price back to the $0.00038 range.

Market cap hovers between $33K and $48K, placing APRIL well below the $1M threshold that defines “micro‑cap” crypto. Trading volume is equally modest: 24‑hour volumes reported range from a few dollars on Coinbase to about $15 on CoinGecko. Such thin liquidity means even modest buy orders can cause noticeable price swings.

Relative performance data (Oct2025) shows:

- -35% vs. USD YoY,

- -62% vs. Bitcoin YoY,

- -58% vs. Ethereum YoY.

On a month‑to‑month basis, April has posted +8.5% vs. USD, +11.4% vs. Bitcoin, and +22.5% vs. Ethereum, suggesting a modest bounce that aligns with broader market rallies.

How Does April Stack Up Against Other Oracles?

| Metric | April (APRIL) | Chainlink (LINK) | Band Protocol (BAND) | API3 (API3) |

|---|---|---|---|---|

| Chain | BSC (BEP‑20) | Ethereum (ERC‑20) | Ethereum (ERC‑20) | Ethereum (ERC‑20) |

| Market Cap (USD) | ~$40K | $7B | $300M | $120M |

| 24‑h Volume | ~$15 | $2.5B | $45M | $23M |

| Supply | 125M (max) | 1B | 100M | 100M |

| Node Diversity | Small, whitelisted set | Thousands globally | Hundreds | Hundreds |

From the table it’s clear that April operates in a vastly different scale. While Chainlink, Band and API3 enjoy deep liquidity, extensive developer ecosystems, and institutional backing, April’s niche focus on ultra‑fast data delivery remains unproven at scale.

Buying, Storing, and Using APRIL

APRIL is listed on several major exchanges, including Coinbase, KuCoin, Binance, Bybit, Bitget and BingX. Because it lives on BSC, you’ll need a BSC‑compatible wallet to receive and send the token. The most common choices are MetaMask (configured for BSC), Trust Wallet, and the Binance Chain Wallet.

Steps to acquire APRIL on a decentralized exchange (DEX):

- Set up a BSC‑compatible wallet (MetaMask, Trust Wallet, etc.).

- Add the BSC network (RPC URL: https://bsc-dataseed.binance.org/).

- Send BNB to your wallet to cover gas fees.

- Visit a DEX like PancakeSwap, paste the APRIL contract address (0x…‑replace‑with‑actual‑address), and swap BNB for APRIL.

On centralized exchanges like Coinbase, the process is a simple “Buy” order using fiat or crypto. However, low volume means order books can be shallow - expect possible price slippage for trades larger than a few hundred dollars.

Risks, Liquidity Concerns, and Community Outlook

Investing in APRIL carries several red flags:

- Liquidity scarcity: Thin order books can cause large price swings.

- Minimal community activity - no active Reddit, Discord, or Telegram channels with regular discussions.

- Lack of recent developer updates - GitHub commits and roadmap releases have been dormant since 2022.

- Competition from established oracles that already have DeFi integrations.

Because APRIL’s price is largely driven by speculative sentiment rather than functional adoption, many analysts classify it as a high‑risk, low‑utility token. If you’re considering a purchase, treat it as a speculative position and keep exposure small relative to your overall portfolio.

Future Outlook - Will April Survive?

There are three possible paths for APRIL:

- Revival through a technical breakthrough: If the team releases a audited ultra‑fast oracle protocol that onboards DeFi projects, the token could see renewed demand.

- Acquisition or integration: A larger oracle provider might absorb April’s tech, giving token holders a payout.

- Fade into obscurity: Without fresh development or community traction, APRIL could remain a low‑volume micro‑cap indefinitely.

At the moment, the third scenario looks most likely, given the lack of public roadmaps or partnership announcements since 2022.

Frequently Asked Questions

What blockchain does APRIL run on?

APRIL is a BEP‑20 token on the Binance Smart Chain. It inherits BSC’s low‑fee, high‑throughput characteristics.

How can I store APRIL safely?

Use any BSC‑compatible wallet such as MetaMask (with BSC network added), Trust Wallet, or Binance Chain Wallet. Keep your private keys offline for maximum security.

Is APRIL mineable?

No. APRIL is pre‑minted with a fixed maximum supply of 125million tokens. New coins are not created through mining.

What makes April’s oracle “ultra‑fast”?

April claims sub‑second data finality by using a small, whitelisted node set on BSC and aggregating signatures off‑chain before posting a single proof on‑chain. This reduces the consensus steps needed for each data point.

Should I invest in APRIL?

APRIL is a high‑risk micro‑cap token with low liquidity and minimal community support. Consider it only if you can afford to lose the entire investment and view it as speculative exposure rather than a core holding.